Autocorrelation is an important concept in financial analysis that helps investors understand the relationship between two variables. Autocorrelation measures the similarity between a variable and itself at a different point in time, allowing investors to better understand how changes in one variable affect the other. By using autocorrelation to understand the relationship between two variables, investors can make more informed decisions and make better predictions about the future. This article will provide an overview of what autocorrelation is and how it can be used to help investors make better decisions.

What Is Autocorrelation and Why Is It Important?

Autocorrelation is an important concept in finance, as it helps investors assess the strength of a security’s returns over a certain period of time. Autocorrelation measures the correlation between a security’s returns and its own previous returns. It is a useful tool for investors to measure how much of a security’s past performance is likely to be repeated in the future. Autocorrelation is important because it helps investors identify trends in a security’s performance and make better investment decisions. The ability to identify trends can help investors gain a better understanding of how a security is likely to perform in the future, allowing them to make better decisions when it comes to investing.

Autocorrelation and Its Role in Financial Markets

Autocorrelation is an important concept in financial markets, as it helps investors and traders understand how the markets are moving and how their investments could be affected. Autocorrelation is basically a measure of how closely related two variables are over a certain period of time. It’s a great way to gauge the strength of a trend, as well as the potential direction and magnitude of any changes that could occur. By analyzing autocorrelation, investors can make more informed decisions when it comes to investing and trading. Additionally, autocorrelation can be used to identify any underlying relationships between variables, which can provide traders with an edge when it comes to predicting future price movements. Autocorrelation is an invaluable tool for any investor or trader and can be used to help maximize returns and minimize risks.

