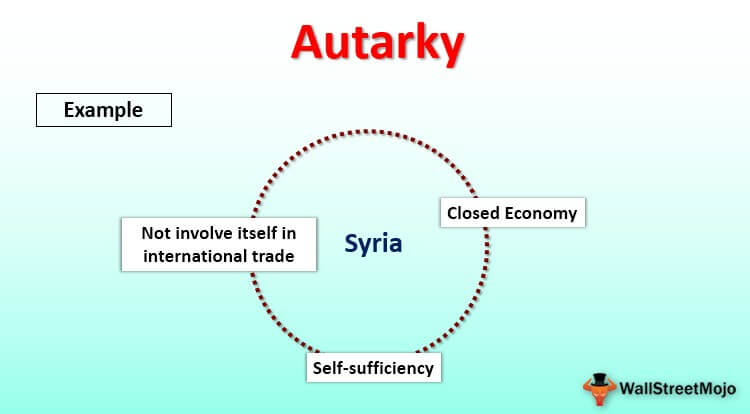

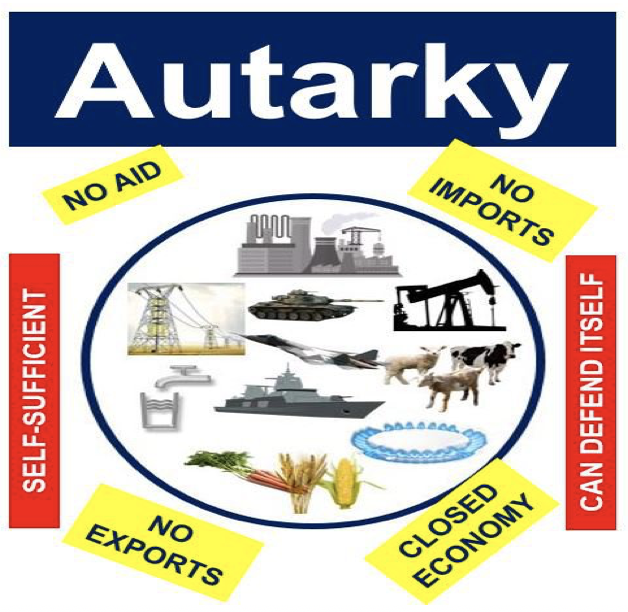

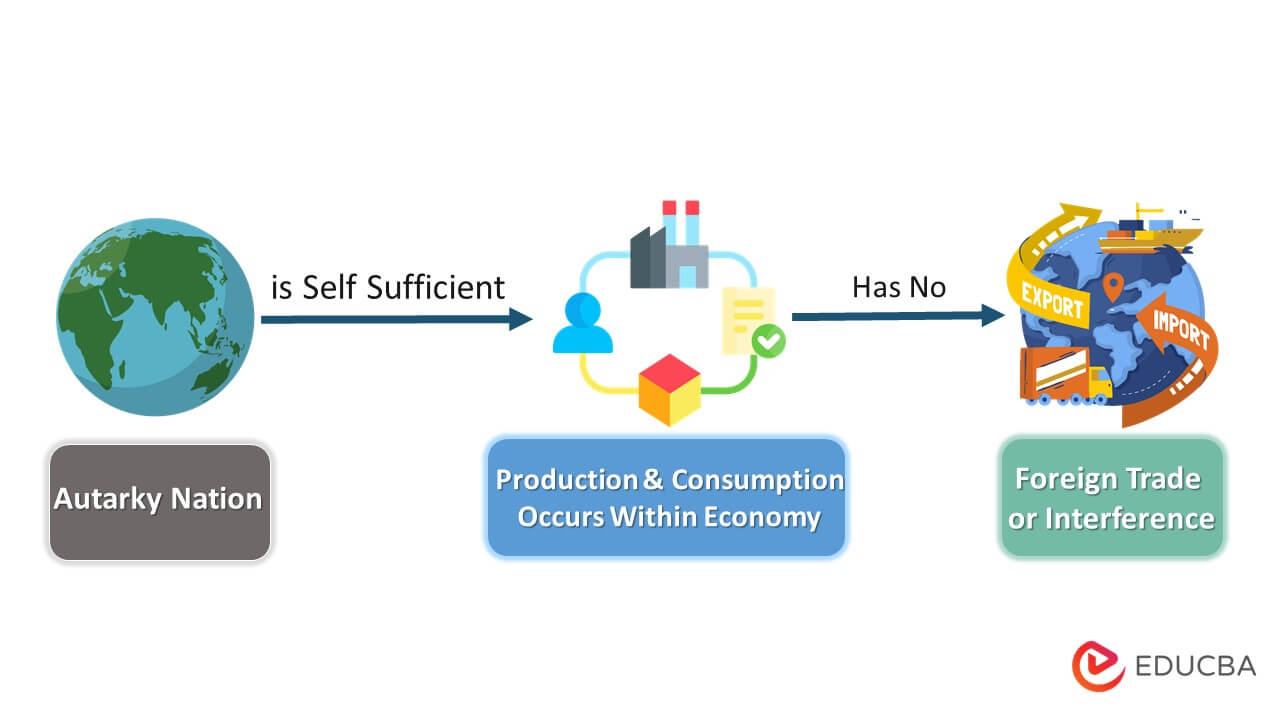

Autarky is an economic term used to describe a situation where a country produces everything it needs without relying on imports or trade with other countries. It is an economic concept that has been around for many centuries, and it holds many implications for countries that choose to pursue it. Autarky can bring many advantages, such as increased economic stability and the ability to remain independent from outside economic influences, but it can also come with risks such as a lack of access to resources and technology from other countries. In this article, we’ll explore the definition of autarky and discuss how it affects countries that pursue it.

