Audit risk is an important concept to understand when it comes to financial matters. It is something that must be carefully managed and monitored, as it can have a significant impact on the overall financial security of any organization. Audit risk is the risk that an auditor’s opinion of a company’s financial statements may be misstated due to errors, fraud, or other irregularities. Understanding audit risk and how it works can help businesses make better decisions regarding their finances and ensure their financial statements are accurate. In this article, we’ll discuss the definition of audit risk, the components of audit risk, and how it can be managed.

Understanding Audit Risk – What It Is and How to Avoid It

Audit risk is a big concern for business owners, especially in today’s ever-changing regulatory climate. Understanding audit risk is key to avoiding costly mistakes. Audit risk is the risk of an auditor issuing an incorrect opinion on a company’s financial statements, which can lead to legal and financial penalties. Knowing the right steps to take to minimize audit risk can save your business time, money and reputation. The best way to avoid audit risk is to ensure that all financial information is accurate, timely and properly presented. Have an experienced accountant or auditor review your financial statements and have them double-check all information. Additionally, create an internal system of checks-and-balances to help ensure that your financial information is up-to-date and accurate. Finally, if any errors are found, make sure to report them to the auditor and take corrective action in a timely manner. Taking the right steps to prevent audit risk can help keep your business running smoothly and protect your bottom line.

