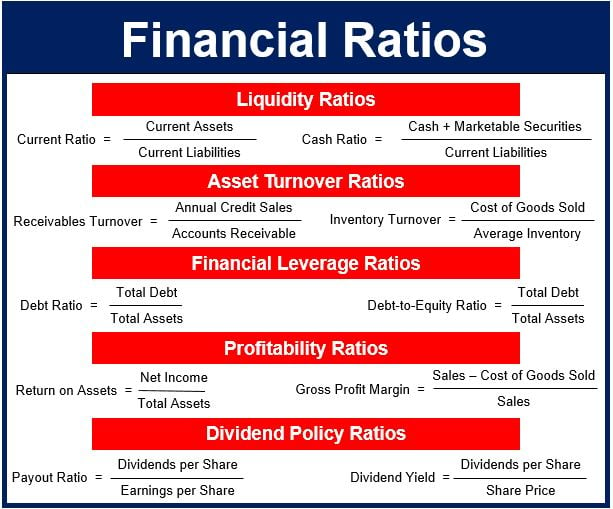

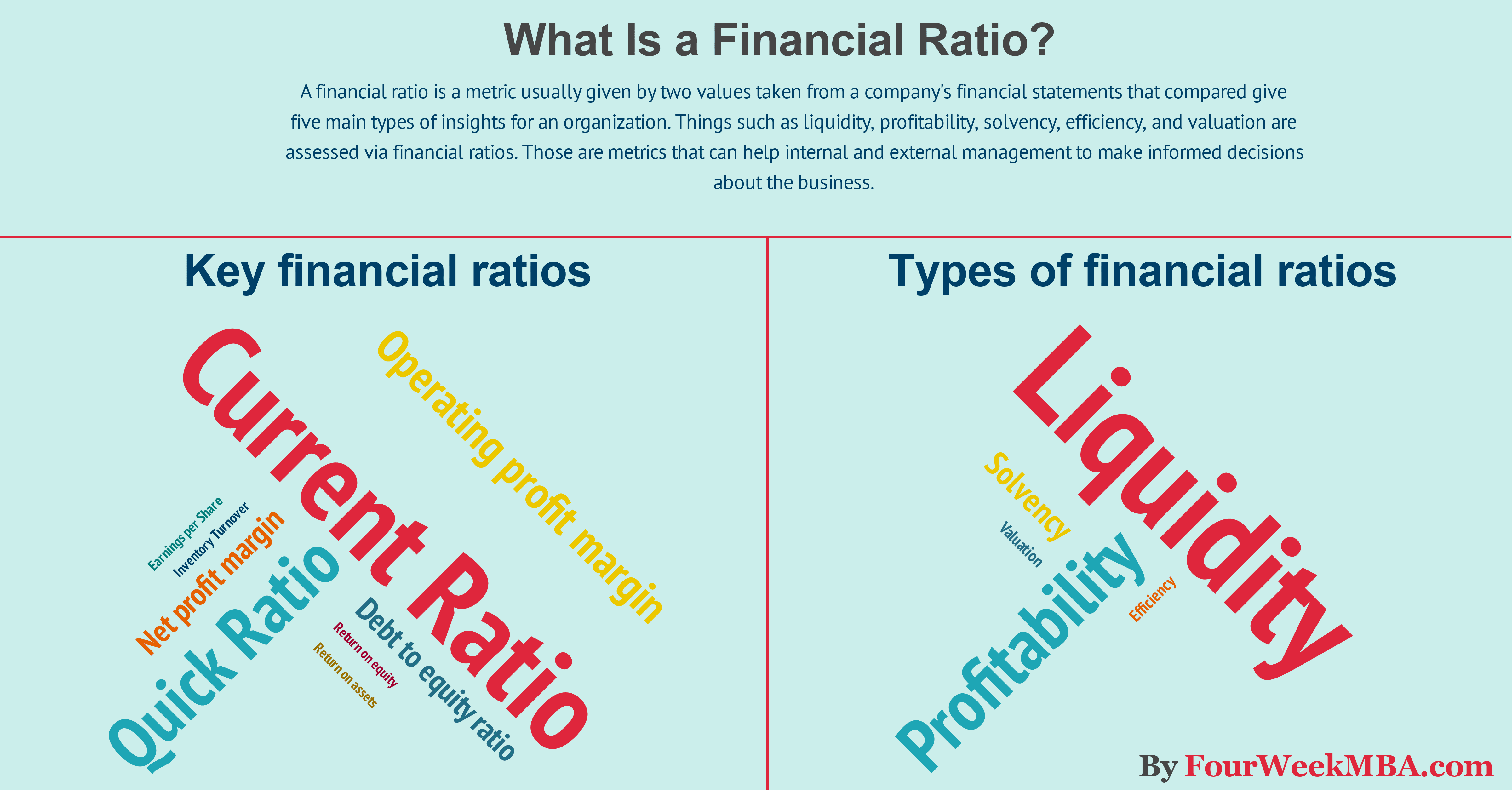

The back-end ratio, also known as the debt-to-income ratio, is one of the most important financial ratios used in the world of finance. It is a key factor that lenders will consider when deciding whether or not an individual can be approved for a loan. This ratio is an indication of how much of an individual’s monthly income is being spent on debt payments. Knowing how to calculate the back-end ratio can help you make better financial decisions and secure the funding you need. In this article, we’ll look at what the back-end ratio is, why it’s important, and how you can use it to your advantage.

What Is the Back-End Ratio and How Is It Calculated?

The back-end ratio is a financial analysis tool that helps lenders determine how much debt a borrower can handle. It’s calculated by dividing the total monthly debt payments by the total monthly income. This ratio helps lenders assess a borrower’s ability to repay debt and is often used as a requirement for loan qualification. Knowing your back-end ratio is essential for anyone looking to borrow money. It’ll give you an idea of how much you can afford to take on, and it lets lenders know if you’re a reliable borrower. To calculate your back-end ratio, divide all your monthly debt payments by your total monthly income – that’ll give you a percentage that lenders use to determine your creditworthiness.

The Benefits of Understanding the Back-End Ratio

Understanding the back-end ratio is important for anyone looking to manage their finances. It can help you make better decisions when it comes to taking out loans, mortgages, and more. Knowing your back-end ratio helps you understand how much of your monthly income is going towards debt obligations, which can help you manage your budget and reduce your reliance on credit. It can also help you determine if you can afford a big purchase or if you need to save more money before taking on more debt. With the back-end ratio, you can get an accurate picture of your current financial situation so you can make the best decisions for your future.

Common Uses of the Back-End Ratio

The back-end ratio is an important financial calculation used to assess an individual’s ability to make monthly payments. This ratio is calculated by dividing an individual’s monthly debt payments with their total monthly income. A low back-end ratio is an indication of good financial health as it suggests that an individual has a low debt burden and is able to repay their debts.The back-end ratio is