What Is Autarky? – An Overview of Autarky and Its Benefits

Autarky is a financial concept that is gaining popularity due to its ability to offer individuals and businesses a greater degree of financial independence. Autarky is defined as the practice of self-sufficiency, or the ability to be self-supporting without relying on outside sources. In the financial sense, autarky refers to financial independence, or the ability to maintain a steady flow of income without relying on external sources. Autarky has many advantages, including providing greater control over finances, reducing the cost of living, and increasing financial security. Autarky also provides greater financial freedom, allowing individuals to pursue their desired lifestyle without worry of financial instability. Autarky is a great way to ensure financial stability and offers numerous benefits that can help individuals and businesses achieve financial independence.

The History of Autarky – How Autarky Came to Exist

Autarky is a concept that has been around since ancient times. It is the idea that a state, nation, or community should be able to maintain its own economic, military, and political independence without relying on outside sources. The history of autarky has had many different interpretations over the years. It can be traced back to Plato’s Republic, where he wrote of a “self-sufficient” state. Autarky has also been used to describe the economic policies of some countries in the 20th century, such as Nazi Germany during the 1930s and 40s. In modern times, autarky has become increasingly popular as an economic policy, with many countries trying to become more self-sufficient, such as China and India. Autarky is a concept that has been around for centuries, but it has recently become a more important concept in the modern world, with some countries striving to become more self-sufficient and independent. Autarky is an idea that is becoming increasingly popular in the 21st century, and it is a concept that could be used to help build stronger economies and more resilient nations.

Autarky Financial Definition – How It Impacts Your Wallet

Autarky is a financial term that refers to a state of self-sufficiency and independence from external sources of income. Autarky is often used to describe a country’s financial independence from other countries and organizations. It is also commonly used to describe a person’s financial independence from outside sources. Autarky can have a huge impact on your wallet as it allows you to be more self-sufficient and not have to rely on outside sources for income. Autarky can help you save money, as you won’t have to pay for imported goods or services. It can also help you build wealth, as you can use the money you save to invest in yourself and your financial future. Autarky is a great way to take control of your finances and be more self-sufficient. It can take some effort to achieve autarky, but the rewards will be worth it in the long run.

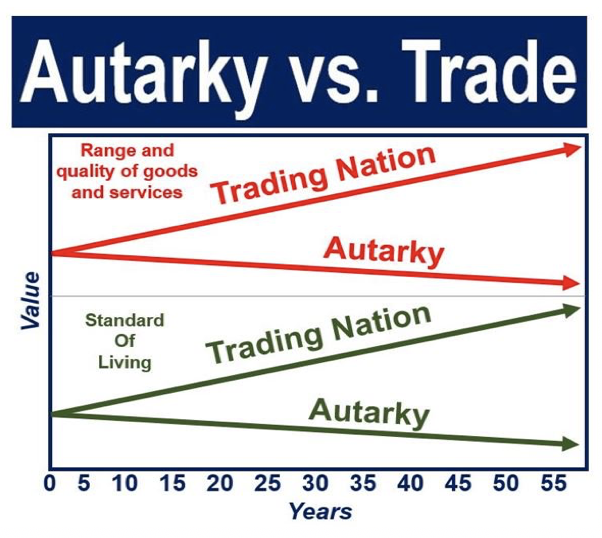

Pros and Cons of Autarky – Weighing the Risks and Rewards

Autarky is a term that describes a financial system that operates with no outside influence or help. With an autarky system, individuals are in control of their own finances and have the ability to make their own decisions. Although there are many benefits to having an autarky system, there are also risks that need to be weighed when considering this type of financial system. The pros of autarky include having more control over your finances, having more freedom to make decisions, and being able to access resources that are not available through traditional banking and financial institutions. On the other hand, the cons of autarky include being exposed to greater risk, having to take on more responsibility for managing your finances, and not having access to the same level of customer service or protections that come with traditional financial institutions. When considering whether or not autarky is the right choice for you, it is important to understand both the pros and cons and weigh the risks and rewards before making a decision.

Avoiding Plagiarism – Tips and Best Practices for Staying Autarky-Compliant

Avoiding plagiarism can be tricky and stressful, but it doesn’t have to be. There are a few key tips and best practices that can help you stay autarky-compliant and make sure you’re always giving credit where it’s due. The most important tip is to always give proper citations and do the necessary research to make sure you’re not accidentally plagiarizing someone else’s work. Additionally, make sure you’re not taking someone else’s ideas and passing them off as your own. Always credit your sources and be sure to double-check any data or facts you present. Staying autarky-compliant also means being aware of any copyright laws and respecting the intellectual property of others. If you follow these simple guidelines, you’ll be well on your way to avoiding plagiarism and staying on the right side of the law.