Are you looking for a better understanding of the Average Collection Period in the financial world? This article will provide an overview of the Average Collection Period, how it is calculated, and how it can help you make more informed decisions about your business’s finances. We’ll cover the definition of the Average Collection Period and the importance of understanding this concept for successful cash flow management. By the end of this article, you’ll have a good understanding of the Average Collection Period and how to use it to your advantage.

What Factors Affect Average Collection Period?

When it comes to understanding the Average Collection Period (ACP), the key is to know what factors may affect it. One of the most important factors is the credit terms that a company offers to customers. If a company offers longer credit terms, the ACP will be higher because it will take longer for customers to pay off their debts. Additionally, the number of customers that a company has can also affect the ACP, as a company with a larger customer base will have more chances of collecting its debts on time. Finally, the speed at which customers pay their debts can also have an impact on the ACP, as the faster customers pay their debts the lower the ACP will be. All these factors should be taken into consideration when assessing the Average Collection Period of a company.

Strategies for Improving Average Collection Period

If you want to improve your average collection period, there are a few strategies you can use. One strategy is to use a customer-friendly payment policy. Make sure you are clear about payment terms, due dates, and any other relevant information. You should also make it easy for customers to pay by offering several payment options. Another strategy is to set up automated reminders for customers who are late on payments. These reminders can be sent through email, text message, or even phone call. Finally, you should also consider offering discounts for customers who pay their invoices early. By implementing these strategies, you can help reduce your average collection period and improve your cash flow.

The Relationship Between Average Collection Period and Cash Flow

The relationship between average collection period and cash flow is an important one. Cash flow is a very important factor in any business, and by understanding the average collection period, you can better plan and manage your cash flow. By monitoring your average collection period, you can ensure that you are collecting payments on time and not missing out on any potential revenue. This can help you stay on top of your cash flow and help you make important decisions about how to allocate funds. With the right understanding of the average collection period, you can ensure that your cash flow is always in a healthy state and you can make informed decisions about where to invest your resources.

