When it comes to estate planning, one of the most important things to understand is the concept of an A-B trust. An A-B trust is a type of trust that can be used to protect assets and minimize taxes.

In this blog post, we will explore the definition of an A-B trust and how it can be used in estate planning. We will also discuss the benefits and drawbacks of using an A-B trust.

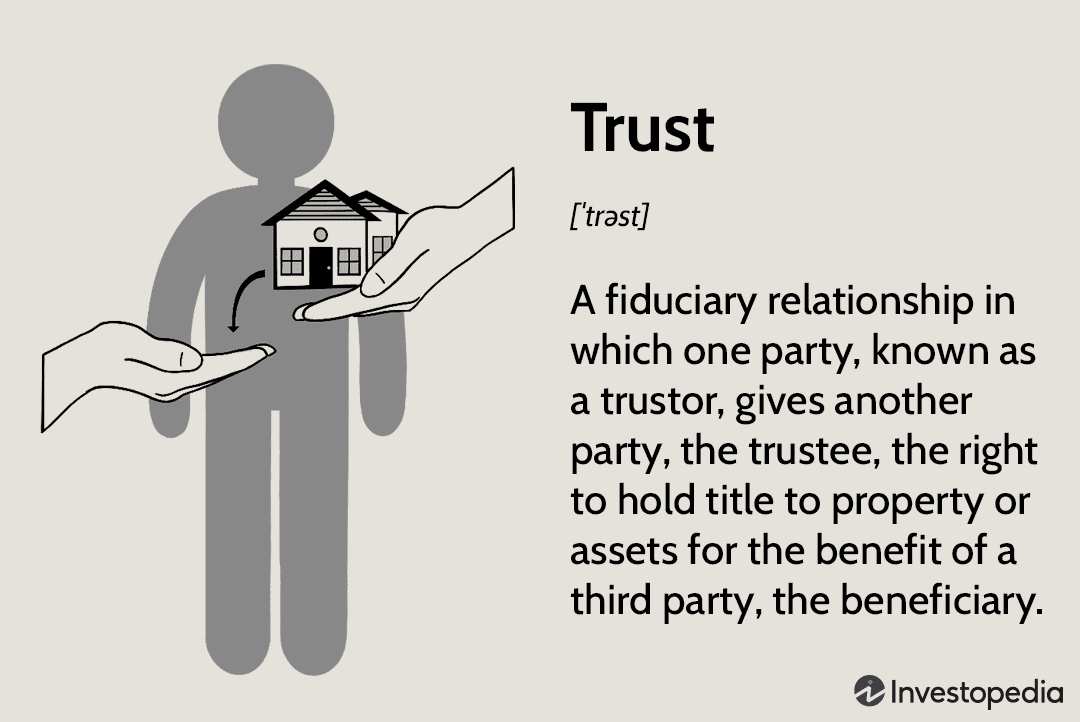

What is a trust?

A-B Trust is a type of trust created by a married couple in order to provide for the distribution of their assets upon their death. The A-B Trust allows for the husband and wife to each have their own trust, which means that each spouse can control how their assets are distributed. This can be beneficial if the couple has different wishes for their children or if one spouse wants to provide for a charity.

An A-B Trust can also help to minimize estate taxes, as each spouse’s trust is taxed separately. This can be especially beneficial if one spouse has a much larger estate than the other.

If you are considering creating an A-B Trust, it is important to consult with an experienced estate planning attorney to ensure that it is properly created and funded.

Benefits of trusts

There are many benefits of trusts, including the following:

1. Trusts can help to protect your assets from creditors.

2. Trusts can help to reduce the amount of taxes you owe.

3. Trusts can help to provide for your family after you die.

4. Trusts can help to control how your assets are used after you die.

5. Trusts can help to make sure that your assets are distributed the way you want them to be.

Who is eligible for a trust?

