Android is the world’s most popular operating system, powering phones, tablets, and other devices around the globe. It is an open-source platform created by the Android Open Source Project (AOSP), and it is maintained by Google. Android has been around for over a decade, and it is used by billions of people worldwide. This article will explore what Android is, how it works, and what it can do for businesses and consumers. We’ll also discuss Android’s financial implications, as well as its potential to revolutionize the world of technology.

Introduction to the Android Operating System

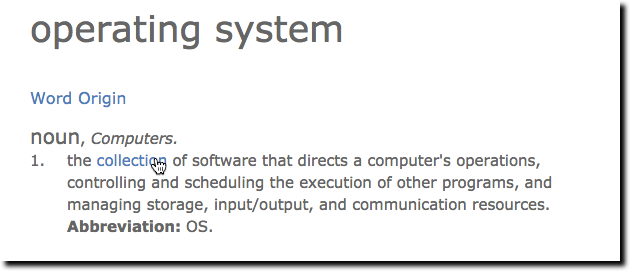

Android Operating System is an open source platform developed by Google. It is the most popular mobile operating system in the world, used by billions of people all over the globe. It is based on the Linux kernel and is designed primarily for touchscreen mobile devices such as smartphones and tablets. Android provides users with a wide range of features and applications, making it a very versatile operating system. It has a simple yet powerful user interface, allowing users to easily navigate and interact with their device. With Android, users can customize their phones with a wide selection of apps and widgets, making it a great choice for those who want to personalize their device. Android also provides a secure environment for its users, as it is regularly updated with the latest security patches and bug fixes. Android is constantly evolving and growing, providing users with an ever-expanding selection of apps and services.

Benefits of Android Operating System

Android is the most popular mobile operating system out there. It boasts features and benefits that make it an attractive choice for users. One of the biggest benefits of using Android is its open source nature. This means that developers can customize the OS to their liking and create apps that take advantage of its features. Android also offers a large selection of apps and services, making it easy to find whatever you need. Additionally, it is extremely user friendly, allowing users to navigate their way around with ease. And since it is backed by Google, users can expect regular updates and security patches. All of these features make Android an ideal choice for those looking for a powerful and reliable mobile operating system.

Understanding Android Operating System Security

Android Operating System security is a crucial factor to consider when developing and using mobile apps. It not only provides protection to the users of the apps, but also ensures that data stored on the device is safe from malicious actors. Android OS security is based on a multi-layered approach that includes device encryption, sandboxing, and permission-based access control. Device encryption ensures that data stored on the device is only accessible to the user, while sandboxing creates a secure environment for apps to run in, and permission-based access control restricts apps from accessing certain features or data without the user’s permission. Android OS security is constantly improving, and developers should be aware of the latest security measures when creating apps. Taking the proper steps to ensure Android OS security is essential for users and developers alike, as it provides protection against malicious actors and allows users to safely use their devices.

How to Download and Install Android Operating System

If you want to get the most out of your Android device, you need to download and install the Android operating system. The Android OS is the software platform that powers all Android devices, and it’s designed to give you access to all your favorite apps, games, music, and more. To get started, you’ll need to make sure your device meets the minimum requirements for the latest version of the Android OS. Then you can download and install the OS to your device. It’s a fairly straightforward process, and you can even do it from the comfort of your own home. Once you’ve got the Android OS on your device, you’ll be able to customize your device to your heart’s content and enjoy all the features and benefits that come with having an Android device.

Common Android Operating System Issues and Solutions

Common Android Operating System Issues and Solutions can be a tricky subject. From slow performance to unresponsive apps and issues with the Play Store, Android OS can present a number of problems. Fortunately, there are plenty of solutions to these issues, ranging from simple restarts to factory resets. If you’re having trouble with your Android device, it’s important to take a few minutes and identify the issue at hand before attempting any fixes. If your device is running slow, clearing the app cache and restarting your device can often work wonders. Additionally, uninstalling apps you don’t use and keeping your device up to date with the latest software updates can help fix any compatibility issues. If you’re running into app-specific issues, such as not being able to update them or download them from the Play Store, you might need to clear the Play Store cache. In more extreme cases, a factory reset might be the only solution. While this is the last resort, it often helps resolve any underlying issues that cannot be fixed with simpler solutions.