Are you curious about what assurance is and what it means? Assurance is defined as a promise or guarantee that a certain outcome will occur or a certain level of quality will be met. It is a way to give someone a sense of security that a product or service will be of a certain standard or quality. This article will provide a detailed overview of assurance, including its definition, its various types, and its different applications in the financial world. We’ll also explain its importance and discuss how it can help protect you and your business. Read on to learn more about assurance and how it can benefit you.

What Assurance Is and How It Can Help You Achieve Financial Security

Assurance is a great tool to help you achieve financial security. It is basically an agreement between two parties that ensures that one party will meet certain obligations. In terms of finances, this could be an agreement that one party will pay certain amounts on a certain schedule or that one party will protect the other party’s assets. Assurance helps to ensure that you have a secure financial future, as it provides a guarantee that the obligations will be met. It is important to make sure that you understand the terms of the agreement before signing off on it, as it can help to protect your financial interests. With the right assurance, you can rest easy knowing that your financial future is secure.

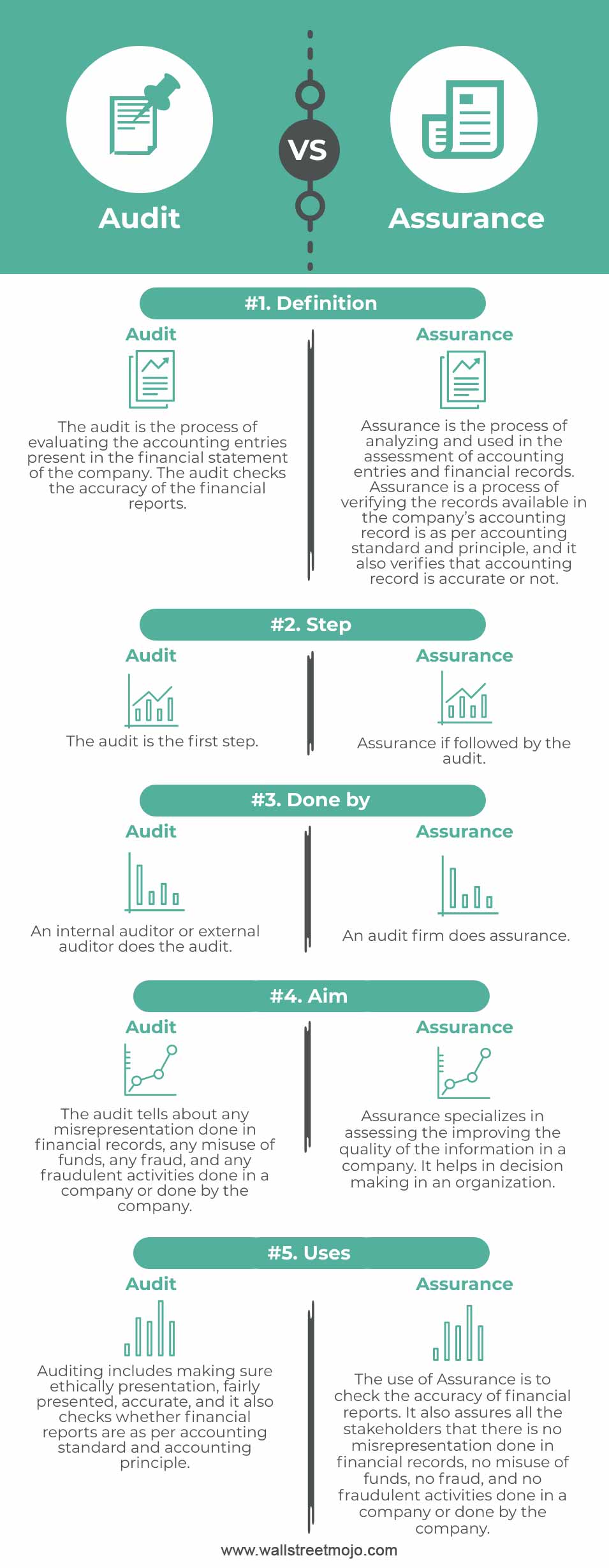

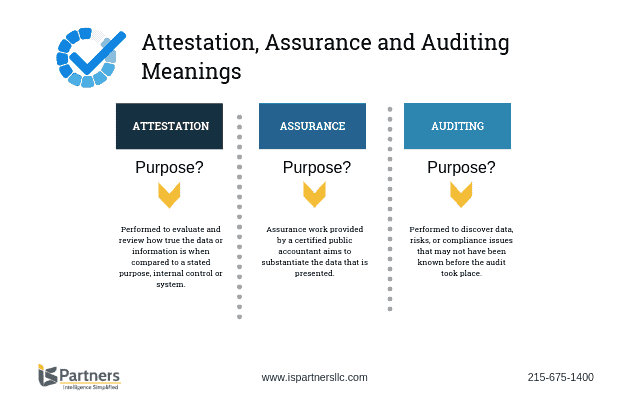

Understanding the Definition of Assurance and its Meaning in the Financial World

Assurance is a term used in the financial world to refer to the security of a financial transaction. It is a process that ensures that a transaction is completed with a certain level of quality, such as a contract, investment or loan. Assurance is also used to refer to the reliability and prudent management of financial resources to ensure that the funds are used wisely and are not wasted. Assurance is important to businesses and individuals as it helps to ensure that their financial transactions are safe and secure. It also provides peace of mind that the funds are being managed in a responsible manner, ensuring that the risks associated with financial transactions are minimized. Assurance is an important part of financial planning, as it helps to ensure that a company or individual has the resources they need to achieve their financial goals.

Types of Assurance and the Benefits of Choosing the Right Policy

When it comes to protecting your finances, there’s no better way to do it than with assurance. Assurance is a type of financial policy that provides protection against the unexpected. It offers peace of mind so you can rest easy knowing that you’re covered. There are many types of assurance policies available, so it’s important to choose the right one for your needs. Life assurance and home assurance are two of the most common types of assurance policies, but there are also other policies that protect your car, travel, business, and more. Each policy offers different levels of coverage, so it’s important to do your research and choose the policy that’s best suited for your needs. The benefits of choosing the right assurance policy are numerous, from providing financial protection to peace of mind. With the right policy, you can rest easy knowing that you’re covered and your finances are safe.

Tips for Avoiding Financial Risks and Protecting Your Assets with Assurance

.If you want to protect your assets and avoid financial risks, assurance is a great way to do so. Assurance is an agreement between two parties that guarantees a certain outcome. It can provide a sense of security and help you prepare for the future. Some tips for avoiding financial risks and protecting your assets with assurance include creating an emergency fund, diversifying your investments, and understanding the terms of any agreements you enter into. Additionally, you should keep an eye on the markets and research any potential investments you’re considering. Taking these steps will help ensure that your assets are safe and secure.

How to Choose the Right Assurance Option and Avoid Plagiarism

When it comes to choosing the right assurance option, it’s important to remember that plagiarism is not an option. Plagiarism is a serious issue, and can have serious repercussions. It’s important to make sure you’re taking the time to properly research and cite your sources. This will help ensure that you are not committing plagiarism and that your work is original. It is also important to remember that while it can be tempting to copy and paste someone else’s work, this is a huge no-no. Always be sure to create your own original content and to properly cite any sources you use. This will ensure that your work is not only original, but also that you are not taking credit for someone else’s work.