Automated Clearing House (ACH) is an electronic payment system that facilitates the transfer of funds between financial institutions. It is an efficient, cost-effective option to process payments quickly and securely. ACH is widely used for direct deposits, pre-authorized payments, and other types of payments, making it an invaluable tool for businesses and consumers looking to streamline their financial operations. With its convenience and reliability, it’s no wonder ACH has become a popular choice for those looking to make secure and convenient financial transactions. Learn more about ACH and the benefits it offers with this guide.

Understanding the Basics of Automated Clearing House (ACH)

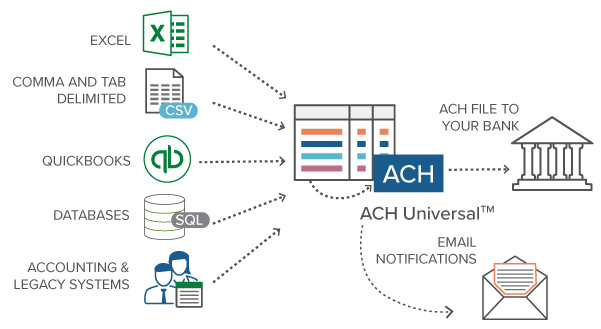

Automated Clearing House (ACH) is an electronic network that facilitates the processing of payments and money transfers from one bank account to another. It’s a secure, reliable, and efficient way to move money quickly and conveniently. It’s widely used for payroll direct deposits, online payments, and bill payments. ACH payments are typically faster and less expensive than paper checks. Plus, they don’t require printing supplies or postage, so it can save time and money. ACH payments are becoming increasingly popular for businesses of all sizes, and it’s easy to get started. All you need to do is provide your bank information and the information of the recipient’s bank account, and the ACH will take care of the rest.

Exploring the Benefits of Automated Clearing House (ACH)

Using Automated Clearing House (ACH) is a great way to save time and money for any business. With ACH, businesses can easily and quickly transfer funds, which can help them stay on top of their payments and financial obligations. In addition, the use of ACH can provide businesses with increased security and improved cash flow, as well as better control over their finances. With ACH, businesses can also manage their accounts more efficiently and quickly, which can lead to improved customer service and satisfaction. The use of ACH can also help businesses reduce their risk of fraud and help them save money on transaction fees, as well as improve their bottom line. All of these benefits make ACH an incredibly useful tool for businesses of all sizes.

