Understanding Average Cost Basis is important for anyone who owns investments such as stocks and mutual funds. Average Cost Basis is a calculation that helps you determine your cost for tax purposes when you sell your investments. In this article, we’ll discuss what Average Cost Basis is, why it is important and how you can calculate it. By understanding Average Cost Basis, you’ll be better equipped to make decisions about when to buy and sell investments, and how to maximize your tax savings.

What Is Average Cost Basis and How Does It Impact Your Investments?

Average cost basis is an important concept to understand if you’re investing. It’s basically the average price you paid for a security or asset over time. This figure can be used to calculate your gain or loss when you sell that security or asset. It’s important to be aware of how your average cost basis impacts your investments because it can have a significant effect on your tax liability. When you sell a security or asset for more than you bought it for, you’ll be liable for taxes on the gain. However, if you’ve held the security or asset for a long time, the average cost basis may be lower than the current price, resulting in a lower tax liability. Knowing your average cost basis is an important step in understanding the overall financial picture of your investments.

Calculating Your Average Cost Basis for Tax Purposes

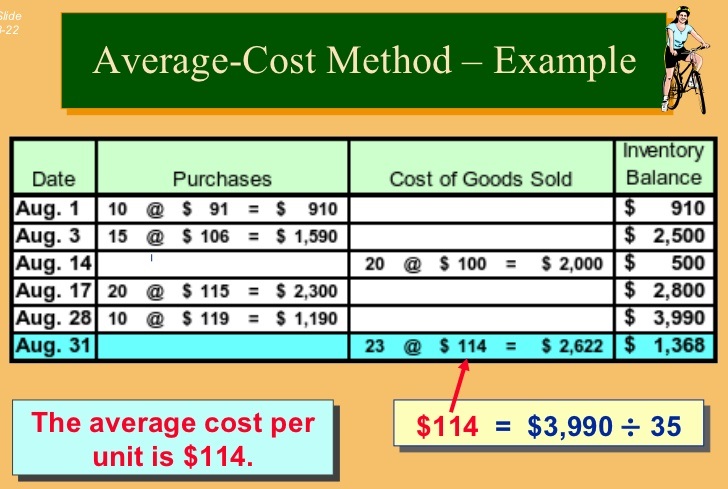

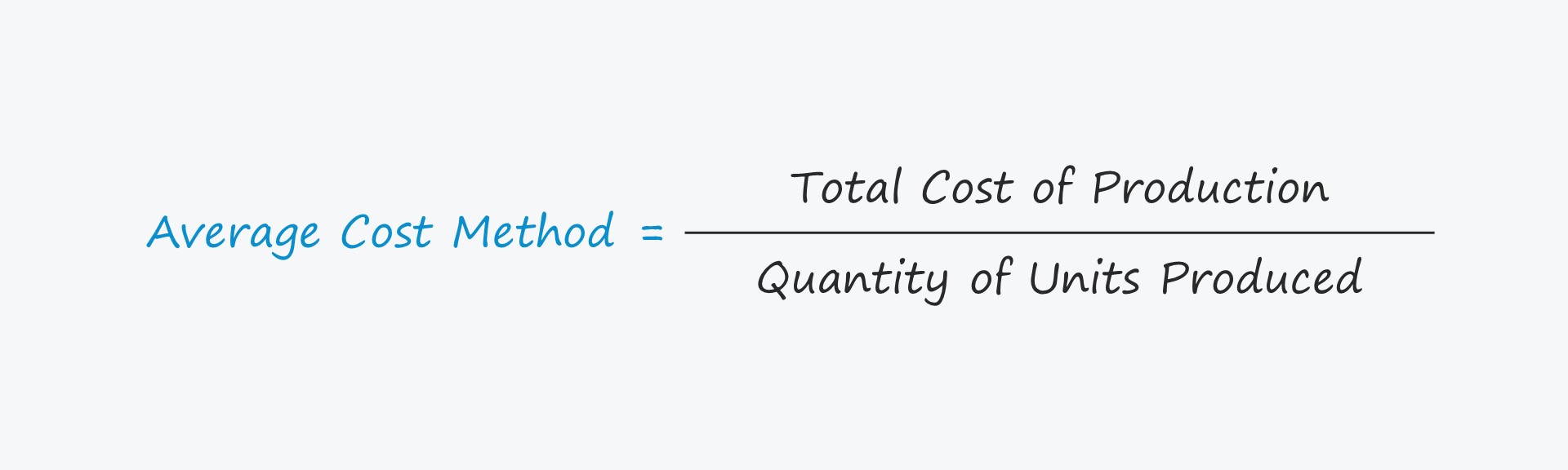

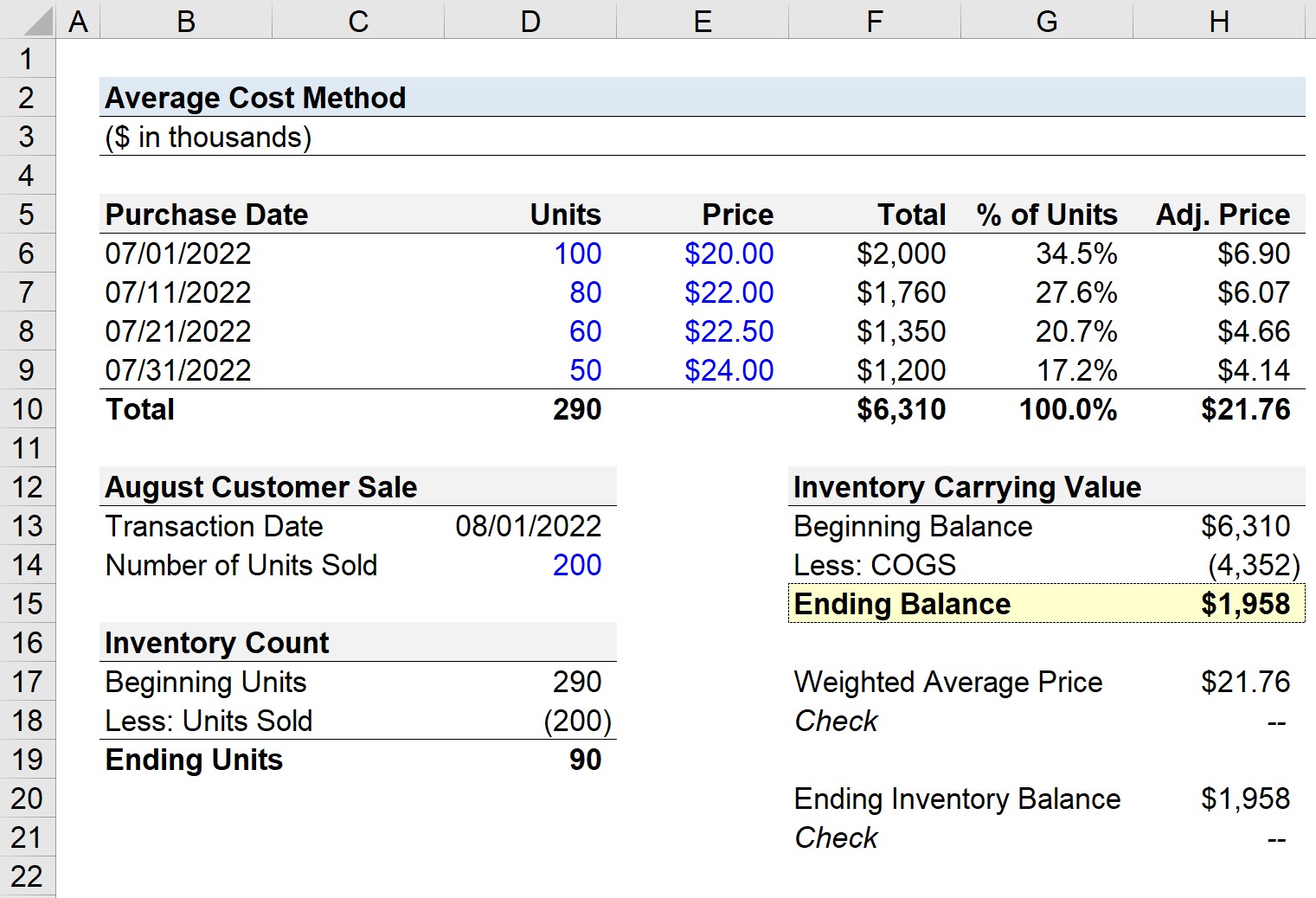

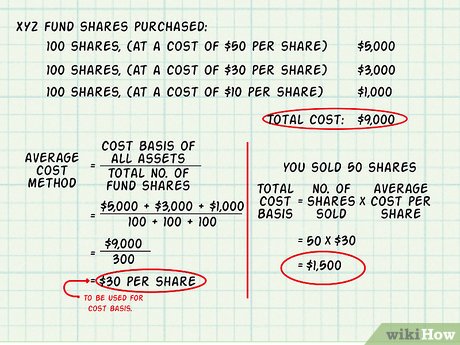

