Understanding what authorized stock is will help you make informed decisions about your investments. Authorized stock is a type of stock that a company is allowed to issue to shareholders. It is the maximum number of shares that a company is allowed to have outstanding at any one time. Authorized stock is established by the company’s board of directors and is set out in the company’s articles of incorporation. It can be increased or decreased as needed. The number of shares issued is known as the issued and outstanding shares. Understanding authorized stock is important for investors, as it affects the total number of shares available to be traded on the market and the value of each share.

What Is the Difference Between Authorized Stock and Issued Stock?

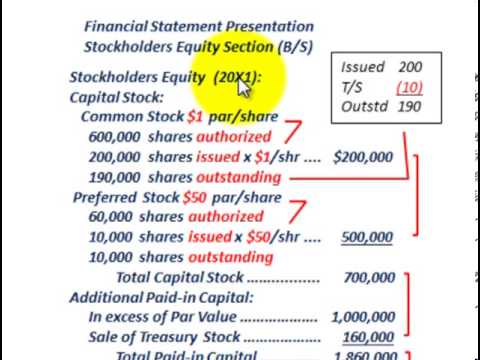

Understanding the difference between authorized stock and issued stock is key for anyone investing in the stock market. Authorized stock is the maximum number of shares that a company is legally allowed to issue. Issued stock is the number of shares that are actually available for purchase on the open market. When a company sets up, the board of directors will decide how many shares they want to authorize. This number is typically much higher than what will eventually be issued. The number of issued shares may grow over time as the company issues more shares to raise capital or to pay dividends to shareholders. Knowing the distinction between authorized and issued stock can help investors make more informed decisions when investing in the stock market.

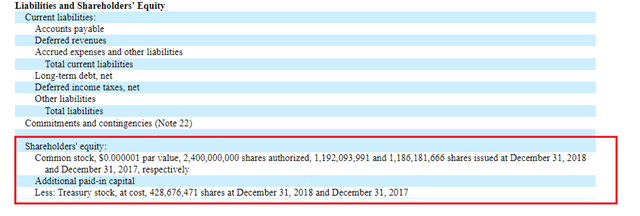

How to Determine the Number of Authorized Shares for a Company

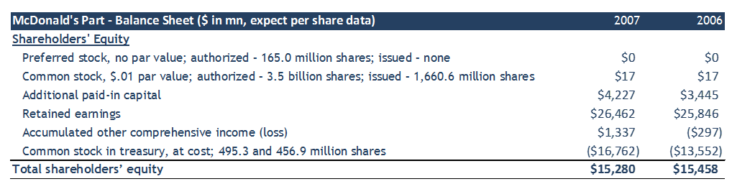

When it comes to determining the number of authorized shares for a company, it’s important to remember that the number of shares a company is allowed to issue is determined by the company’s articles of incorporation. This number, known as authorized stock, is the maximum number of shares the company is allowed to issue. It’s important to note that the number of authorized shares does not necessarily reflect the number of shares actually issued. To determine the number of authorized shares, you’ll need to review the company’s articles of incorporation and look for the number of shares that the company is authorized to issue. Once you have the number of authorized shares, you can calculate the company’s total share capital. This will give you the total value of the company’s authorized stock. Knowing the number of authorized shares, and the value of the authorized stock, is essential for understanding the company’s fundamentals and can help you make informed decisions when it comes to investing.

Understanding the Legal Requirements for Authorized Stock

When dealing with authorized stock, it’s important to understand the legal requirements associated with it. Authorized stock is the maximum amount of stock that a company is allowed to issue, as defined in its articles of incorporation. This is an important legal limit, and it should be taken seriously. Companies should take the time to ensure that their authorized stock is properly defined and that their corporate documents are in order. Not doing so could lead to legal issues and potential financial losses. Knowing the legal requirements for authorized stock is the first step to making sure your business is compliant and running smoothly.

The Benefits of Authorized Stock for Growing Businesses

Having authorized stock is a great way for growing businesses to get the resources they need to succeed. Authorized stock gives businesses the ability to issue more stock, which can be used to raise capital, attract investors and reward employees. With additional stock available, businesses can expand their operations, hire more staff and increase their production. Authorized stock also helps businesses grow by allowing them to keep more of their profits, as opposed to having to pay out a large portion of their profits to shareholders. Having authorized stock is a great way for businesses to take their operations to the next level and reach their full potential!

How to Calculate the Value of Authorized Stock for Investors

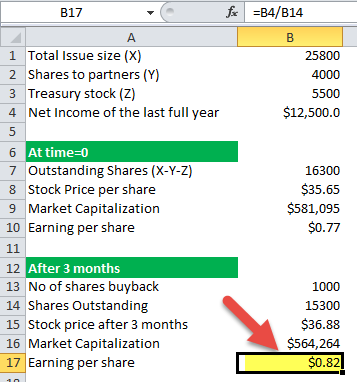

If you’re an investor looking to calculate the value of authorized stock, it’s important to know what authorized stock is and how it works. Authorized stock is the maximum number of shares a company is allowed to issue, as set forth in the company’s articles of incorporation. This number can be changed over time, but the total amount of authorized stock is not allowed to exceed the stated amount. To calculate the value of authorized stock for investors, you’ll need to look at the number of shares outstanding, the current share price, and the total number of authorized shares. By multiplying these three figures together, you can figure out the total value of the company’s authorized stock. This can give you a better understanding of the company’s overall financial standing and can help you make more informed investment decisions.