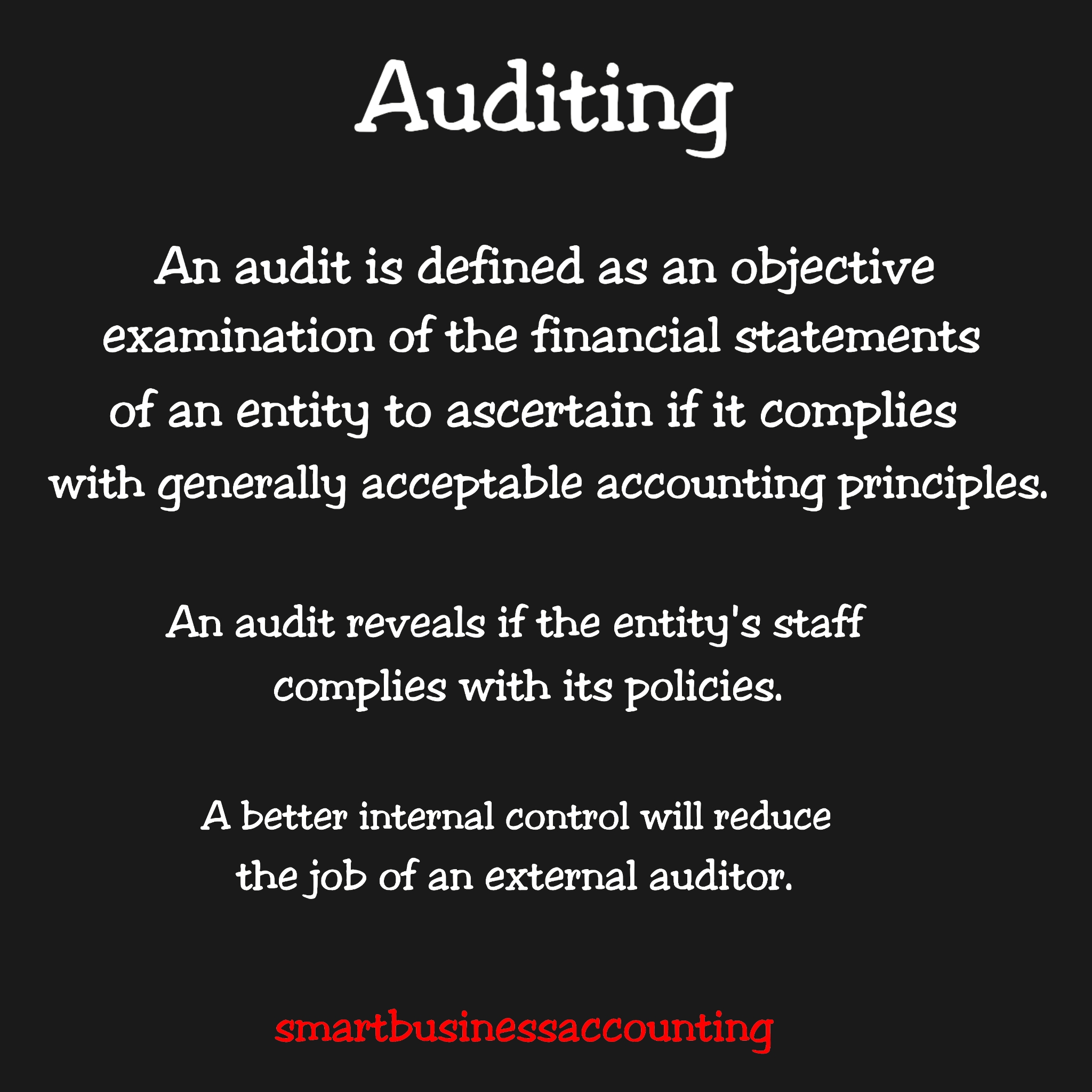

Auditing is an important and integral part of a company’s financial operations. An auditor is a professional who performs independent assessments of a company’s financial statements and operations. The auditor’s job is to verify that all transactions are accurately reflected in a company’s financial statements, as well as to ensure that all legal and regulatory requirements are being met. Auditors are also responsible for detecting fraud, errors, and other potential problems. In this article, we will explore what an auditor is, what they do, and the importance of their role in a company’s financial operations.

What is the Role of an Auditor and What Are The Benefits?

