Automated Customer Account Transfer Service (ACATS) is an efficient and secure system for transferring assets from one financial institution to another. It is used by investors and traders to quickly and easily move stocks, bonds, and other assets between accounts. This service helps minimize paperwork and provides a streamlined process for account transfers. With ACATS, customers can transfer their assets quickly and securely, without having to worry about the complexities of the transfer process. ACATS is a great way to make sure your accounts are secure and that your investments are handled properly.

What Is Automated Customer Account Transfer Service (ACATS)?

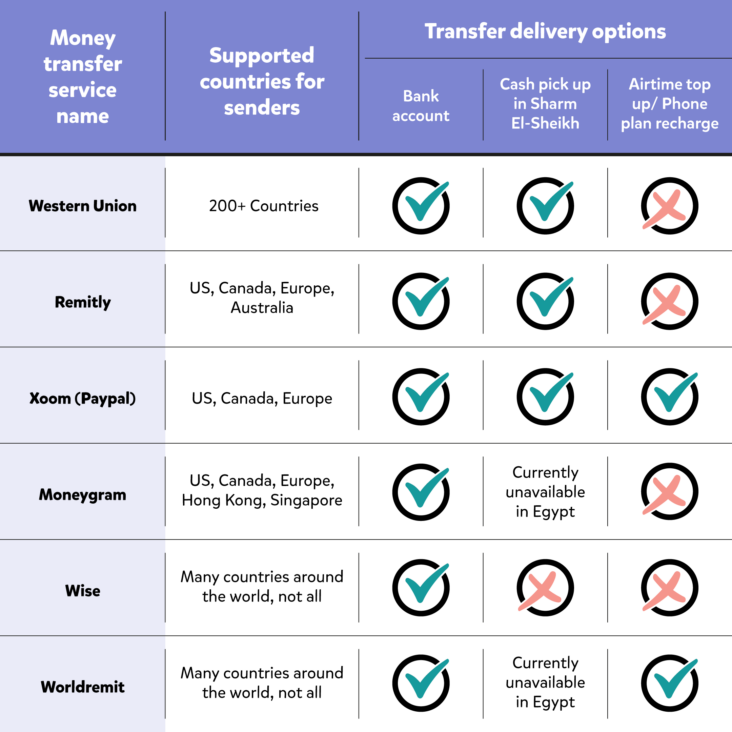

Automated Customer Account Transfer Service (ACATS) is a service that streamlines the process of transferring assets from one brokerage account to another. The system automates the process of transferring securities, such as stocks, bonds, and mutual funds, from one account to another. This service makes it easier and faster to move accounts from one broker to another, allowing investors to take advantage of the best available products and services. In addition to simplifying the process of transferring assets, ACATS also helps to ensure accuracy and security by verifying the account information and transactions. ACATS is a valuable tool for investors who want to take advantage of the best products and services available on the market. With ACATS, investors can quickly and easily transfer their assets between accounts, giving them access to the most competitive rates and features.

Benefits of Using Automated Customer Account Transfer Service (ACATS)

ACATS is awesome for those who want to make transferring accounts a lot easier. It can save you a lot of time and effort, by automating the process of transferring accounts from one broker to another. By using ACATS, you don’t have to worry about manually transferring all the data, as it does the work for you. Plus, the process is secure and accurate, so you don’t have to worry about any mistakes occurring. Another benefit of using ACATS is that it saves you money, since you don’t have to pay any commission fees or other charges associated with manually transferring accounts. Finally, using ACATS is convenient since you don’t have to be present in order to initiate the transfer. All you have to do is provide the necessary information and the transfer will be processed in just a few minutes. ACATS is definitely the way to go if you want to easily, securely, and conveniently transfer accounts.

How Does Automated Customer Account Transfer Service (ACATS) Work?

