Are you curious about what a Baby Boomer is? Baby Boomers are a generation of individuals born between 1946 and 1964, and are often referred to as the “post-war” generation. They are a large, influential group of people with distinct financial needs, and understanding what a Baby Boomer is and what their financial definition is can help you better understand their unique financial situation. In this article, we will discuss the Baby Boomer financial definition, their financial challenges, and strategies they can use to help ensure their financial success.

Overview of the Baby Boomer Generation

The Baby Boomer generation is one of the largest in history and is composed of people born between the mid-1940s and mid-1960s. Known for their ambition and drive, Baby Boomers are the ones who experienced the cultural and economic revolutions of the 1960s and 70s. They are the ones who pushed for gender and racial equality and who helped shape the modern world as we know it today. In terms of finances, Baby Boomers are typically more conservative than their younger counterparts, with a greater emphasis on saving and investing for the future. They are also more likely to have retirement plans in place and are more likely to have more liquid assets, such as stocks and bonds, than younger generations. With the Baby Boomer generation now beginning to retire, understanding their financial needs is of utmost importance for those who want to properly plan for their future.

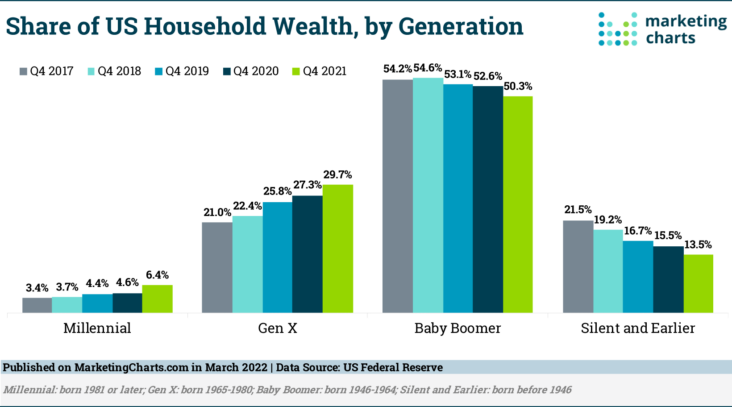

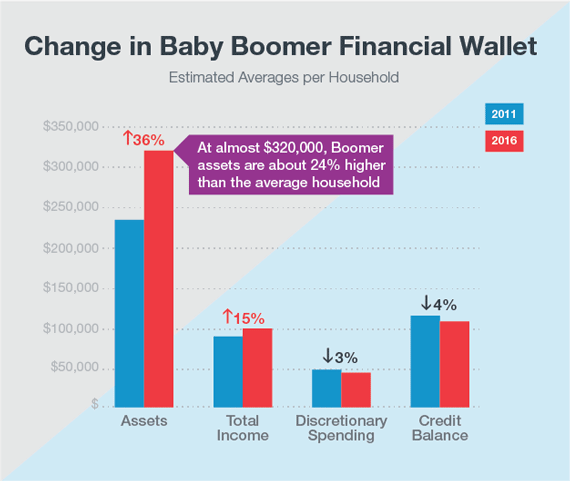

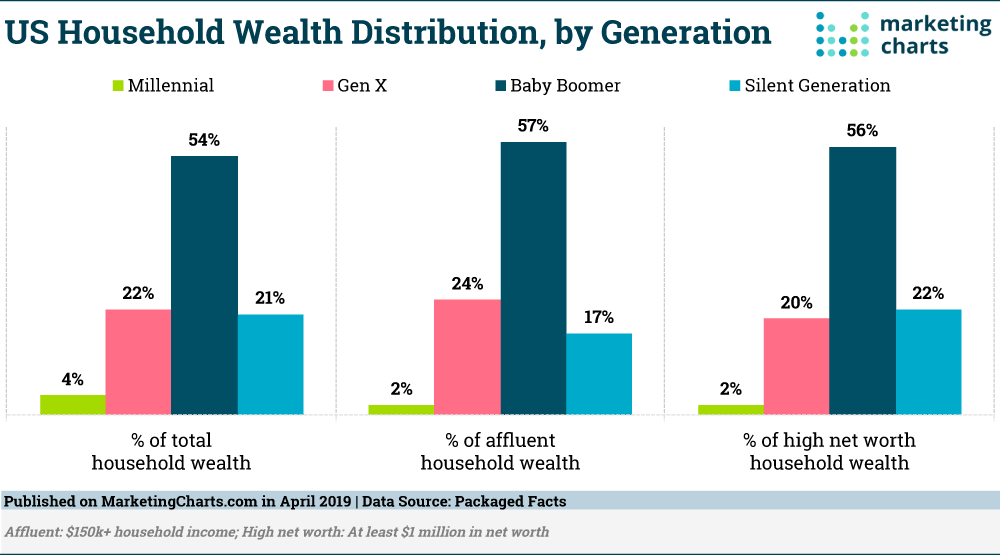

The Impact of Baby Boomers on the Economy

Baby Boomers have had a tremendous impact on the economy, not just in the US, but around the world. As the first generation of people to have access to unprecedented levels of education, employment, and technology, Baby Boomers have helped to shape economic growth and development in many different ways. They have created new businesses, increased the demand for goods and services, and boosted the economy in countless ways. At the same time, they have also had an impact on the labor market, as they are living longer and retiring later than previous generations. This has caused a shift in the way of doing business, as companies must now plan for an aging workforce. Additionally, Baby Boomers have had an effect on the stock market, as their investments have created new opportunities for investors and companies alike. Finally, the Baby Boomer generation has been a major contributor to global economic growth, as their spending has increased the demand for goods and services in many countries. All in all, Baby Boomers have had a tremendous impact on the economy, and it’s only expected to become more profound in the years to come.

Financial Planning Strategies for Baby Boomers

Baby boomers are a large generation of individuals born between 1946 and 1964. As they age, they face unique financial challenges and must plan for their retirement years. Financial planning strategies for baby boomers include saving early, diversifying investments, and planning for long-term care. Saving early, while you are still young and your income is higher, will give you a head start in building your retirement nest egg. Diversifying investments can help protect your money from large losses during times of market volatility. Finally, planning for long-term care will help you have peace of mind knowing that your future medical needs are taken care of. Baby boomers are in a unique position to take advantage of a variety of financial planning strategies to ensure their retirement years are secure and comfortable.

Social Security Benefits for Baby Boomers

As a Baby Boomer, you’re entitled to some awesome social security benefits! Social Security is a great way to help you maintain financial stability as you age, and it’s also a great way to plan for the future. With Social Security, you can look forward to receiving retirement benefits, survivor benefits, disability benefits, and more! You can also make sure you receive the highest possible benefit by filing for Social Security at the right time. Baby boomers are often eligible for the highest benefits due to their age, so if you’re a Baby Boomer, make sure you don’t miss out on what’s coming to you!

Investing Tips for Baby Boomers to Maximize Wealth

If you’re a Baby Boomer looking to maximize your wealth, there are some important investment tips you should keep in mind. First, diversify your portfolio to minimize risk. Having a mix of stocks, bonds, mutual funds, and other investments can help protect your assets from any potential losses. Additionally, consider investing in low-cost index funds or ETFs, as these can provide good returns with minimal fees. Finally, ensure you have an emergency fund available in case of any unexpected expenses, as this will help you maintain financial stability. With these tips, you can set yourself up for a secure financial future.