When it comes to understanding the role of an auditor and all the benefits associated with it, it can be hard to keep track of all the information. An auditor is a professional who reviews and examines financial statements to ensure accuracy and compliance with accounting rules and regulations. They also assess the effectiveness of internal controls and check that all financial information is presented in accordance with applicable laws and regulations. Auditors are important for businesses as they provide an independent, objective opinion on the financial statements, which can help reduce the risk of errors or fraud. They can also help to identify areas where improvements can be made and provide assurance to stakeholders. The benefits of having an auditor include increased accuracy of financial information, greater assurance of compliance with laws and regulations, improved internal controls, and increased trust from stakeholders. Auditors are essential for businesses, providing an essential service that can help to identify any potential problems before they become a major issue.

Understanding the Responsibilities of Auditors and How They Help Businesses

Auditors are crucial for businesses, especially those that are publicly traded. They help ensure that the financial statements, such as income statements, balance sheets, and cash flow statements, of the businesses are accurate and free from any material misstatements. Auditors’ responsibilities include reviewing the financial statements and ensuring that the financial statements meet the generally accepted accounting principles (GAAP). They also check that the financial statements are compliant with the applicable laws and regulations of the specific jurisdiction. Furthermore, they assess the internal control systems of the businesses and make sure they are functioning correctly. The auditor’s job is not just to check the accuracy of the financial statements, but also to provide assurance that the financial activities of the business are in accordance with the applicable laws and regulations. This helps businesses in their decision-making process and boosts investor confidence.

Exploring the Different Types of Auditors and Their Roles

Auditing is an important part of financial management, and there are several different types of auditors available to perform the task. External auditors are hired by the company to provide a third-party opinion of the company’s financial statements and to ensure compliance with accepted accounting practices. Internal auditors are employed by the company to review and analyze internal operations, such as corporate governance and internal controls. Government auditors are employed by government agencies to ensure that organizations are meeting their legal requirements. Finally, forensic auditors are used to investigate potential fraud and other financial crimes. Each type of auditor has a specific role to play, ensuring that companies and organizations are operating in a financially responsible manner.

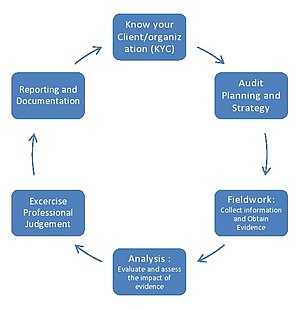

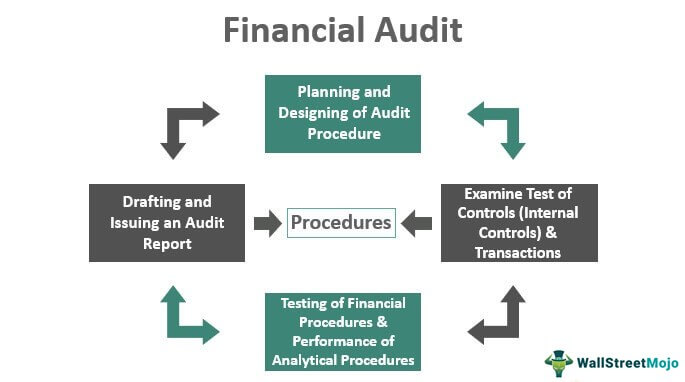

The Process of Auditing and How It Can Help Businesses Avoid Plagiarism

Auditing is an important process that helps businesses avoid plagiarism. It provides an independent evaluation of the accuracy and completeness of financial statements, which in turn helps businesses identify any areas where plagiarism might be occurring. Auditing also helps businesses identify any internal control weaknesses or inefficiencies that could lead to plagiarism. With the help of an auditor, businesses can stay on top of any potential plagiarism threats and ensure that their financial statements are accurate and up-to-date. Auditing is essential for businesses who want to protect their intellectual property and ensure that their financial information is accurate and up-to-date. By taking the time to audit their financial statements, businesses can rest assured that they are avoiding any potential plagiarism threats that might arise.

Exploring the Different Regulatory Requirements for Auditors and Their Impact on Businesses

When it comes to financial auditing, it’s important to understand the different regulatory requirements that auditors must follow and their impact on businesses. Different regulatory bodies have different standards, and it’s important to understand how each one affects your business. For example, the Sarbanes-Oxley Act of 2002 requires public companies to have their financial statements audited by qualified, independent auditors. This act has had a significant impact on businesses, as they must now make sure their financial records are up to date and accurate. Additionally, the Financial Accounting Standards Board (FASB) sets standards for public companies, including reporting requirements and accounting principles. These standards also serve to protect businesses, as they ensure that financial statements are reliable and accurate. Auditors must make sure that companies are in compliance with all of these requirements, and any business that fails to do so could face serious financial penalties. Understanding the different regulatory requirements for auditors and their impact on businesses is essential for any business to remain compliant and successful.