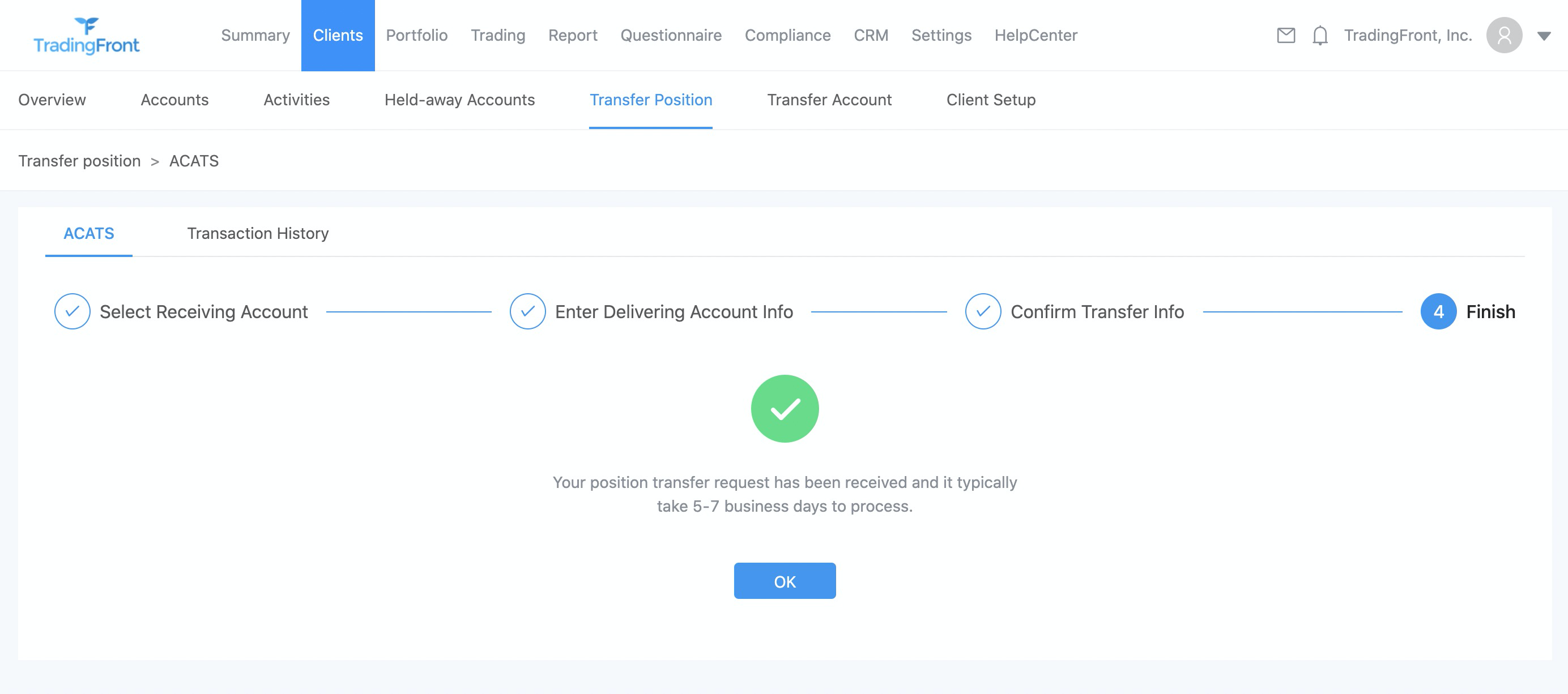

ACATS is a secure, automated system used to transfer securities between brokerage firms. It’s facilitated by the National Securities Clearing Corporation (NSCC), a subsidiary of the Depository Trust & Clearing Corporation (DTCC). The process is designed to ensure that customers’ investments are securely and efficiently transferred between brokerages. The ACATS system is widely used when customers switch brokerages or move investments from one account to another.The ACATS system works by first verifying that the accounts involved in the transfer are authorized to do so. The system then verifies that the securities to be transferred are in good order and that the customer has the necessary funds or margin available. Once all the necessary details have been verified, the transfer is initiated. The process typically takes three to five business days to complete. Once the transfer is complete, the customer will receive confirmation from the brokerages involved. The process ensures that customers’ investments are transferred quickly and securely, with minimal disruption to their accounts.

What Are the Risks Associated with Automated Customer Account Transfer Service (ACATS)?

Using Automated Customer Account Transfer Service (ACATS) can be convenient, but there are risks involved. The most common risk is the potential for incorrect transfer of assets. If incorrect information is provided or the transfer is not properly authorized, your assets can be moved to the wrong account or institution, leading to a significant delay in the transfer process. Additionally, the transfer of assets can be subject to the terms and conditions of the transferor and transferee, meaning that the transfer may not be completed in the expected time frame. Finally, the transfer of assets can expose you to the risk of fraud, as assets can be stolen or misappropriated if the transfer is not properly monitored. For these reasons, it is important to ensure that you are aware of the risks associated with using ACATS and to take all necessary steps to ensure the security and accuracy of your transfers.

How to Ensure Compliance with Automated Customer Account Transfer Service (ACATS)?

When it comes to using the Automated Customer Account Transfer Service (ACATS), compliance is key. There are certain steps you should take to make sure your account is compliant with this service. The first step is to make sure that you have the proper authorization and documentation for any transfers that you’re making. You should also make sure that your account is properly coded for the ACATS process. In addition, you should make sure you are recording all of your transactions and keeping a detailed log of your activity. Finally, it’s important to comply with all of the relevant rules and regulations that come along with using the ACATS service. Taking the proper steps to ensure compliance will help you make sure that your account is secure and that your transfers are being processed correctly.