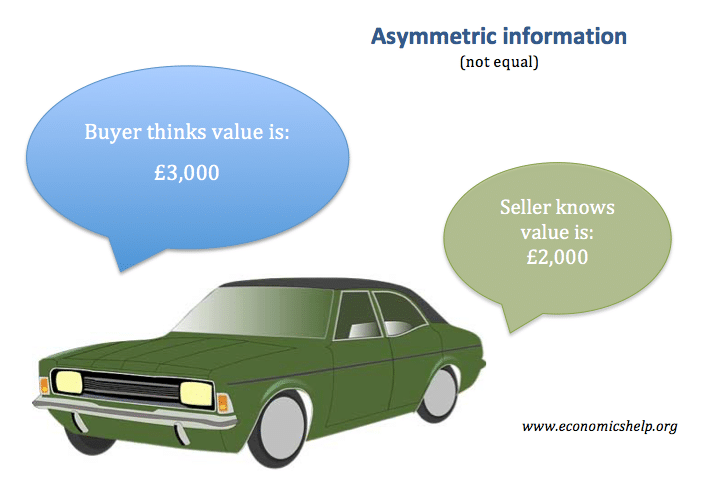

Asymmetric information is a concept that affects almost every aspect of our lives. It occurs when one party in a transaction has more or better information than the other. This can cause market inefficiencies and can lead to an imbalance in the bargaining power of the parties involved. This concept is especially relevant to financial markets, where it has a major impact on the pricing of goods and services. In this article, we will explore the concept of asymmetric information, its financial definition, and how it affects the decisions we make.

Understanding the Basics of Asymmetric Information

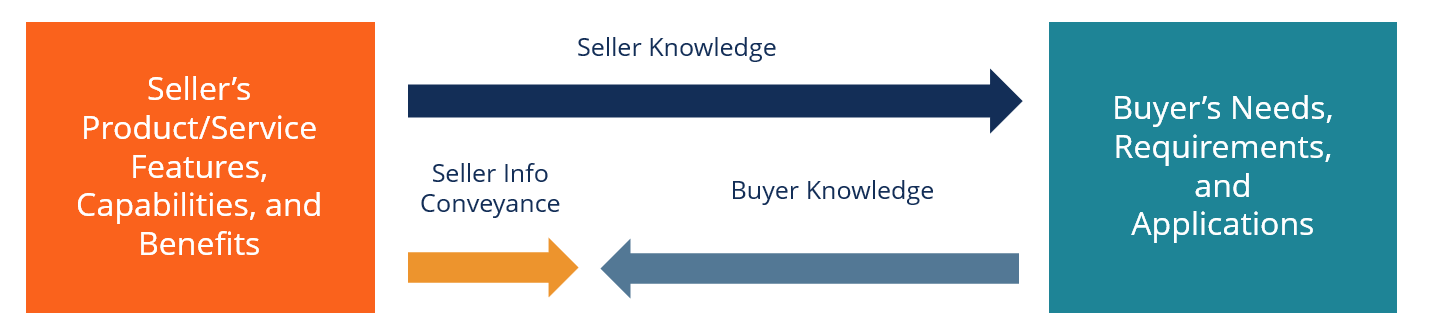

Asymmetric information is an important concept to understand when it comes to financial markets and economics. Basically, it means that one party has more information than another – for example, one buyer may have more information about a product than the seller does. This can lead to huge discrepancies between the parties, such as one party having an advantage or one party being disadvantaged. Asymmetric information can be used strategically to gain an edge in financial transactions, and it’s important to understand how it works so you can make informed decisions. It’s also important to note that asymmetric information is not always bad, as it can sometimes lead to more efficient markets. Knowing how to recognize and use asymmetric information can be an invaluable tool in your financial toolbox.

Different Types of Asymmetric Information

Asymmetric information is an imbalance of knowledge between two parties involved in a transaction. It can lead to a variety of different outcomes, depending on the situation. There are four main types of asymmetric information: adverse selection, moral hazard, information asymmetry, and market failure. Adverse selection occurs when one party has more information than the other, allowing them to make an unfair advantage. Moral hazard is when one party has better information than the other, which leads to a higher risk of one party taking more than their fair share. Information asymmetry happens when one party has more information than the other, resulting in a lack of trust. Finally, market failure occurs when one party has more information than the other, leading to a lack of competition and higher prices. All of these types of asymmetric information can lead to a variety of different outcomes, and it’s important for individuals to be aware of them when making decisions.

How Asymmetric Information Can Affect Financial Decisions

itAsymmetric information can have a huge effect on financial decisions that individuals, businesses, and governments make. It can cause a misallocation of resources and create inefficiencies in financial markets. When one party has more information than the other, it can lead to the party with less information making decisions based on incomplete or incorrect information. This can lead to decisions that are not in the best interest of the party with less information, because they are unable to make an informed decision. Asymmetric information can also lead to markets being slow to react to changing conditions as parties with more information may be unwilling to make decisions until they know more. It is important for individuals to be aware of asymmetric information when making financial decisions, in order to make the best decisions possible.

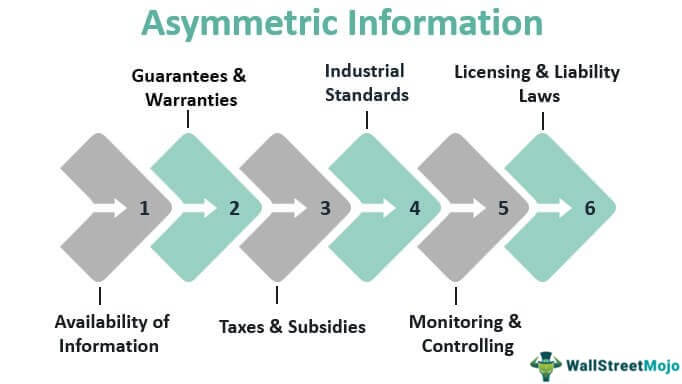

Strategies to Reduce the Risk of Asymmetric Information

Strategies to reduce the risk of asymmetric information can be incredibly useful in the financial world. For businesses, especially those that are new or small, it can be difficult to get reliable information on the market. One strategy to combat this is to create an internal policy that requires all employees to be transparent and honest about their financial decisions. This will ensure that everyone is on the same page and that all data is shared equally. Another strategy is to form partnerships with other businesses in the same industry that may have access to more information. This could help to reduce the risk of asymmetric information by providing access to a larger body of data. Finally, businesses should also make sure to research the market thoroughly and use reputable sources when making decisions. By doing this, they can reduce the risk of asymmetric information and make the most informed decisions possible.

How to Avoid Plagiarism When Researching Asymmetric Information

.It’s important to do your research on asymmetric information – but it’s just as important to do it without plagiarizing! The best way to avoid plagiarism when researching is to make sure you’re citing your sources properly and double-checking your facts. Take the time to read through material thoroughly and make sure you’re not just copying and pasting what other people have said. Don’t forget to use quotation marks and cite your sources to make sure you’re giving credit where it’s due! Asymmetric information is an important concept to understand and by taking the time to make sure you’re not plagiarizing, you can ensure that you have the correct information and that you’ve done your due diligence.