If you are looking for information about what a Baby Bond is, you have come to the right place. Baby Bonds are a type of fixed-income security that can provide a steady stream of income and potential appreciation over time, making them a great investment choice for those seeking a low-risk way to grow their money. In this article, we’ll discuss the basics of Baby Bonds, including what they are, how they work, and the potential benefits. We’ll also explore the different types of Baby Bonds available, how to purchase them, and the risks associated with investing in them. With this knowledge, you’ll be able to make a more informed decision about whether Baby Bonds are the right investment for you.

What is Baby Bond?

Baby bonds are an awesome way to save for the future! They are a type of investment that allows you to put money away for your child’s future. Basically, you open up a savings account for your little one where you can deposit money and earn interest. The money you save can be used for your child’s college education, a down payment for their first home, or even to start a business. Baby bonds are a great way to give your child a head start in life, and the potential for earning interest can make this a great long-term investment. Plus, it’s never too early to start teaching your child the importance of saving and investing for their future.

What Are the Benefits of Investing in Baby Bonds?

Investing in baby bonds can be a great way to build long-term wealth and financial security. With their low-risk nature and relatively high yields, these bonds are a great way to get your money working for you. Baby bonds can be bought with a minimum investment of just a few hundred dollars, meaning they’re accessible to almost anyone. The benefits of investing in baby bonds are numerous; you can benefit from the stability of fixed income, a steady stream of income, and potential capital gains. Baby bonds are also highly liquid, meaning you can easily access your money in the event of an emergency. Finally, baby bonds are relatively low-maintenance investments, so you don’t have to worry about constantly monitoring and managing your portfolio. Investing in baby bonds is a great way to build financial security and grow your wealth in the long-term.

How Can I Invest in Baby Bonds?

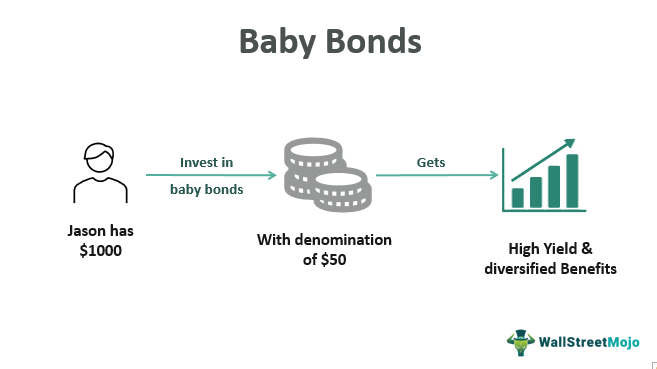

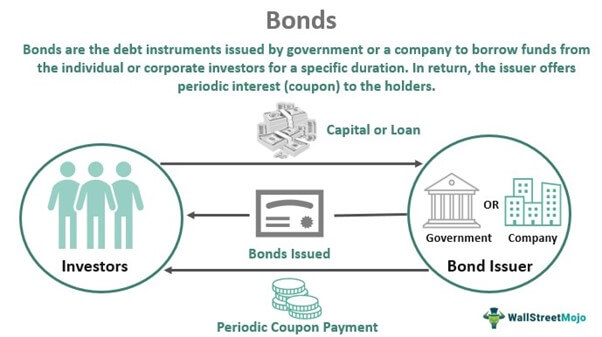

If you’re looking to invest in baby bonds, there are a few things you should know. Baby bonds are a type of debt security issued by companies or governments that have a lower minimum investment amount than traditional bonds. This makes them attractive to younger investors who may not have the resources to invest in traditional bonds. When you invest in baby bonds, you’re essentially lending money to the company or government that issued the bonds, and in return, you receive interest payments over the life of the bond. You can usually purchase baby bonds through a broker or through the issuer’s website. It’s important to note that baby bonds are typically not as liquid as other investments, so you may not be able to sell them as easily as you would other investments. That said, baby bonds can be a great way to diversify your portfolio and potentially benefit from the higher returns of a bond investment.

What Are the Risks of Investing in Baby Bonds?

Investing in baby bonds can be a great way to diversify your portfolio and earn some extra income. But like any investment, there are some risks involved. One of the primary risks is that the issuer of the bond might not be able to make the payments on the principal and interest, which could result in a loss of your principal amount. There is also the risk of inflation, which can erode the value of the bond if the issuer doesn’t adjust the interest rate to keep up with inflation. Lastly, the issuer could also default on their payment obligations, which could result in a complete loss of your principal investment. For these reasons, it’s important to do your research before investing in any baby bonds to ensure you are comfortable with the level of risk.

What Is the Difference Between Baby Bonds and Other Bonds?

When it comes to bonds, baby bonds are quite different from the other types of bonds you might come across. They are relatively small denominations of bonds, usually starting from denominations of $25 and below. This makes them more accessible to investors with smaller budgets, and gives them the chance to invest in bonds without having to invest as much money. Baby bonds also provide a relatively low level of risk compared to other bond types, while still offering a reasonable return on investment. This makes them an attractive option for those looking to invest in bonds but don’t want to risk too much of their money. Baby bonds are a great way for new investors to start investing in the bond market without taking on too much risk.