How to Calculate Autocorrelation

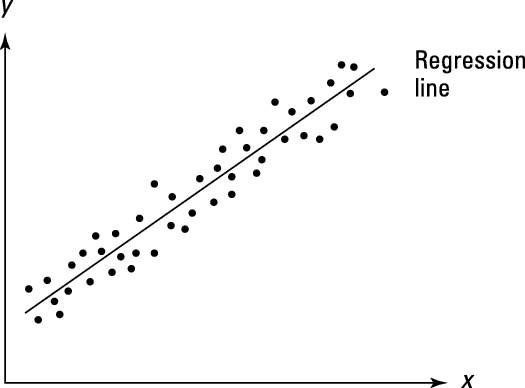

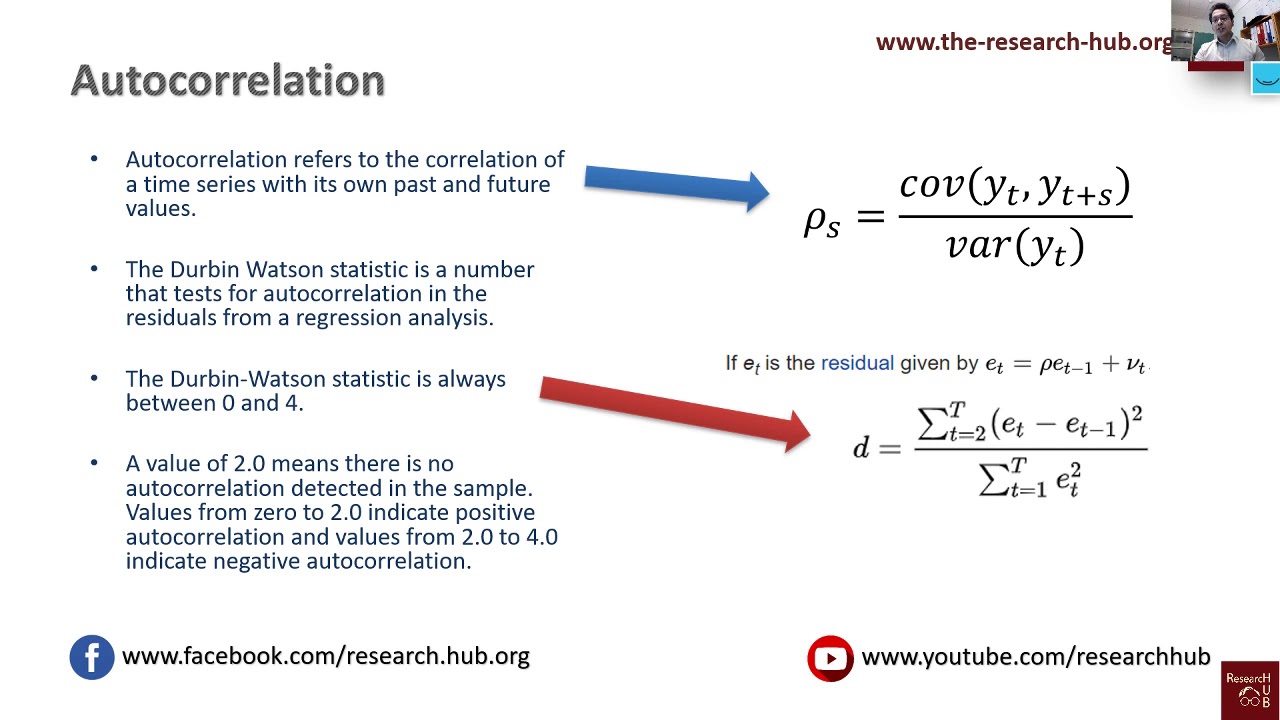

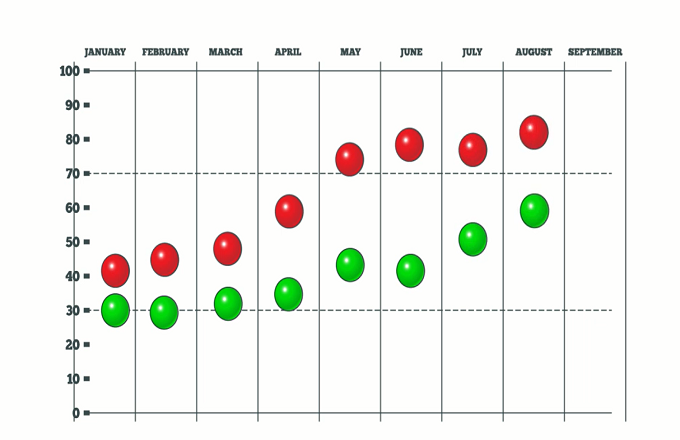

Autocorrelation is a measure of how well a variable or set of variables is related to itself. It’s a way of seeing if a certain variable is correlated with itself over a certain period of time. Calculating autocorrelation can be a great way to identify patterns in data that may not be evident at first glance. Autocorrelation can be calculated for a wide variety of variables, including stock prices, exchange rates, and sales figures. To calculate autocorrelation, you’ll need to look at the correlation between data points over a certain period of time. For example, if you wanted to measure the correlation between stock prices over the course of a year, you’d need to compare the stock price at the start and end of the year and measure the degree of correlation. The higher the correlation, the higher the autocorrelation. Autocorrelation can help you better understand the trends and patterns behind data, allowing you to make better business decisions.

Avoiding Plagiarism in Autocorrelation Research

Avoiding plagiarism when researching autocorrelation is super important, especially if you’re a student. Plagiarism is a serious offense and can cause some major consequences! To make sure you don’t get caught up in plagiarism, make sure to always cite your sources when using someone else’s work. Additionally, you should be careful to paraphrase and make sure that the words you use are your own. Lastly, make sure to double check the sources you use. If an article looks too good to be true or it’s from an unreliable source, don’t use it! Doing research on autocorrelation can be a lot of work, but it’s important to do it right and make sure you don’t get caught up in plagiarism.

Autocorrelation Applications and Trends

Autocorrelation can be used in a variety of applications in finance and other industries. One of the most common applications of autocorrelation is in trend analysis. Autocorrelation can help identify trends in a financial market or in a company’s performance. Autocorrelation can also be used to detect patterns in stock prices and other financial instruments. By understanding a stock’s trends, investors can make informed decisions about buying and selling. Autocorrelation also has applications in forecasting. Autocorrelation can help predict future stock prices and other economic trends. This can help investors make more informed decisions and can help traders take advantage of short-term trends in the market. Finally, autocorrelation can be used to monitor the performance of portfolios. Autocorrelation can be used to identify correlations between different investments and can be used to help rebalance a portfolio to meet an investor’s goals. Autocorrelation is a powerful tool used in finance and other industries that can help investors and traders make better decisions and manage their portfolios more effectively.