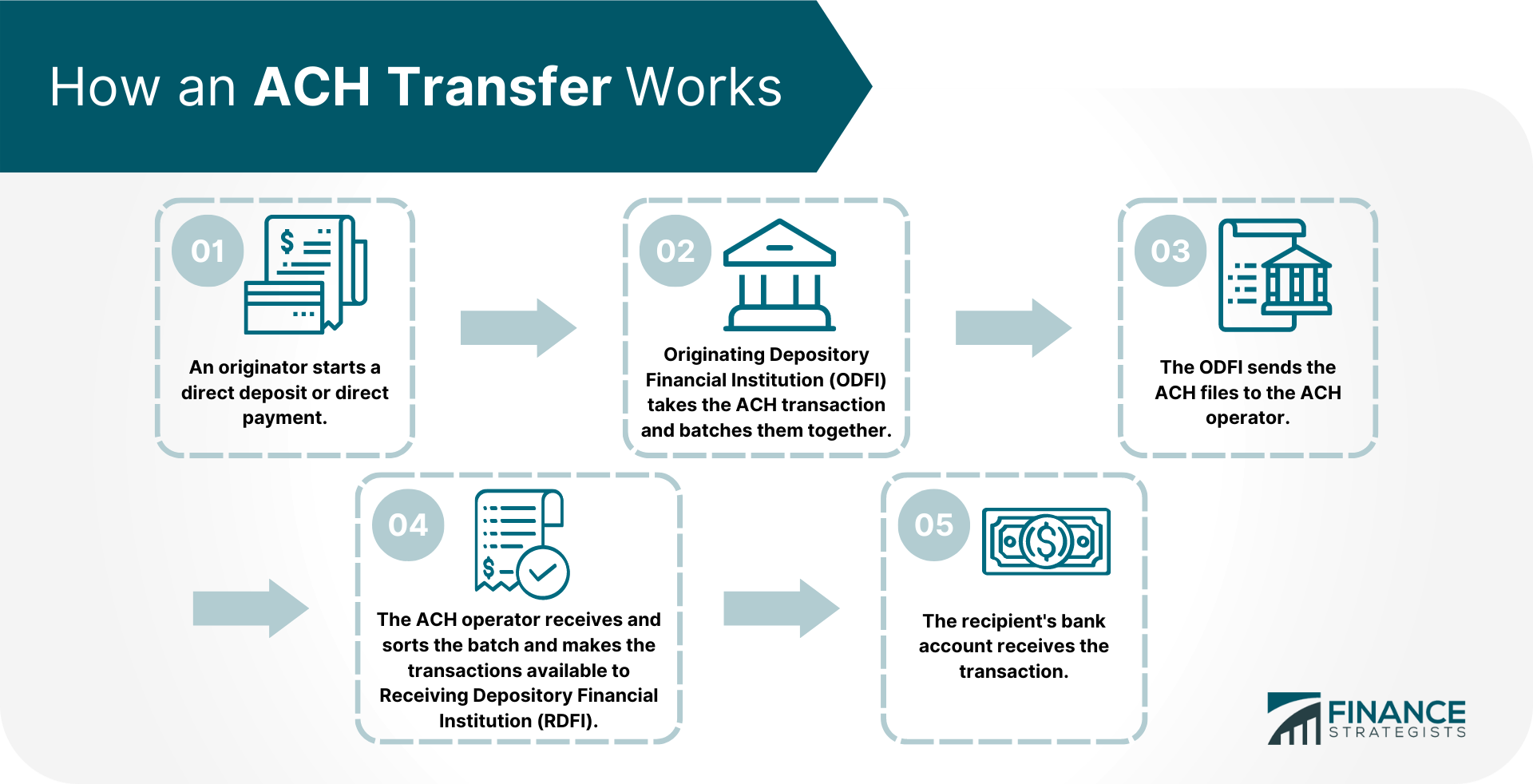

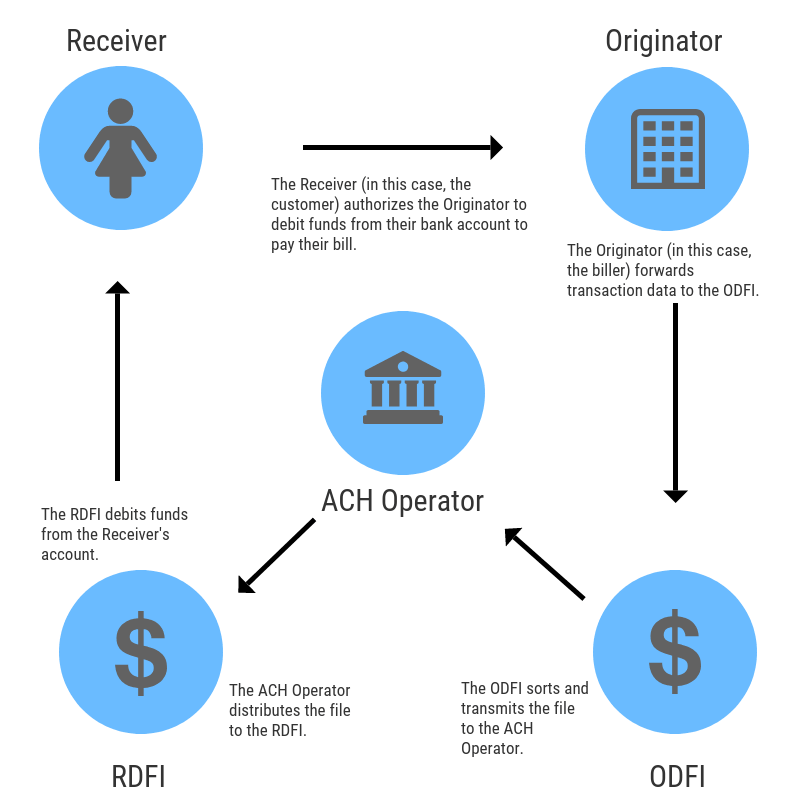

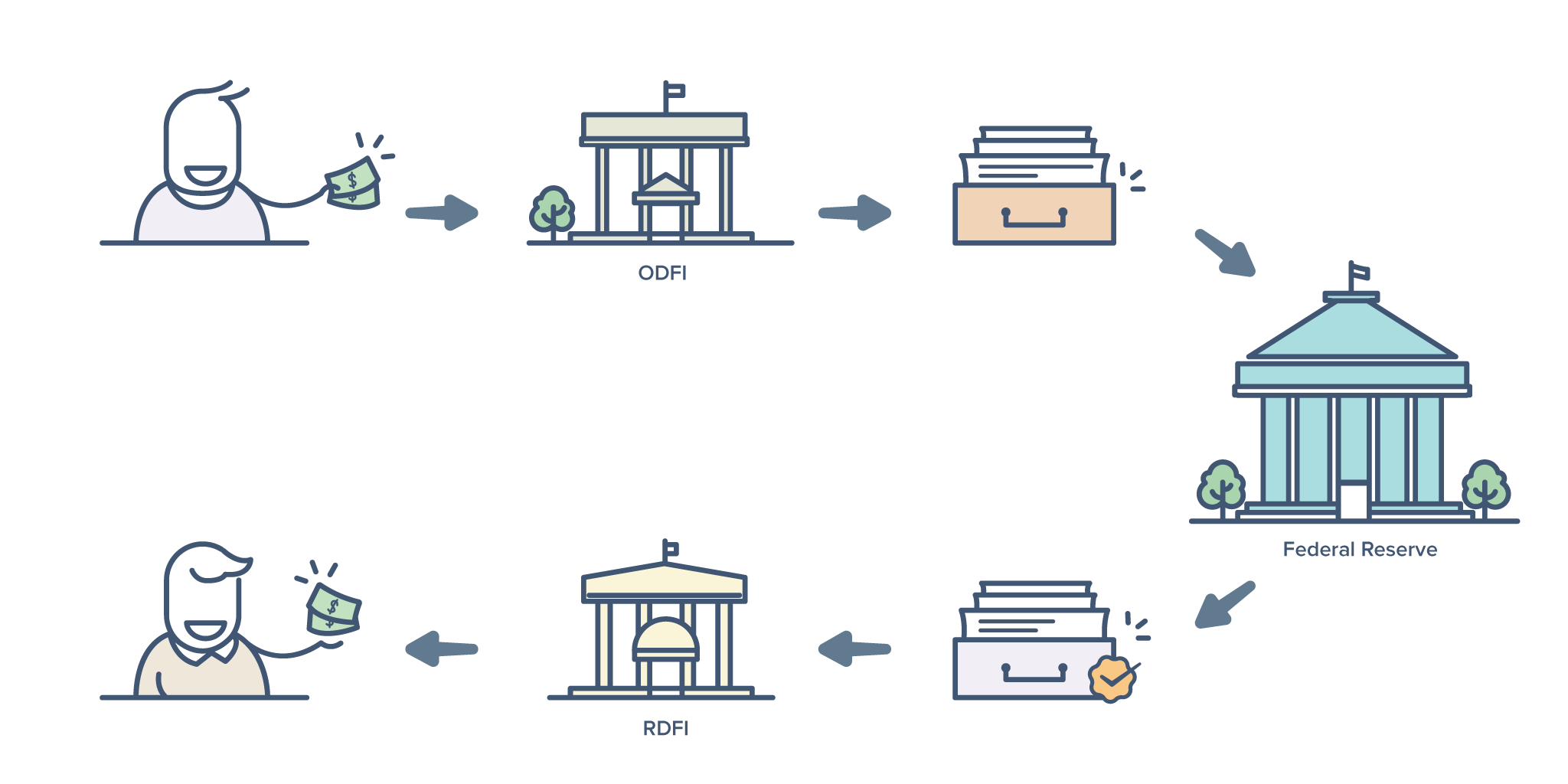

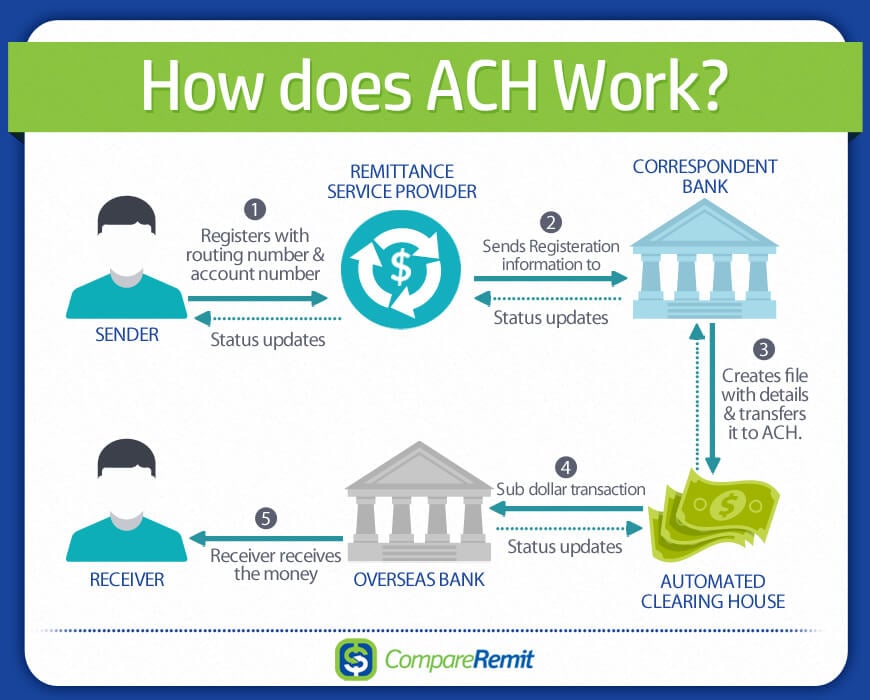

How Automated Clearing House (ACH) Transfers Work

ACH transfers work by electronically transferring funds from one bank account to another. They are a great way to quickly and securely move money without having to write a check or use a wire transfer. ACH transfers are easy to set up, and can be done online or through your bank. When you initiate an ACH transfer, the money is sent from the sender’s bank to the recipient’s bank, usually within a few days. It’s convenient, secure, and usually less expensive than other transfer options. ACH transfers are safe and reliable, and can be used for many different types of transactions, from payroll to bill payments. If you’re looking for an easy and secure way to transfer money, ACH transfers may be the perfect solution.

Tips for Ensuring Security with Automated Clearing House (ACH)

