The Average Cost Method is a method of inventory valuation that assigns an average cost to items in inventory. It is a simple, easy to use method that is often used by small businesses, allowing them to keep track of inventory costs and make accurate calculations. This method is also used by large corporations to keep track of their inventory costs and ensure that their books are up-to-date. By understanding the Average Cost Method, you can ensure that your business stays financially sound. In this article, we’ll explain what the Average Cost Method is, how it works, and the benefits it offers.

Overview of the Average Cost Method

The Average Cost Method is an accounting technique used to calculate the value of inventory. It’s a popular option for businesses that want to accurately assess the worth of their inventory without having to spend a lot of time crunching numbers. With this method, the average cost of all units purchased during a specific period is calculated and used to value current and future inventory. This approach helps to reduce the amount of time and effort needed to correctly value inventory and provides a more accurate estimate than other methods. The Average Cost Method is simple to use, and it can help businesses better manage their inventory levels, resulting in higher profits and better customer service.

Advantages of Using the Average Cost Method

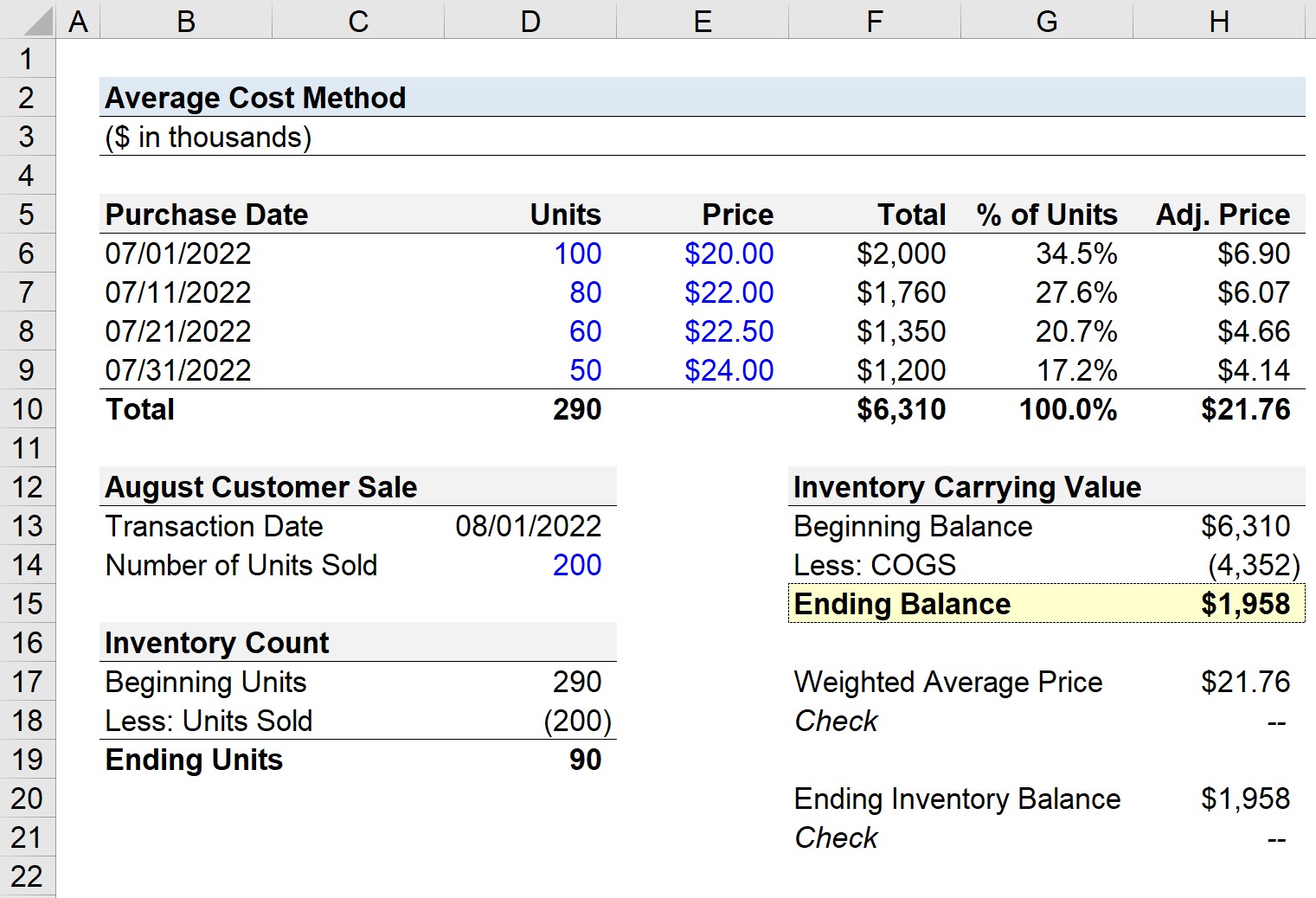

itThe Average Cost Method is an accounting method used to calculate the cost of goods sold and the inventory value. It works by taking the total cost of goods purchased and dividing it by the total number of units purchased. This gives you an average cost per unit which is then applied to all units in the current inventory. This method is popular because it’s simple, consistent, and easy to administer.The advantages of using the Average Cost Method are numerous. It provides a consistent basis for inventory valuation and cost of goods sold calculations. This method also simplifies the process of accounting for inventory, as the same cost per unit is applied to all units. It’s also easy to understand and can be used in a variety of business environments. Furthermore, it’s easy to implement and maintain, allowing for accurate and reliable financial data.

Disadvantages of the Average Cost Method

The Average Cost Method is a popular financial method used by businesses to calculate their inventory costs. It is a useful tool to measure the average cost of inventory items over a period of time. This method is beneficial for companies that buy large amounts of inventory and need to find the most accurate way of tracking their costs. Although the Average Cost Method is beneficial for many businesses, it does have some drawbacks that should be considered before utilizing it. One of the main disadvantages of this method is that it does not account for the changing costs of inventory over time. This means that if the cost of an item increases, the average cost of the item will not be updated to reflect the increase. Additionally, the Average Cost Method does not consider the quality of the item, which could lead to inaccurate calculations. Despite these drawbacks, the Average Cost Method is still a useful financial tool for businesses that require an accurate method of tracking inventory costs.

How to Calculate the Average Cost Method

Calculating the average cost method is an important part of any business’s financial planning. It allows you to determine the average cost of goods sold (COGS) for a given period of time. This method takes into account all of the costs associated with acquiring, producing, and selling a product or service. To calculate the average cost, you must first determine the total cost of all goods purchased or produced during the period of time you are measuring. Then, divide the total cost by the number of units sold during that period. The resulting number is your average cost. This can be used to determine pricing strategies, budgeting, and to compare costs between different suppliers and products. Additionally, the average cost method can be used to determine the cost of goods sold for tax filing purposes. Knowing your average cost can help you make more informed decisions about your business’s financial planning.

Tips for Avoiding Plagiarism When Using the Average Cost Method

Using the average cost method is a great way to accurately track costs for a business, but it can also be a source of plagiarism if not done right. To avoid this, it’s important to stay organized and keep track of sources. When researching, make sure to note the source of the information and always give credit where it’s due. Additionally, be sure to cite any sources you use so that the information can be verified. Finally, if you’re using a source that’s not your own, be sure to write in your own words and not simply copy and paste. Doing this will help you avoid any potential plagiarism issues and ensure that your business is using accurate data.