commonly used by banks and other lenders when assessing an individual’s creditworthiness. When an individual applies for a loan, lenders will use the back-end ratio to determine how much of the individual’s total income is being used to pay off existing debts. A low back-end ratio is seen as favorable as it suggests that the individual is able to manage their monthly debt payments and still have enough left over to cover the loan payment.The back-end ratio is also commonly used by employers when evaluating potential hires. Employers will use the back-end ratio to assess whether an individual is able to take on additional debt without stretching themselves too thin financially. A low back-end ratio is seen as an indication of good financial health and suggests that the individual will be able to manage their finances responsibly.The back-

The Impact of a High Back-End Ratio

When it comes to your financial health, the back-end ratio is an important metric to take into consideration. A high back-end ratio indicates that you’re living beyond your means and may be in a precarious financial situation. This ratio measures your total monthly debt payments, including credit cards, loans and mortgages, divided by your gross monthly income. Having a high back-end ratio can have serious consequences for your credit score and future financial opportunities. It can make it difficult to take out loans, mortgages, and other debt products, and it can have an overall negative effect on your creditworthiness. Even if you have an excellent credit score, a high back-end ratio can still have an impact. If you have too much debt, lenders may view you as a risky borrower and be less likely to lend to you. To reduce your back-end ratio, focus on paying off debt and reducing unnecessary expenses. If you can lower your ratio, it can help you in the long run by improving your creditworthiness and giving you more financial freedom.

Strategies for Improving Your Back-End Ratio

If you want to improve your back-end ratio, there are a few strategies you can employ. One of the most important things you can do is to reduce your total debt. You can do this by paying off existing debt or by refinancing your existing debts into a single loan with a lower interest rate. You can also try to increase your income and reduce your expenses, as this will help improve your ratio. Finally, you can try to negotiate with creditors to reduce the amount of debt you owe them. By taking these steps, you can significantly improve your back-end ratio and improve your overall financial health.