A-B trusts are created for the benefit of a married couple, with the surviving spouse receiving all of the assets in the trust upon the death of the first spouse. The couple’s children are the beneficiaries of the trust after the death of the second spouse. To be eligible for an A-B trust, the couple must be married and have children who are alive at the time the trust is created.

How does a Trust work?

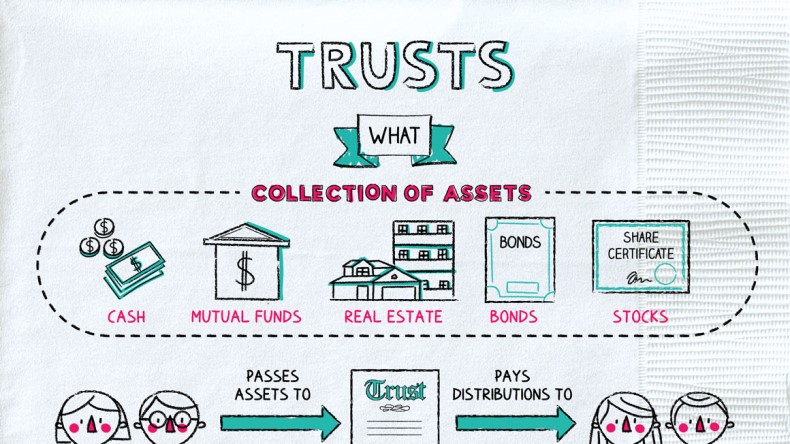

A trust is a legal arrangement in which one person, called the trustee, holds property for another person, called the beneficiary. The trustee may be an individual, a bank, or a corporation. The beneficiary may be an individual, a group of people, or a charitable organization.

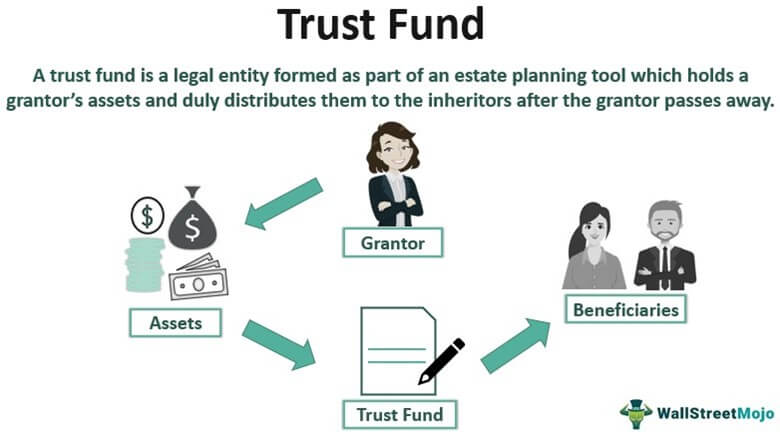

A trust can be created for any purpose that is legal and not against public policy. For example, trusts are often created to provide for the care of minor children or disabled adults, to manage property for people who cannot do so themselves, or to reduce the size of an estate for tax purposes.

Under the terms of the trust agreement, the trustee has a duty to manage the trust property according to the instructions of the settlor (the person who creates the trust). The trustee also has a duty to act in the best interests of the beneficiaries.

