Are you looking for a comprehensive overview of assurance services? Whether you’re a business owner or an individual, understanding assurance services is essential to making smart financial decisions. Assurance services provide an independent assessment of information to ensure it’s reliable and accurate. In this article, we will explain the definition of assurance services, the different types of assurance services, and the benefits of these services. We’ll also consider factors to consider when selecting an assurance services provider. By the end of this article, you’ll understand what assurance services are and how they can help you make sound financial decisions.

Overview of Assurance Services and Their Benefits

When it comes to financial planning, assurance services are a great way to make sure you have a secure future. Assurance services offer an array of services that help protect your investments, financial documents, and personal information. These services provide an independent review of your financial documents, identifying any risks and potential areas of improvement that could benefit your long-term financial goals. Assurance services also provide a layer of protection against fraudulent activities, helping to protect your investments and personal information from being misused. The benefits of assurance services are endless, giving you peace of mind knowing that your financial future is in good hands.

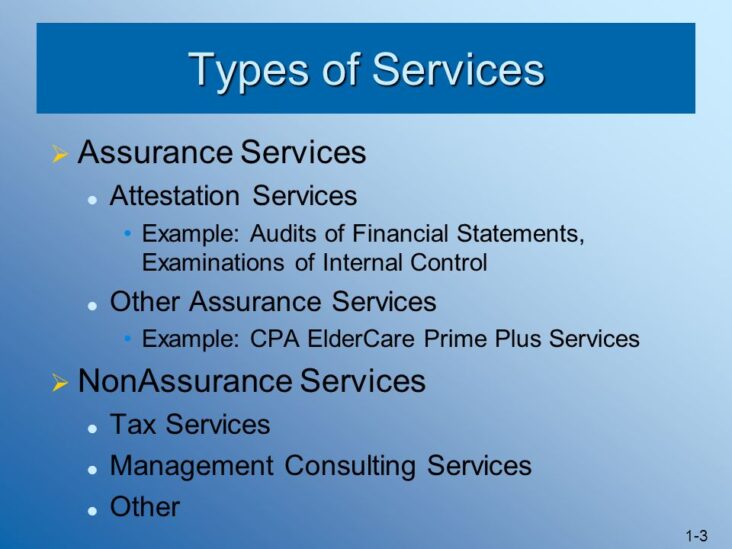

Different Types of Assurance Services

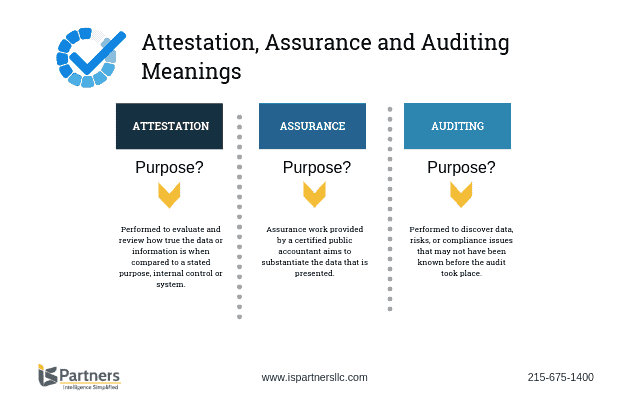

Assurance services are a great way to help businesses stay on top of their finances. They provide an independent, professional opinion on a company’s financial statements and internal controls to give stakeholders peace of mind. There are a few different types of assurance services, and each one can serve a unique purpose. The most common type is a financial statement audit, which provides an in-depth look at a company’s financial statements to ensure accuracy and completeness. Additionally, there are assurance services such as internal control reviews, compliance audits, and IT audits, which provide an independent assessment of the effectiveness of the company’s internal controls and processes. Lastly, attestation services serve as a way to ensure the integrity of a company’s information and data. All of these assurance services provide a great way for companies to stay on top of their finances and make sure everything is in order.

The Role of Assurance Services and Professional Standards

Assurance services are an integral part of the financial industry and provide a range of professional services designed to increase the reliability of financial information. In particular, assurance services are designed to increase the trustworthiness of financial statements and other financial documents, such as audited financial statements and tax returns. The role of assurance services is to provide independent verification and assurance of the accuracy of financial information, which helps to protect the interests of users of financial statements. Professional standards are established by assurance services to ensure the reliability and accuracy of financial information. These standards include the International Standards on Auditing, which provide a framework for the performance of assurance services and the quality of the results. Professional standards also include the Code of Professional Conduct, which outlines the ethical standards for assurance services professionals.

Challenges of Utilizing Assurance Services

Utilizing assurance services can be a great way to gain peace of mind when it comes to your finances. However, there are certain challenges that come with utilizing these services. One of the biggest challenges is the cost associated with assurance services. These services can be quite expensive, and many individuals and businesses may not have the means to afford them. Additionally, assurance services may require a considerable amount of paperwork and documentation, which can be daunting and time-consuming. Lastly, it can be difficult to know whether or not an assurance service is trustworthy, as there is no guarantee of the quality of the service provided. When considering utilizing assurance services, it is important to weigh the pros and cons carefully to decide if it is worth the investment.

Benefits of Engaging an Assurance Service Provider

Assurance services are an incredibly valuable asset to any business, big or small. Engaging an assurance service provider can provide numerous benefits that can help a business grow and succeed. One of the biggest advantages of utilizing an assurance service provider is the peace of mind that comes with knowing that your finances are being managed properly. Assurance services have the ability to monitor and review financial statements and other data, ensuring accuracy and compliance with regulations. This can help businesses avoid potential legal issues or financial mismanagement. Additionally, assurance services can provide insight and advice on how to better manage finances, allowing businesses to save money, increase profits, and make more informed decisions. Assurance services can also provide valuable insight into areas such as risk management, audit services, and fraud prevention, further helping businesses to protect their assets and safeguard their future.