Investing money can be a great way to grow your wealth, but understanding the ins and outs of the market is essential. One important concept to understand is the average return, which refers to the expected rate of return on an investment over a certain period of time. By understanding the average return, investors can make informed decisions about what investments to make. In this article, we’ll explain what average return is and how to calculate it. We’ll also explain the pros and cons of average return so you can decide if it’s the right choice for you.

What Is the Average Return on Investment?

When it comes to investing, the average return on investment (ROI) is an important measure to consider. It’s the average rate of return on all investments over a period of time. It’s used to compare the profitability of different investments and to determine the overall performance of an investment portfolio. The average return on investment can be calculated by taking the total return of all investments in a portfolio and dividing it by the total number of investments in the portfolio. This calculation is useful for comparing the ROI of different investments and determining the overall profitability of an investment portfolio. It’s also a great way to evaluate the performance of an investment over time. Knowing your average return on investment can help you make informed decisions when it comes to investing and can help you maximize your returns.

How to Calculate Average Return

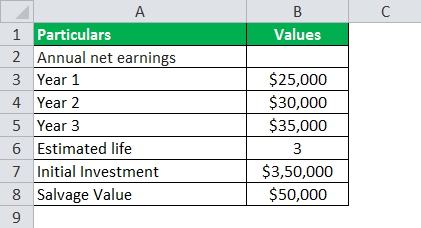

Calculating your average return can be an important part of understanding your financial performance. It can help you determine how successful your investments have been and give you a better idea of your overall financial goals. When it comes to calculating your average return, there are a few key steps to keep in mind. First, figure out your total investment return by adding up all of your investment gains and subtracting any losses. Then, divide this total by the total number of investments you made. Finally, to calculate your average return, divide the total return by the total number of years you have held the investments. This will give you your average return for each year of your investments. Knowing your average return can help you better understand your financial performance and help you make more informed decisions about your investments going forward.

Strategies to Maximize Average Return

Maximizing your average return on investments is a great way to maximize your portfolio’s growth. There are a few different strategies that you can employ to make sure you’re getting the most out of your investments. The first is by diversifying your portfolio. By investing in a variety of different assets, you’re able to spread out your risk and ensure that you’re not overly exposed to any single asset. Another strategy is to take advantage of compounding interest. By investing your money in a steady, long-term manner, you can take advantage of the compounding effect and see your average return increase over time. Finally, it’s important to keep an eye on any changes in the market that could affect your investments. By staying up to date with the latest news and trends, you can make sure that you’re investing in the right assets at the right time. Taking these strategies into account can help you make sure that your average return is maximized.

Common Mistakes to Avoid When Calculating Average Return

When trying to calculate average return, it’s important to avoid some common pitfalls. First, beware of averages that are weighted too heavily towards one time period or one particular type of investment. If the average return is based on a few high-performing investments, it could be masking other losses in the portfolio. Second, be aware of the risks associated with each investment, as this could affect the average return. Finally, make sure to account for any fees or taxes associated with the investments, as these could significantly impact the average return. By taking these precautions and being mindful of the different factors that affect average return, you’ll be able to get a more accurate picture of your investment performance.

Advantages of Knowing and Understanding Average Return

Knowing and understanding average return can be a great advantage when it comes to making investment decisions. Average return is a measure of the expected return of a security or portfolio, taking into account the probability of different returns. It gives investors an estimate of what they can expect to see in terms of returns over a certain period of time. Knowing the average return of a security or portfolio can help investors decide which investments make the most sense for them, as they can look at how much they may be able to gain or lose over a certain amount of time. Understanding average return can also help investors plan for long-term success, as they can use the measure to build a portfolio that is well-suited to their individual financial goals. With this knowledge, investors can make more informed decisions and be better prepared for the future.