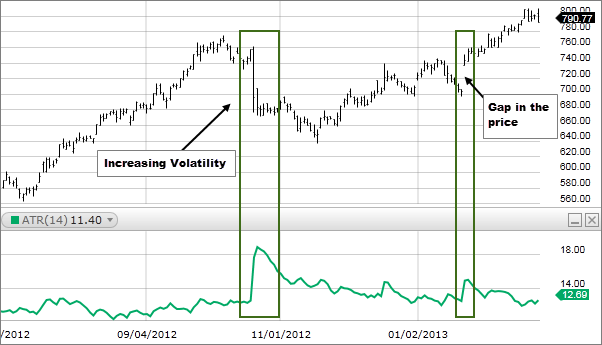

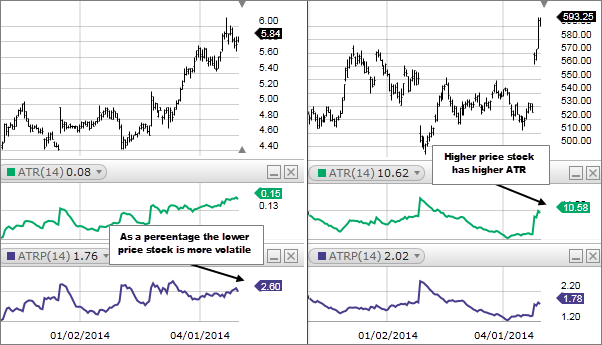

Average True Range (ATR) is a technical indicator used to measure the volatility of a security or asset. It is an important tool for traders and investors to understand the market conditions and determine the best entry and exit points for their trades. ATR is calculated based on the true range of the asset, which is the difference between the highest and lowest prices over a given period of time. ATR can help traders identify the trend of the asset and determine whether the asset is trending or non-trending. By understanding the true range of an asset, traders can make better decisions on when to enter and exit the market.

What is Average True Range (ATR) and How Does it Work?

Average True Range (ATR) is an indicator used to measure the volatility of a stock. It helps investors determine the price movements of a particular stock by taking into account the high and low prices of the day, as well as the closing price of the previous day. ATR is a great tool for traders who want to identify potential buying and selling opportunities. By using ATR, traders can see how volatile the market is and how much a price can move up or down on a given day. ATR is a great way to gain insight into the market and make informed trading decisions. ATR is a simple yet powerful indicator that can be used in any trading strategy to maximize profits. So, if you want to get the most out of your trading, make sure you’re using ATR!

Exploring the Benefits of Using Average True Range (ATR)

Using Average True Range (ATR) can be a great way to measure volatility in the markets. This tool can help traders make more informed decisions when it comes to setting stop losses and entering into trading positions. It can also help traders gauge the risk associated with any particular trade. Not only is it useful to traders, but ATR can also help investors discover how much money they need to allocate to a particular asset. It can also be used to measure the amount of time a trade has been open, giving investors an idea of how long they should hold onto their asset. With all the benefits of using Average True Range (ATR), it is no wonder why it is a popular tool among traders and investors.

