At Par is an important financial term that is used to describe a type of transaction where a borrower and a lender agree to exchange money for an asset at its current market value. It is a common practice in the financial world and is used by companies and individuals to ensure they are getting the best terms for their investment. In this article, we’ll take a look at what At Par means, how it works, and why it’s important to understand it before making any financial decisions.

Understanding the Definition of At Par

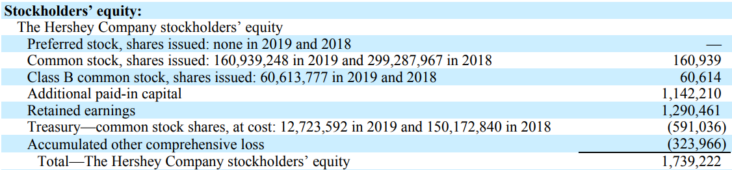

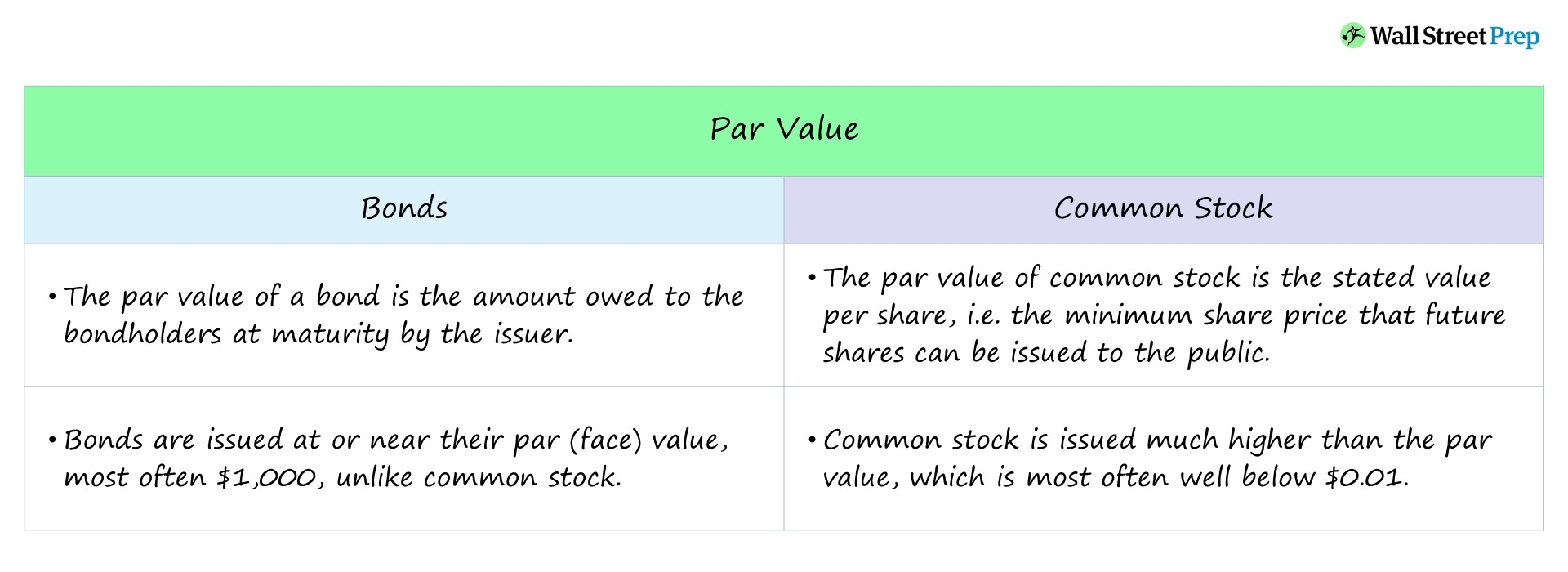

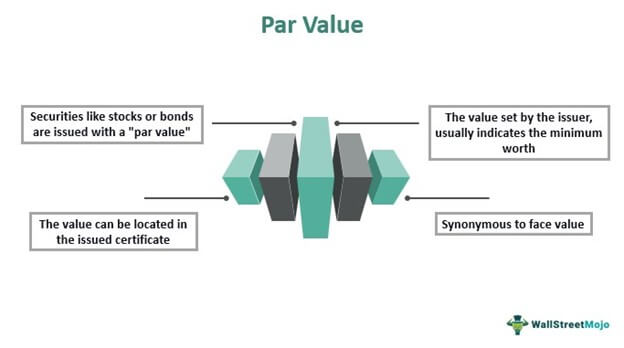

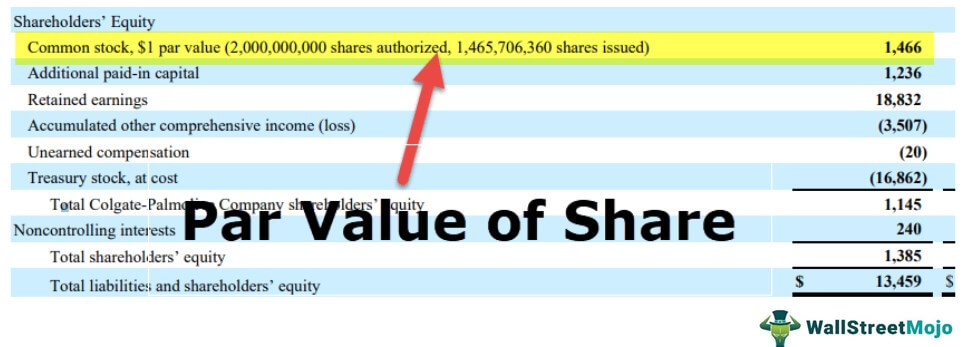

At par is an important financial term that you should know if you’re involved in any type of financial transactions. At par, simply put, is the value of an asset or security that is equal to its face value, or the amount that it was originally issued for. Put simply, it means that something is worth exactly what you paid for it. When a security is trading at par, it means that the price of the security is the same as its face value and that the issuer of the security is not offering any discounts or premiums. This is important to understand because it can have a big impact on the value of your investments and how successful they are. Knowing what at par means can help you make more informed decisions when it comes to investing and help you get the most out of your money.

At Par in the Financial World

At par in the financial world is a term used to define the value of a financial instrument, such as a bond, stock, or currency. At par is the face value of the instrument, and it is equal to the amount of money that was originally invested in the instrument. At par is important because it is the basis for measuring the performance of an instrument over time. If an instrument is performing well, its value will rise above par, whereas if it’s performing poorly, its value will fall below par. This is why it’s important to stay on top of the performance of your investments to ensure that they’re performing up to par.

How At Par Affects Financing Decisions

