The Average Propensity to Consume (APC) is an important economic concept that relates to how much of their income households spend on consumption. The APC is a key indicator of how much of a nation’s income is used to purchase goods and services, and is an important measure in understanding overall economic health. It can provide insight into consumer confidence, income disparities, and the strength of an economy. This article will explore what the APC is, how it is calculated, and how it is used in economic analysis.

Understanding the Average Propensity to Consume

The Average Propensity to Consume (APC) is an important economic concept that can help you make better financial decisions. It measures the proportion of income that people spend on consumption, which can provide valuable information about consumer confidence and spending habits. Knowing the average propensity to consume can help you understand how much of your income you should save and how much you should spend. It can also help you plan for big purchases, such as a car or house, and determine if you should take out a loan or not. Understanding the average propensity to consume is a key piece of knowledge for anyone looking to make smart financial decisions and achieve their financial goals.

Exploring Factors Affecting the Average Propensity to Consume

When it comes to determining how much a person or household is likely to consume, the average propensity to consume (APC) is a helpful tool. This metric looks at the ratio of total consumption to total disposable income, allowing people to get a better idea of what their average spending habits are. But what factors affect the APC? There are a few, including income level, age, and household size. Higher income levels tend to lead to higher APCs, as people have more disposable income to spend. Age can also have an effect, as young people tend to have a higher APC than older individuals. Lastly, household size can also have an impact on the APC, since larger households tend to have more members contributing to the total income and expenditure. Understanding these factors can help you better understand your own APC and make more informed spending choices.

Measuring the Average Propensity to Consume

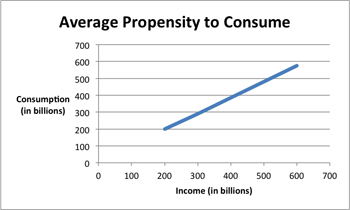

Measuring the Average Propensity to Consume can be an important way for individuals and businesses to get a better understanding of their overall financial health. By understanding the average propensity to consume you can start to make more informed decisions about your financial future. It is a measure of how much of your income you are spending on goods and services. It can give you an idea of whether you’re spending too much or too little and can help you to plan your budget more effectively. The average propensity to consume can be calculated by taking your total income and subtracting your total savings. This number is then divided by your total income. The higher the number, the higher the average propensity to consume. This means that you are spending more of your income on goods and services than you are saving. If you want to make sure that you are in a good financial situation it’s important to keep track of your average propensity to consume. Knowing what your spending habits are and how they are affecting your overall financial health can help you to make better decisions and plan for your future.

Calculating the Average Propensity to Consume

One of the most important concepts to understand when it comes to personal finance is the Average Propensity to Consume (APC). APC measures how much of a person’s income is consumed as opposed to being saved. Knowing one’s APC can help you make informed decisions about how to best manage your income and save for the future. Calculating APC is fairly simple and involves taking the total amount of money someone spends on consumption over a given period of time and dividing it by their total income. This number can help you plan your budget and make sure you are setting aside money for the future. Knowing your APC is an essential element in setting financial goals and ensuring you have a secure future.

Applying the Average Propensity to Consume to Financial Planning and Decision Making

When it comes to financial planning and decision making, understanding the Average Propensity to Consume (APC) can be essential. The APC is a measure of the average household’s consumption, which helps to ascertain the rate at which households are spending money. Knowing the APC can give you an idea of the overall economic health of the nation, which in turn can be used to inform your own financial decisions. The APC can be used for budgeting and forecasting, allowing you to see how your own spending may affect the economy. It can also be used to understand the impact of changes in public policy on consumption. Understanding the APC can help you make more informed decisions when it comes to personal finance and economic planning.