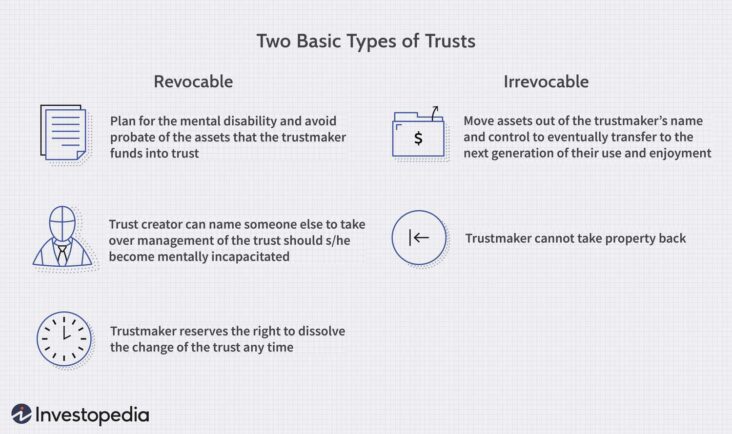

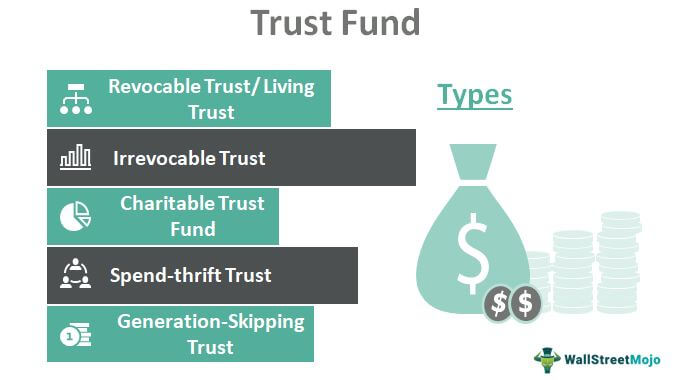

The terms of a trust can be very simple or very complex, depending on the desires of the settlor. Trusts can be revocable or irrevocable. A revocable trust can be changed or terminated by the settlor at any time. An irrevocable trust cannot be changed or terminated by the settlor except in rare circumstances.

Trusts are governed by state law. The laws of each state are different, so it is important to consult with an attorney before creating a trust.

Types of Trusts

A-B trusts are the most common type of trust used in estate planning. There are two types of A-B trusts: testamentary and inter vivos. Testamentary trusts are created by will and take effect upon the death of the grantor. Inter vivos trusts, on the other hand, are created during the grantor’s lifetime.

Both types of A-B trusts are irrevocable, meaning that once they are created, the terms cannot be changed. This is important because it allows the grantor to protect assets from creditors and estate taxes.

A-B trusts can be either revocable or irrevocable. If a trust is revocable, that means the grantor can change the terms at any time. If a trust is irrevocable, that means the terms cannot be changed after the trust is created.

Most A-B trusts are revocable because they give the grantor more control over the assets during their lifetime. Revocable trusts also have the advantage of being able to be changed if the grantor’s circumstances change. For example, if the grantor gets divorced, they can change the trust so that their former spouse does not receive any of their assets.

Irrevocable trusts have the advantage of providing more protection from creditors and estate taxes. However, once an irrevocable trust is created, the terms cannot be changed, even if the grantor’s circumstances change.

Who does not need a trust?

Anyone who doesn’t own property or have a large estate generally doesn’t need a trust. If you don’t have any assets to transfer after you die, there’s no need for a trust. Trusts are also not necessary if you have a small estate that can be easily distributed through a will.

What Is A-B Trust? – A-B Trust Financial Definition

An A-B trust is a type of trust that is created for the benefit of two people, usually a husband and wife. The trust is divided into two parts, the A trust and the B trust. The A trust is also known as the marital trust or the family trust. The B trust is also known as the bypass trust or the credit shelter trust.

The A trust is funded with property that is owned by the husband and wife jointly. The property in the A trust is subject to estate taxes when the first spouse dies. The B trust is funded with property that is owned by the husband or wife individually. The property in the B trust is not subject to estate taxes when the first spouse dies.

When the first spouse dies, the A trust becomes a separate trust for the benefit of the surviving spouse. The B trust becomes a separate trust for the benefit of the children of the marriage or other beneficiaries. The trustee of each trust has discretion to distribute income and principal to beneficiaries as provided in the terms of the trusts.

The advantages of an A-B Trust are that it can save estate taxes at the death of the first spouse and it can provide income tax advantages for the surviving spouse.