Are you intrigued by the concept of Average Selling Price (ASP)? Have you ever wondered what exactly it is and how it can be used in financial matters? ASP is a term used to describe the average price at which a product or service is sold over a particular period of time. This article will provide an overview of what Average Selling Price is, how it is calculated and how it can be used to assess the performance of a company. We will also look at some examples of how ASP can be used in the financial world and how it can be used to make decisions and forecasts.

What is Average Selling Price (ASP) and How Does It Work?

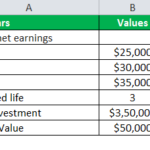

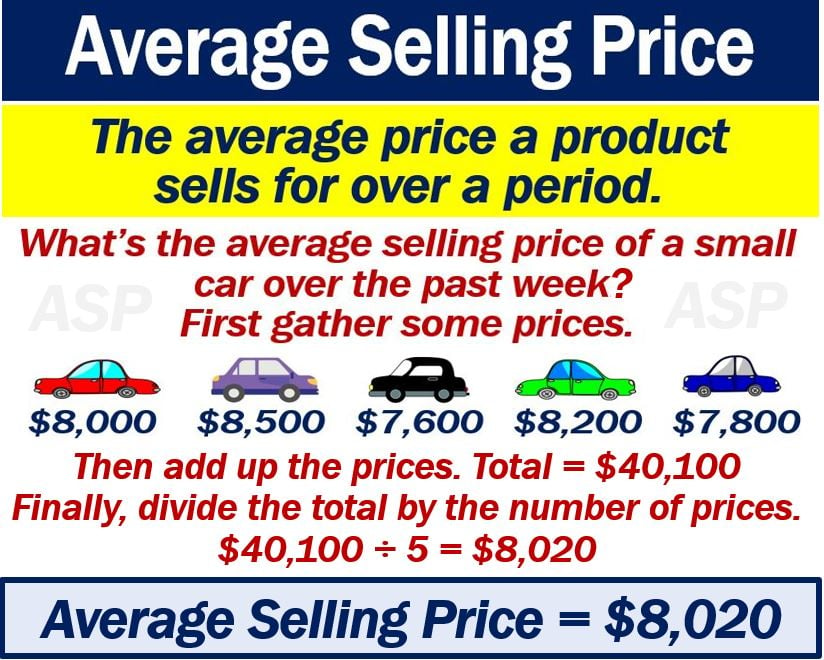

Average Selling Price (ASP) is a way to measure the success of a product or service, and it’s an essential tool for any business. ASP is a metric that helps analyze the profitability of a product or service by calculating the average price of all the items in a given period. It allows businesses to track how much they’re making on an item, taking into account the number of sales, the number of items sold, and the total price of the items. To get the most accurate ASP figure, businesses must take into account how much each item costs, how many items are being sold, and how much they’re making on each sale. This figure can then be used to measure the success of the product or service, compare it to other similar products or services, and determine how much profit the business is making. ASP is a great way for businesses to track their success and make sure they’re making the most of their investments.

How to Calculate Average Selling Price (ASP)