Calculating your average cost basis for tax purposes is an important part of understanding the financial implications of your investments. By knowing your average cost basis, you can accurately calculate your capital gains or losses for tax filing purposes. In order to calculate your average cost basis, you must first determine the total cost of all purchases of the same security, then divide that cost by the total number of shares purchased. The result is your average cost basis per share. When calculating your average cost basis, you must also remember to factor in any brokerage or commission fees that were paid in the purchase of the security. Knowing your average cost basis can help you determine the profits or losses associated with selling securities, as well as the taxes you may owe.

Advantages and Disadvantages of Using Average Cost Basis

Using the average cost basis for financial investments can be a great way to keep track of your assets, but it is important to note that there are some potential disadvantages to this approach. The biggest advantage to using average cost basis is that it is easy to calculate and track. It also helps to simplify your tax filings and provides a more accurate cost basis for investments than other methods. However, there are some drawbacks to using average cost basis as well. One of the main disadvantages is that it does not take into account the timing of purchases and sales, which can result in a lower cost basis than if you had used a specific cost basis. Additionally, it can be difficult to make precise calculations when using average cost basis, and it is not always the most accurate method of determining cost basis. However, if you are looking for a simple and straightforward way to track your investments, average cost basis may be the right choice for you.

Strategies for Optimizing Your Average Cost Basis