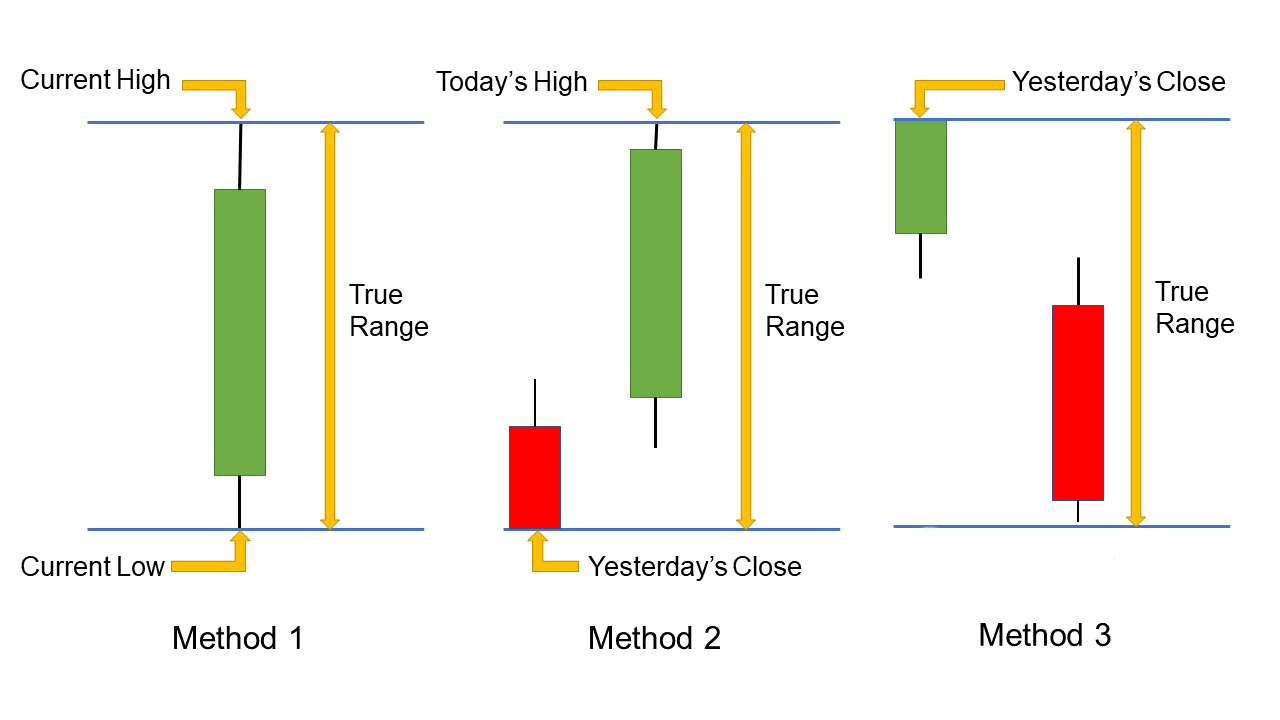

How to Calculate Average True Range (ATR)

Calculating Average True Range (ATR) is an important part of technical analysis that can help traders make more informed decisions. The ATR measures the degree of price volatility over a given period of time. It is calculated by taking the exponential moving average of the absolute difference between the highest high and the lowest low of the given period. The ATR can be used to identify trends, gauge market volatility, and determine entry and exit points in the market. It can also be used to set stop loss and take profit levels. By understanding the ATR and its calculation, traders can make more informed trading decisions and increase their chances of success in the market.

Common Pitfalls to Avoid When Using Average True Range (ATR)

When it comes to Average True Range (ATR), it’s important to understand the common pitfalls to avoid. One of the most important things to remember is that ATR can be used in many different ways, and depending on your trading strategy, you may find yourself using it differently. Another mistake is relying too heavily on ATR as a measure of volatility, which can lead to inaccurate decisions. Additionally, ATR should be used in conjunction with other indicators, as it cannot provide a full picture of the market on its own. Finally, it’s important to remember to be consistent when using ATR, as any changes in your trading strategy can throw off the indicator. By being aware of these common pitfalls and taking the necessary precautions, you can make sure you’re getting the most out of ATR and using it to its full potential.

Using Average True Range (ATR) in Your Trading Strategy

If you’re looking to use Average True Range (ATR) to enhance your trading strategy, then you’re in the right place. ATR is a powerful indicator that can help you identify trends and make informed decisions when trading. By using ATR, you can track price movements and volatility to help you determine when to enter and exit a position. ATR can also be used to identify potential support and resistance levels, allowing you to make more informed decisions when trading. With ATR, you can make better trades, more quickly, and with less risk. Start using ATR today to improve your trading strategy and get ahead of the market.