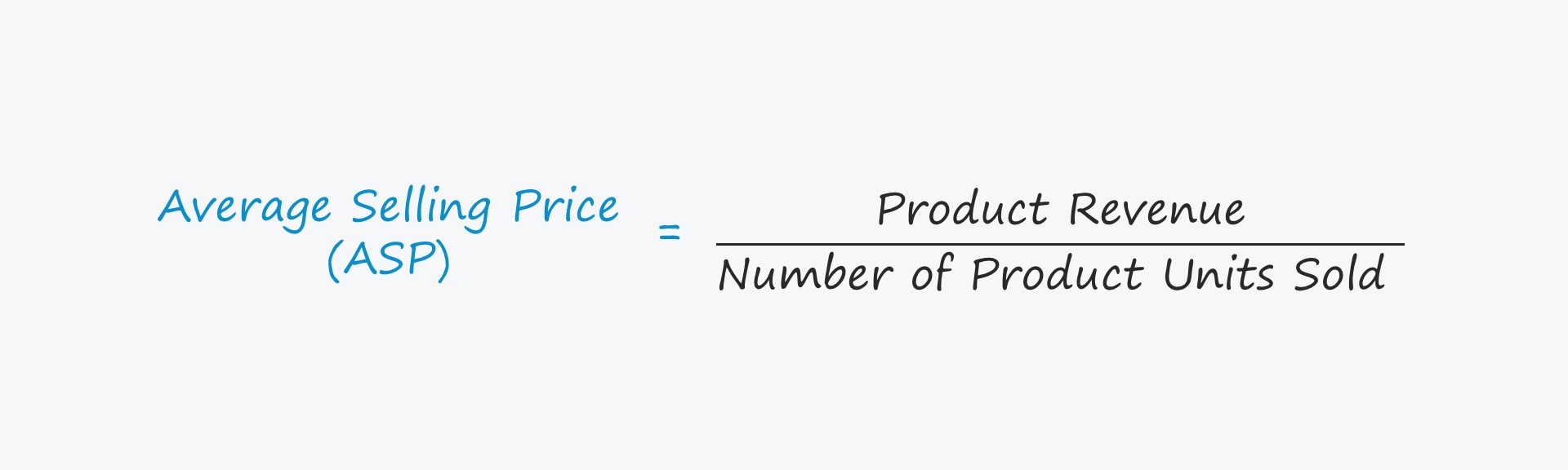

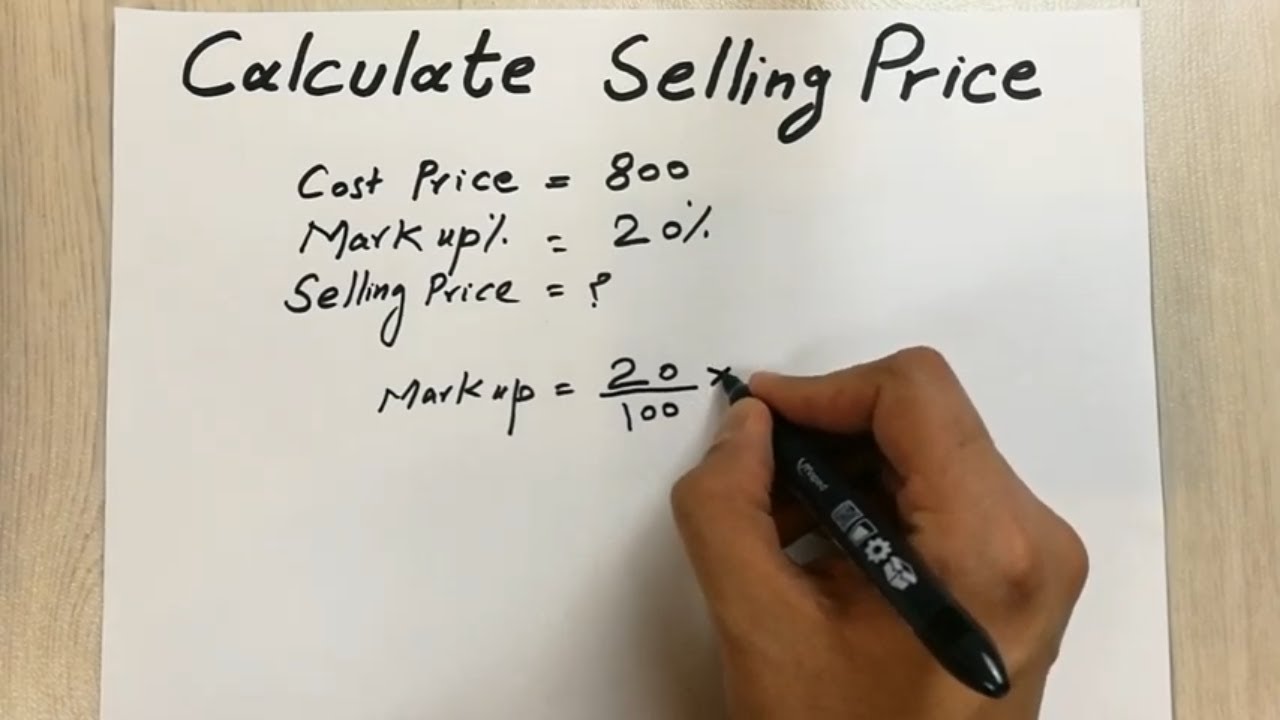

Calculating Average Selling Price (ASP) is an important step to understanding how well your products are selling. It can give you a better idea of how much money you’re making and how to adjust your prices to maximize profits. To calculate your ASP, you’ll need to look at the total sales of your products over a certain period of time and divide that by the total number of products sold. This can help you better understand your pricing and how to adjust it to make the most money. Knowing your ASP can help you make better decisions about how to price your products, as well as give you insights into the types of products that are selling the best.

Benefits of Knowing Average Selling Price (ASP)

Knowing your Average Selling Price (ASP) is essential for any business. It can help you understand what your customers are willing to pay for products or services, and give you an idea of where to focus your marketing efforts. By understanding your ASP, you can also set pricing strategies to maximize profits, create better customer experiences, and better understand your target market. With an understanding of your ASP, you can make more informed decisions about what products or services to offer, how to market to different demographics, and how to adjust pricing to maximize profits. Knowing your ASP can help you stay competitive in the marketplace, and ensure that your business is running at its most profitable level.

Strategies to Maximize Average Selling Price (ASP)

Maximizing your Average Selling Price (ASP) is a great way to increase revenue and gain a competitive edge. There are a few strategies you can use to make sure you are getting the most out of your price points. The first is to focus on improving customer experience. This means making sure your customers are getting what they need, when they need it, and that they are satisfied with the product or service they receive. Additionally, you can look at increasing the value of your products or services. This could be done by adding additional features or services, or by creating bundles or packages. Another way to maximize ASP is to offer discounts or promotions to select customers. Finally, you can work on increasing the visibility of your products or services. This could be done through marketing campaigns or by increasing the presence in online marketplaces. With a little effort and strategy, you can increase your Average Selling Price and improve your bottom line.

Common Mistakes to Avoid When Calculating Average Selling Price (ASP)

Calculating your Average Selling Price (ASP) is one of the most important metrics when it comes to tracking your business performance. A good ASP allows you to measure how much product you are selling and the overall success of your business. However, it’s important to be aware of the common mistakes when it comes to calculating ASP. First, be sure to include all relevant sales in your calculations. Many businesses forget to include items like taxes and shipping fees which can dramatically affect the final ASP. Second, be careful when calculating the ASP of multiple products. It’s important to note that the ASP of the products must be calculated separately in order to get the most accurate results. Finally, be sure to calculate the ASP over a long enough period of time to get a more accurate understanding of the performance of your products. By avoiding these common mistakes, you can get a more accurate understanding of your Average Selling Price and make better business decisions.