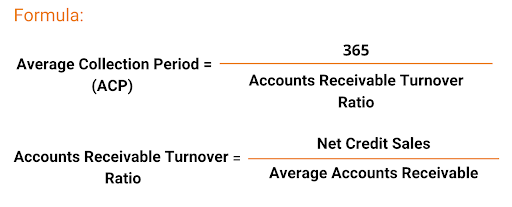

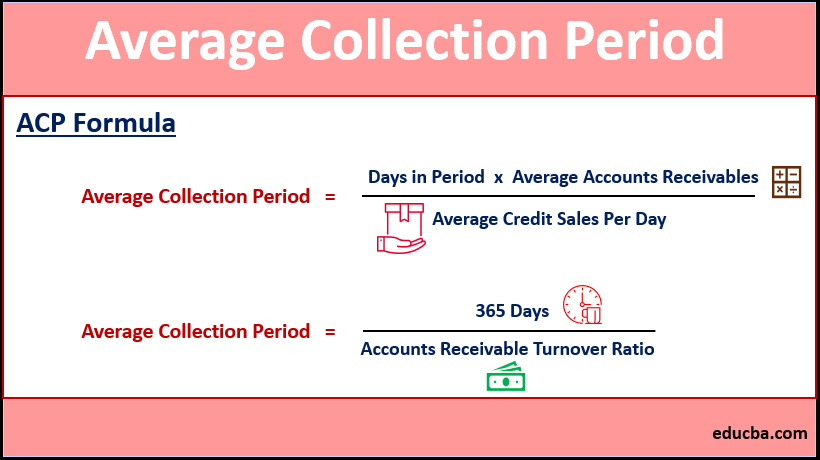

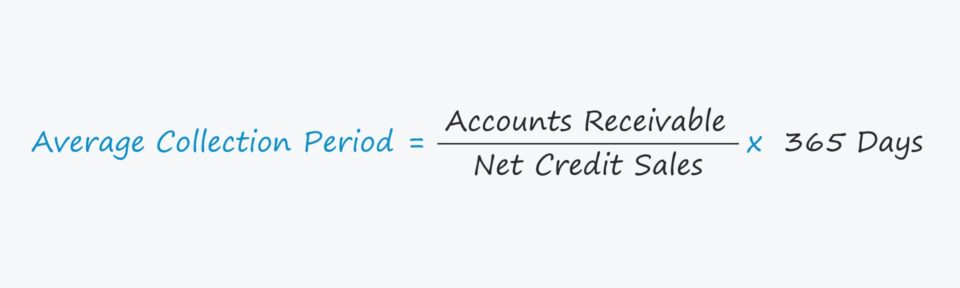

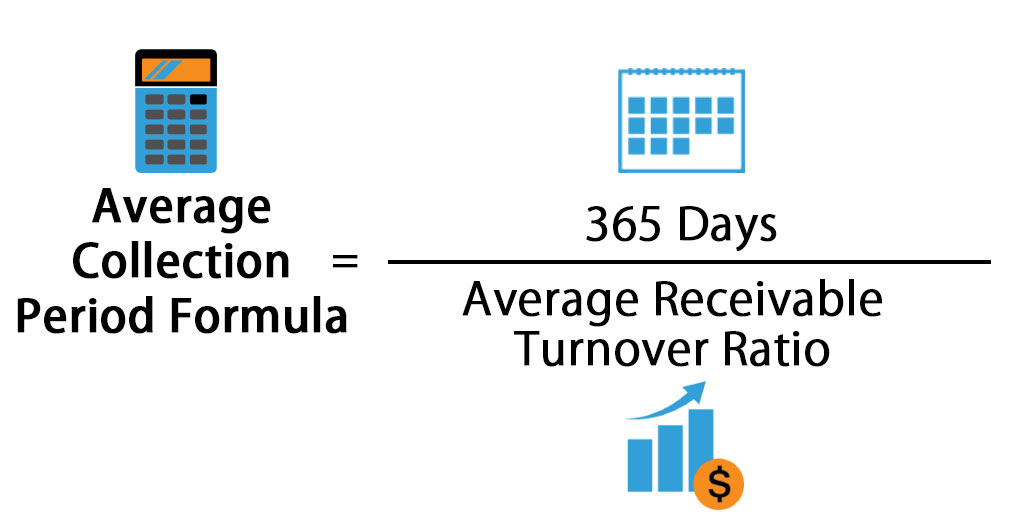

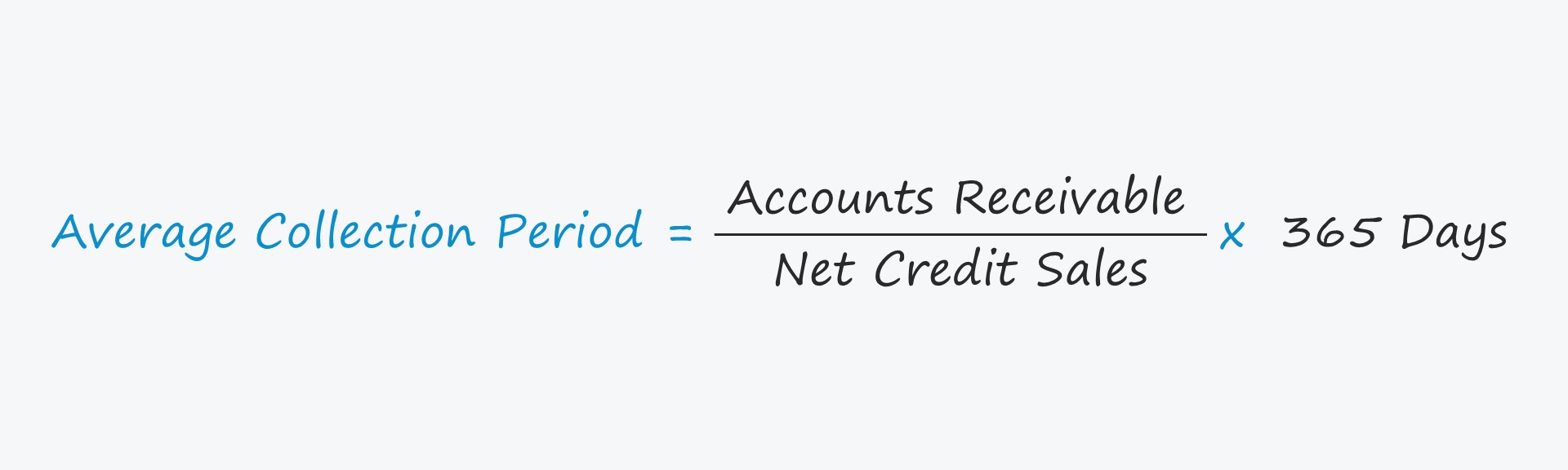

How to Calculate Average Collection Period

Calculating your average collection period is a great way to measure the efficiency of your company’s accounts receivable process. It’s a simple calculation that takes into account the amount of time it takes your customers to pay you. Knowing your average collection period gives you a better understanding of the cash flow of your business. To calculate the average collection period, you need to take the total receivables for a period of time (usually a month or year) and divide it by the average daily sales for that same period of time. This will give you the average number of days it takes for customers to pay. For example, if you had total receivables of $200,000 and average daily sales of $10,000, then your average collection period would be 20 days ($200,000/$10,000=20). This means it takes your customers an average of 20 days to pay you. Having this information on hand can help you better manage your cash flow and plan for future investments.

The Benefits of Understanding Average Collection Period

Having a good understanding of your Average Collection Period (ACP) is incredibly important for any business. Knowing your ACP can help you keep track of any customer payments you may be expecting and also give you an insight into the overall financial health of your business. Having this information can help you make more informed decisions about your cash flow, allowing you to plan for future expenses and investments. Additionally, knowing your ACP can help you spot any irregularities or trends in customer payments and allow you to take steps to improve your collection process. Having a good handle on your ACP is a great way to make sure your business is running as efficiently and effectively as possible.