If you’re serious about investing, you need to optimize your average cost basis to maximize your returns. One of the best ways to do this is to invest in smaller increments over time. You can buy shares a little at a time and take advantage of fluctuating prices. This will help you lower your cost basis and get the most out of your investments. Another strategy for optimizing your average cost basis is to invest in stocks with lower volatility. Stocks with lower volatility are less likely to have huge swings in price, so you can buy more shares at a lower price. Finally, you should consider investing in index funds, which can help you lower your average cost basis and diversify your portfolio. With these strategies, you’ll be able to get the most out of your investments and maximize your returns.

Common Mistakes to Avoid When Calculating Average Cost Basis

Calculating average cost basis isn’t always intuitive, and it’s easy to make mistakes that can cost you down the line. One of the biggest mistakes you can make is to calculate your cost basis using the purchase price, rather than the actual cost. Purchase price only includes the amount of money you paid for the asset, not the fees or commissions associated with the purchase. When calculating your average cost basis, it’s important to include the total cost of the asset, including any fees or commissions associated with the purchase. Another mistake people make is to forget to factor in reinvested dividends when calculating average cost basis. Any dividends that are reinvested should be added to the original cost of the asset in order to get an accurate cost basis. Lastly, it’s important to remember to adjust your cost basis when you sell part of the asset, as this will affect the remaining cost basis. Taking the time to properly calculate your average cost basis will save you money and headaches in the future.