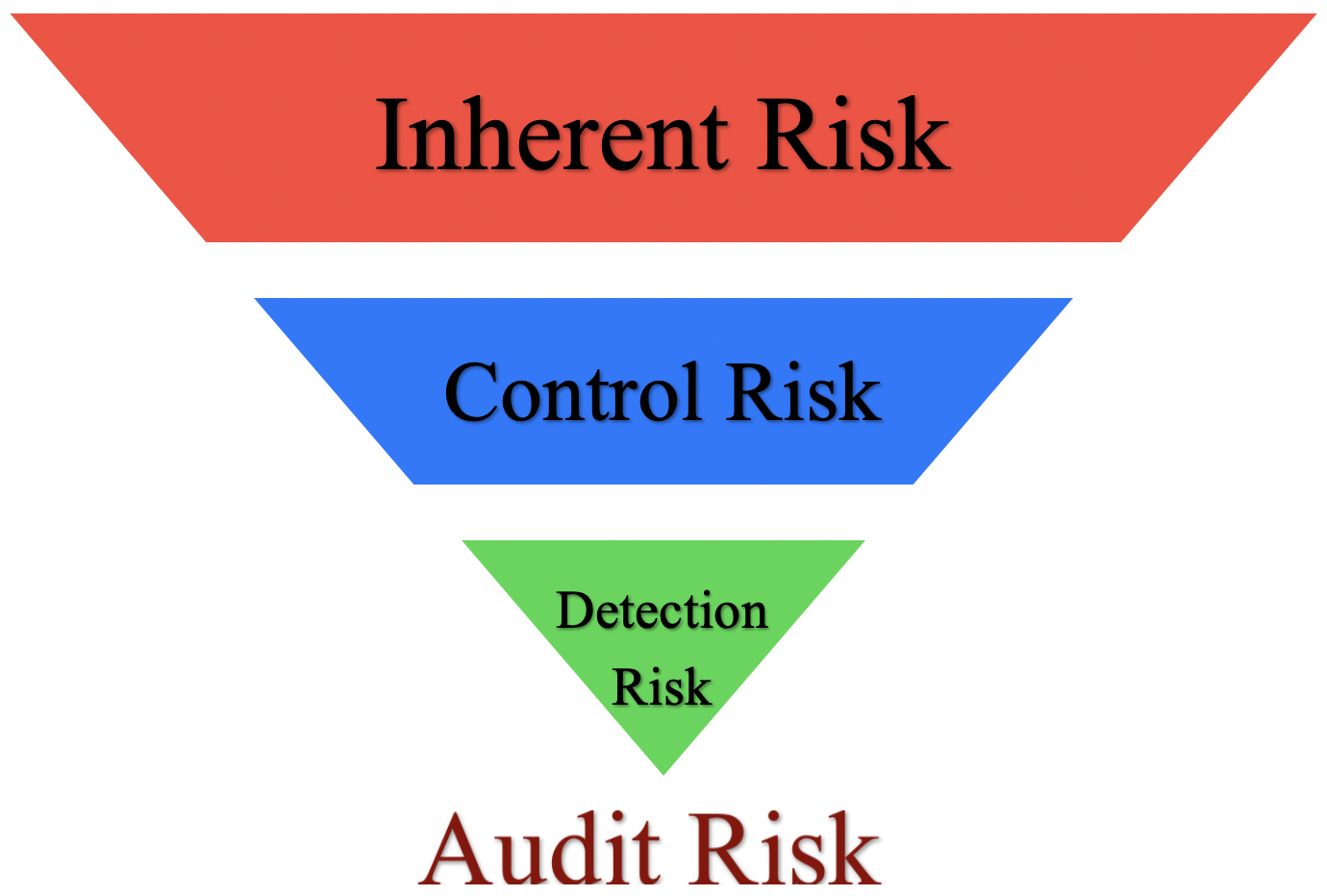

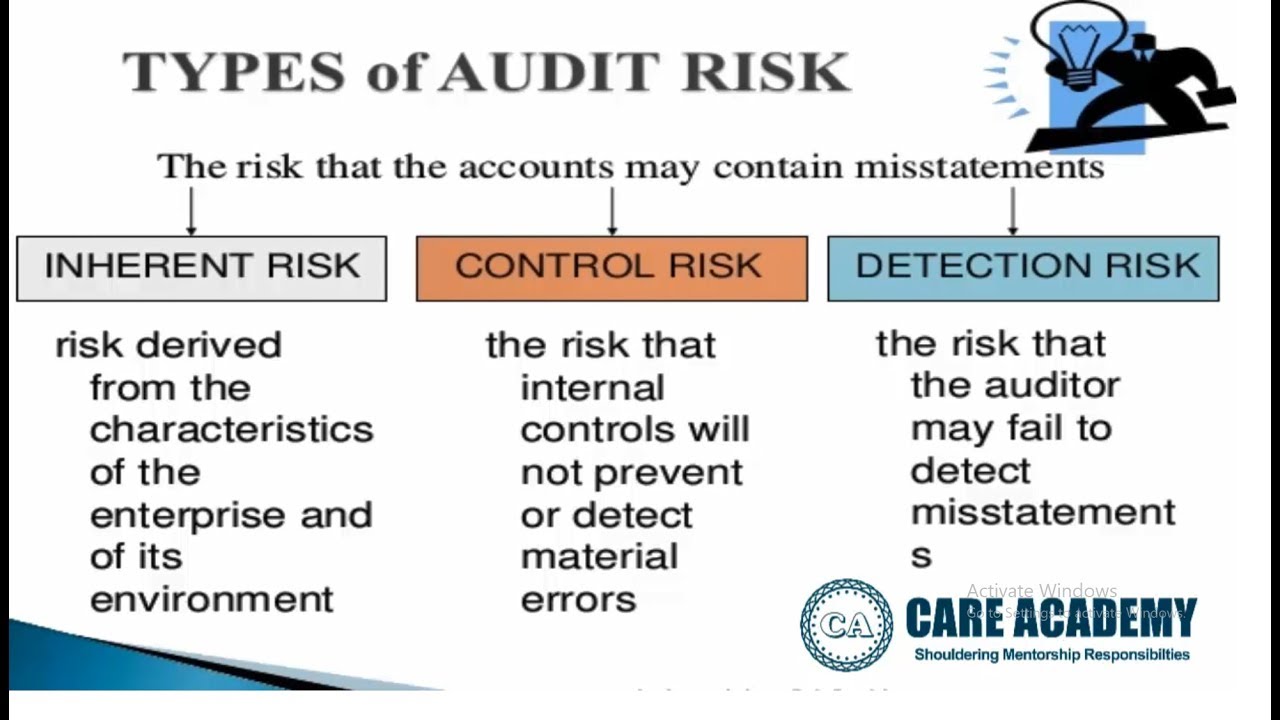

Identifying the Components of Audit Risk

.Audit risk is an important concept to understand when it comes to financial analysis. Audit risk is the risk of an auditor issuing an incorrect opinion on the financial statements of a business. The risk of an auditor issuing an incorrect opinion can be broken down into three components: control risk, inherent risk, and detection risk. Control risk is the risk of material misstatement due to an inadequate system of internal control. Inherent risk is the susceptibility of an account or financial statement item to material misstatement regardless of the controls in place. Detection risk is the risk that the auditor’s procedures will not detect material misstatements that exist. Understanding these components of audit risk is key to successful financial analysis.

Reducing Audit Risk with Effective Financial Reporting

Want to reduce your audit risk? Effective financial reporting is key. Proper financial reporting requires that you have accurate, reliable and complete data. You’ll need to ensure that all of your financial information is up-to-date and accurate, so that it can be verified by auditors. Additionally, you’ll need to make sure that you have sufficient internal controls in place to protect against fraud and other errors. Finally, make sure that you keep all relevant documents organized and filed in an orderly fashion. By taking these steps, you can help to minimize the risk of surprises during your audit and ensure that your financial statements are up to snuff.

The Role of Auditors in Minimizing Audit Risk

Auditors play a vital role in minimizing audit risk. They are responsible for ensuring that financial statements are accurate and reliable. Auditors examine the financial records of a business or organization to make sure all information is accurate and complete. This includes not only verifying the accuracy of the financial statements but also making sure the company is in compliance with all applicable laws and regulations. By thoroughly reviewing the financial information, auditors can detect any potential problems or errors and take corrective action if necessary. This helps to reduce the risk of inaccurate or fraudulent financial statements, thereby minimizing audit risk. Auditors also provide assurance that a company is operating in a responsible manner and that its financial statements are reliable. This helps to provide assurance to stakeholders that the organization is being managed properly and that the financial data is accurate.

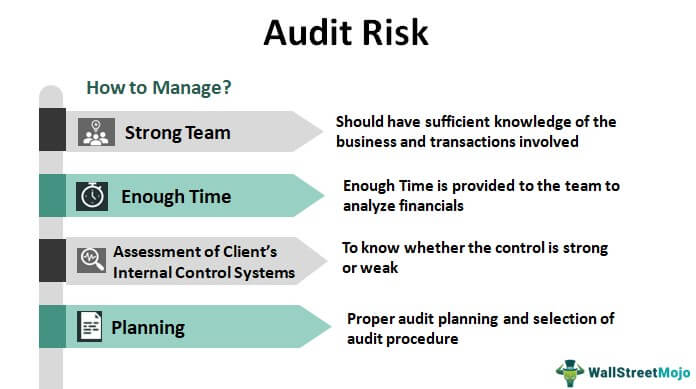

Mitigating Audit Risk Through Effective Risk Management Strategies

Audit risk can be a scary thing for businesses, but there are ways to mitigate it through effective risk management strategies. One of the best ways to do this is by having internal controls in place that can detect potential issues before they become a problem. Regularly reviewing processes and procedures can help identify potential risks and allow managers to take steps to mitigate those risks. Additionally, implementing a system of checks and balances can help ensure that processes are being followed and that financial information is accurate. Finally, having a comprehensive internal audit program in place can provide additional assurance that risks are being addressed. With these strategies in place, businesses can reduce their audit risk and help ensure their financial success.