An amortization schedule is an important tool that can help you plan your financial future. It allows you to calculate loan payments over time, giving you a clear picture of how much you owe and when payments are due. Knowing your amortization schedule can help you budget, make informed decisions about debt, and ensure you stay on track with your payments. Read on to learn more about the definition of an amortization schedule, how it works, and how it can help you reach your financial goals.

What Is Amortization and How Does It Work?

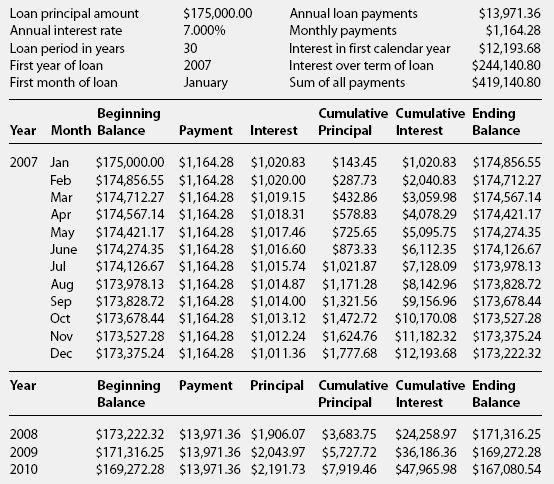

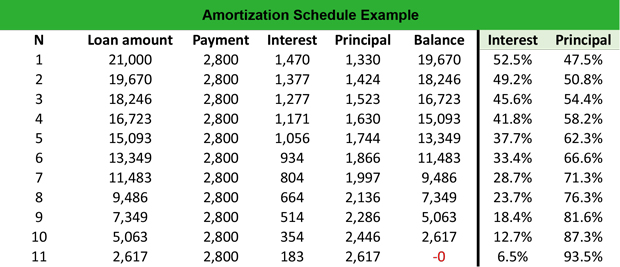

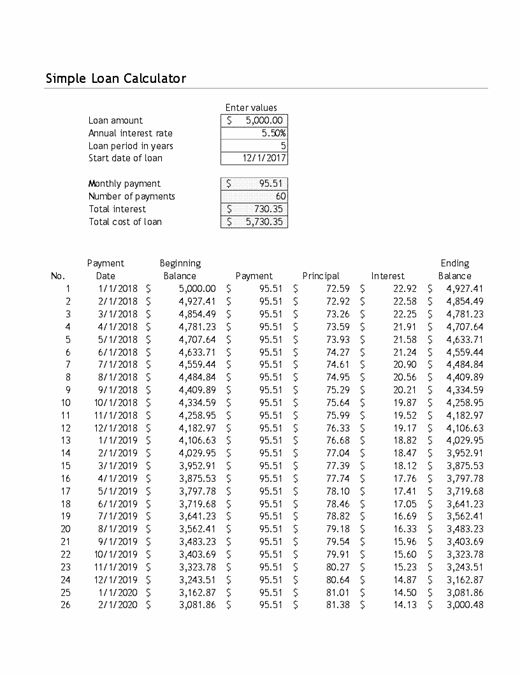

An amortization schedule is a document that outlines the payments you have to make to pay off a loan. It outlines the interest and principal components of each payment you make, and how much of the payment goes to each. Amortization is the process of paying off a loan with regular payments over a period of time. It works by breaking down each payment into two components, an interest portion and a principal portion. The interest portion is calculated based on the remaining balance of the loan and the interest rate. The principal portion is the amount of the payment that goes towards paying off the loan. With each payment, the balance decreases and the amount of interest paid decreases as well. This process continues until the loan is completely paid off.

Understanding the Components of an Amortization Schedule

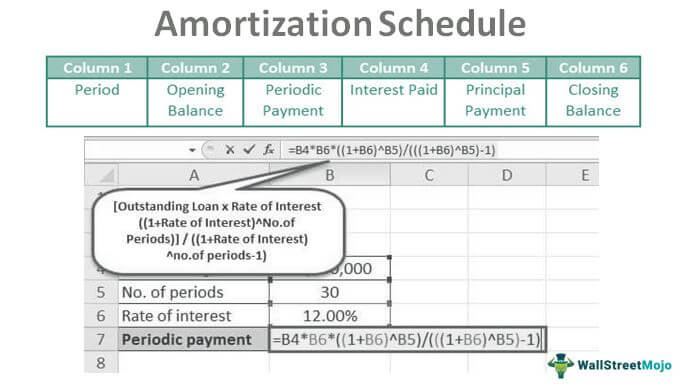

An amortization schedule can seem like a complicated financial document, but understanding the components of it can help make it easier to interpret. At its core, an amortization schedule is a table or chart that shows how much principal and interest is paid on a loan over a period of time. The schedule typically includes the loan’s start and end dates, loan balance, payment amount, and interest rate. It also breaks down each payment into the principal and interest portions. By looking at the amortization schedule, you can see how much you’re paying in interest and how much you’re paying to reduce the loan balance. With the information from an amortization schedule, you can more easily plan for future payments and make sure you’re paying off your loan in a timely manner.

Benefits of Using an Amortization Schedule

Having an amortization schedule can be a great way to stay organized when it comes to your finances. An amortization schedule is a table that outlines the periodic payments made on a loan. It includes the amount of each payment and shows how much of each payment goes towards the principal balance, as well as how much goes towards the interest. This can be helpful for a number of reasons. For one, it allows you to better plan out your loan payments and keep track of how much you owe. It also helps you know when to expect the interest and principal payments, which can help with budgeting. Additionally, it can help you see the long-term costs of the loan, so you can make sure you’re getting the best deal possible. Overall, having an amortization schedule can help you manage your finances and make sure you’re on track to pay off your loan in a timely manner.

Different Types of Amortization Schedules

An amortization schedule is a great way to keep track of your loan payments and the interest you’re paying over time. It’s a table that breaks down each payment into its principal, interest, and remaining loan balance over the life of the loan. Knowing what your payments look like can help you budget and plan for the future. There are three main types of amortization schedules: the straight line, declining balance, and interest-only. The straight line amortization is the most common and requires you to pay the same amount each month for the life of the loan. The declining balance amortization reduces your monthly payment as the principal decreases, while the interest-only amortization keeps your monthly payments the same but only pays the interest portion of the loan. Understanding these different types of amortization schedules can help you make the best decision for your financial situation.

Tips for Creating an Effective Amortization Schedule

Creating an effective amortization schedule can be tricky, especially if you’re new to the concept. To make sure you’re on the right track, there are a few tips you should keep in mind. First, make sure to calculate your loan’s interest rate and principal balance correctly. This will give you the necessary information to accurately amortize your loan. Next, consider the length of the loan and the number of payments you’ll need to make. This will help you plan the frequency of your payments and determine the amount you’ll need to pay each time. Lastly, be sure to double-check your calculations and review your amortization schedule regularly to make sure everything is in order. Following these steps will ensure that you have an effective amortization schedule that is organized and up-to-date.