If you’re looking to ensure security when it comes to Automated Clearing House (ACH) transactions, here are a few tips to keep in mind. First, make sure to have a secure gateway to ensure all transactions are encrypted. This will ensure that the data being transferred is kept safe and secure at all times. Additionally, it’s important to have a secure authentication process that requires a two-step authentication to verify the identity of the user. This will help prevent unauthorized access to ACH transactions. Finally, make sure to keep all your ACH transactions up to date with the latest security protocols to ensure maximum safety. Following these tips will help you ensure a secure environment when it comes to using ACH.

Common Questions About Automated Clearing House (ACH) Payments

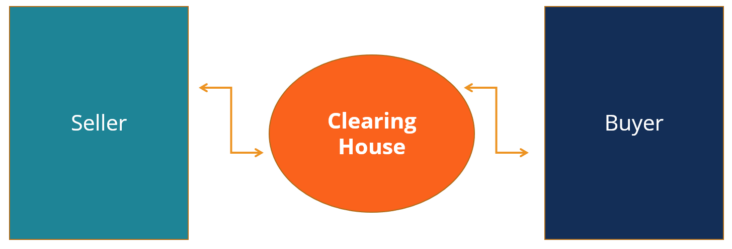

The Automated Clearing House (ACH) is a payment network used to securely transfer money between two parties. It’s a great way to quickly and easily move money between banks, pay bills, and even send out commission payments. With the ACH system, payments are processed quickly and securely, making it a popular choice for businesses. But with all its advantages, there are still some common questions about ACH payments. How safe is ACH? How long does it take to process an ACH payment? How do I set up an ACH payment? These are all valid questions and it’s important to understand the answers before you make the leap. ACH payments are incredibly secure, taking advantage of the latest encryption technology to ensure your funds are safe. Generally, ACH payments take between one and three business days to process, depending on the size of the transaction. Setting up an ACH payment is also quite simple. All you need to do is provide your bank with the necessary information and they will take care of the rest. So if you’re looking for a safe, fast, and easy way to process payments, look no further than the Automated Clearing House.