An amortization schedule is a great tool to help you understand and manage your finances. It is a record of how an loan or debt is paid over time. It provides a detailed breakdown of the payments made over the entire loan period, including the principal and interest payments, as well as the remaining balance. Knowing how to calculate an amortization schedule can help you budget and plan for future payments. This article will explain what an amortization schedule is and how to calculate it using a formula.

Overview of What an Amortization Schedule Is and How to Use It

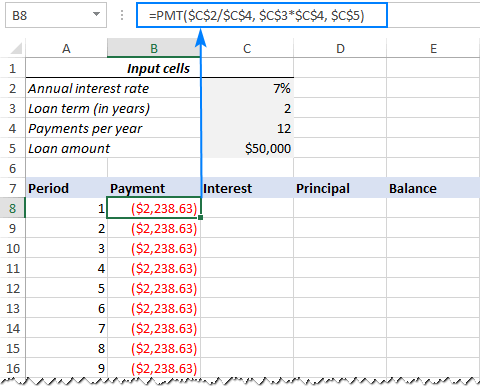

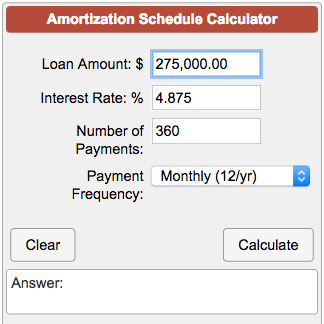

An amortization schedule is a helpful tool for understanding the process of paying back a loan. It breaks down your loan payments into individual amounts, including the principal and interest due. The schedule also shows how much of your payment goes toward the principal, and how much goes toward interest. This can be a great way to keep track of your loan payments and make sure you’re on track to pay it off. Knowing how much of your payment goes towards interest and principal can also help you plan for future payments. Calculating an amortization schedule with a formula is simple. All you need is the loan amount, the interest rate, and the number of payments. You can then plug these numbers into the formula to get an accurate amortization schedule. Knowing how to calculate an amortization schedule can be a great way to keep track of your loan payments, and make sure you’re on track to pay it off on time.

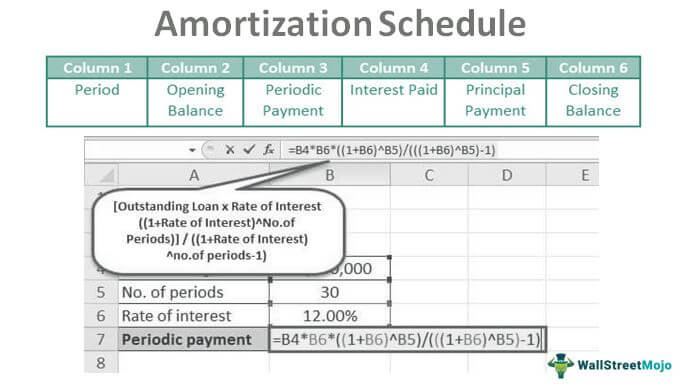

Explaining the Amortization Schedule Formula and Its Components

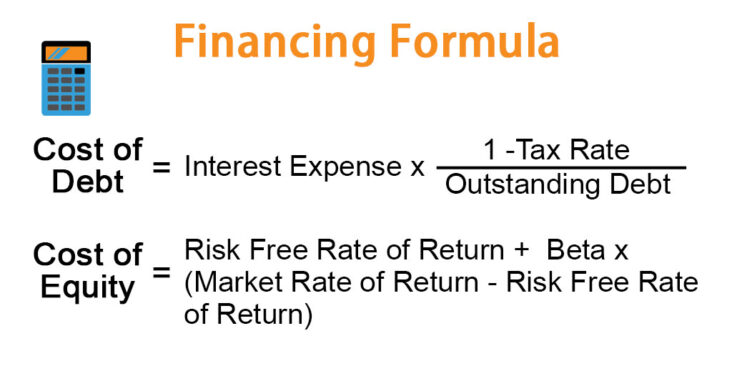

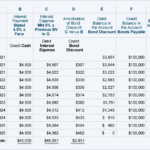

An amortization schedule is a document that outlines the payments made over time to pay off a loan. It includes the principal balance, interest rate, payment amount, and remaining balance for each payment. The formula for calculating an amortization schedule is quite simple, but understanding all of its components can help you make better financial decisions. The formula consists of the principal balance, interest rate, and number of payments. The principal balance is the original loan amount, the interest rate is the cost of borrowing money from the lender, and the number of payments is the total number of payments you will make over the life of the loan. Knowing these components and how to calculate an amortization schedule can help you make more informed decisions when it comes to finances.

Benefits of Using an Amortization Schedule

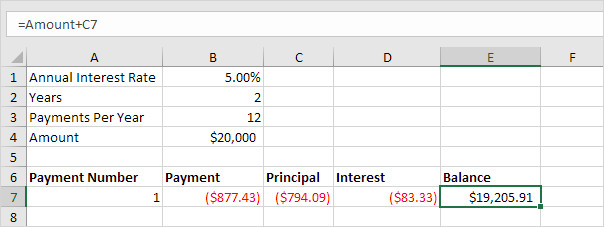

An amortization schedule is a financial document that shows the breakdown of a loan, including the loan’s interest and principal payments over the life of the loan. It’s an important tool for managing your finances and understanding how the loan works. The schedule also allows you to calculate the total amount paid on the loan, as well as how much of the principal is being paid off each month. With an amortization schedule, you can also easily calculate how much of the principal will be paid off by a certain date. The benefits of using an amortization schedule are numerous. You can easily see how much of the loan is being paid off each month, what the total amount paid will be, and which payments are going towards principal and which are going towards interest. Additionally, you can use the amortization schedule to determine when your loan will be paid off in full and plan accordingly. This can be especially useful if you plan to pay off the loan early. An amortization schedule is an invaluable tool for understanding and managing your finances, and it can help you make the most of your loan.

Common Uses of an Amortization Schedule

An amortization schedule is a key component of any loan or debt repayment plan. It essentially breaks down a loan into its component parts, showing how much of each payment goes towards paying off the principal balance and how much goes towards paying interest. This calculation is important for determining how long it will take to pay off a loan and how much interest will be paid over the life of the loan. With the help of a formula, you can easily calculate an amortization schedule to determine the exact amounts of each payment. Common uses of an amortization schedule include keeping track of mortgage payments, student loan payments, and car loans. Knowing how much of each payment goes towards principal and interest can also be useful for budgeting purposes, since it can help you determine how much of your monthly payment is going to interest and how much is going towards paying off the loan itself. By understanding an amortization schedule, you can make sure you are on track to pay off a loan in a timely manner and save money in the long run.

Best Practices for Creating an Amortization Schedule and Calculating with Formulas

An amortization schedule is a great way to keep track of loan payments and understand the total cost of a loan. It’s important to understand how to calculate an amortization schedule with formulas so you can make sure you know exactly how much you will be paying over the life of your loan. To calculate an amortization schedule with formulas, you need to know the principal amount of the loan, the interest rate, and the length of the loan. From there, you can use the formula to calculate the monthly payment amount and the total cost of the loan. Best practices for creating an amortization schedule include writing down all the loan details, such as the principal amount, interest rate, and term length, and making sure to keep track of all the payments made. Additionally, it’s important to double-check your calculations to make sure the schedule is accurate. Once you understand how to calculate an amortization schedule with formulas, you can save time and ensure you know exactly how much you will be paying towards your loan.