Making financing decisions can be a difficult task, and being aware of the concept of at par is important when assessing the options. At par is the stated value of a security, usually a bond or note, that equals the face value of the security. This means the security is trading at the same value as the face value. When assessing financing decisions, understanding what at par means is essential. This is because at par can directly affect the cost of the loan. If a loan is trading at a premium, meaning it is priced higher than the face value, then the cost of the loan is more expensive. Alternatively, if the loan is trading at a discount, meaning it is priced lower than the face value, then the cost of the loan is cheaper. Therefore, when making financing decisions, understanding the concept of at par and how it affects the cost of a loan is important.

Spotting At Par Opportunities

Spotting At Par Opportunities is all about knowing when it’s worth taking a risk and when it’s not. With At Par, you can get a better return on your money than a traditional savings account, but you also have to be aware of the risks. To get the most out of At Par, it’s important to look for opportunities that offer the most potential returns with the least amount of risk. This could be anything from a bond or stock offering to a new business venture or even a real estate investment. It’s important to do your research before getting involved in any At Par opportunity to make sure you fully understand the potential risks and rewards. With the right research and knowledge, you can make the most of your At Par investments and reap the rewards.

Avoiding Plagiarism When Researching At Par

When researching the term ‘At Par’, it’s important to avoid plagiarism and make sure you’re writing your own original content. To do this, make sure to cite any outside sources you use and put the information in your own words. It might be tempting to copy and paste content from other sources, but this is a big no-no. Not only is it unethical, but it could result in major consequences. Instead, take the time to research the topic thoroughly and write your own unique explanations and opinions. Doing this is the best way to ensure that your content is both original and accurate.