Assets Under Management (AUM) is an important financial term that has many implications for investors, businesses, and even governments. AUM is the total market value of all investments that an individual, company, or organization manages. This includes stocks, bonds, mutual funds, and other investments, and it is used to measure the size and success of an investment manager. Understanding AUM is vital to making informed decisions when it comes to investments, so let’s explore exactly what it means and how it impacts investment strategies.

What is Assets Under Management (AUM) and How Does It Work?

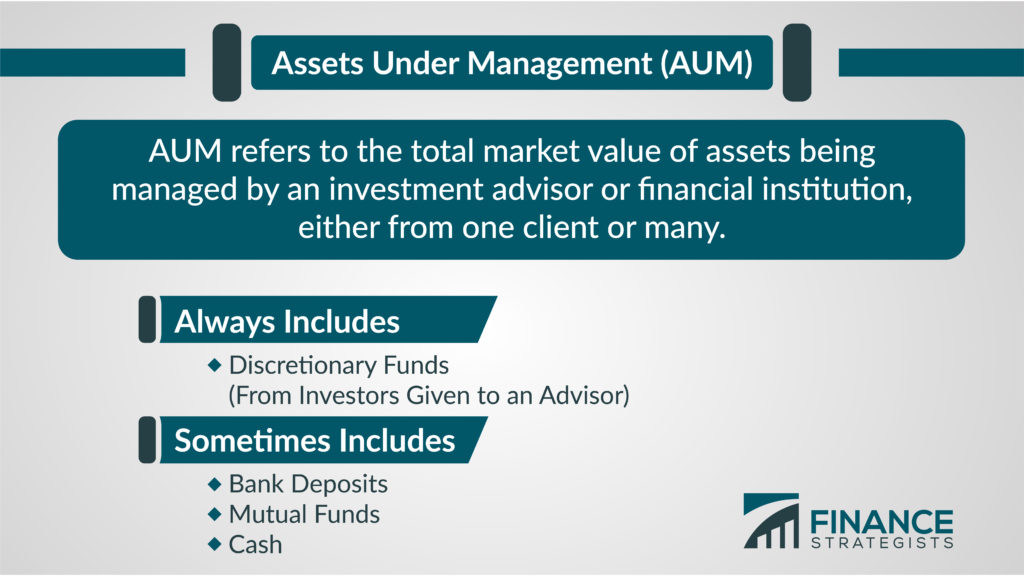

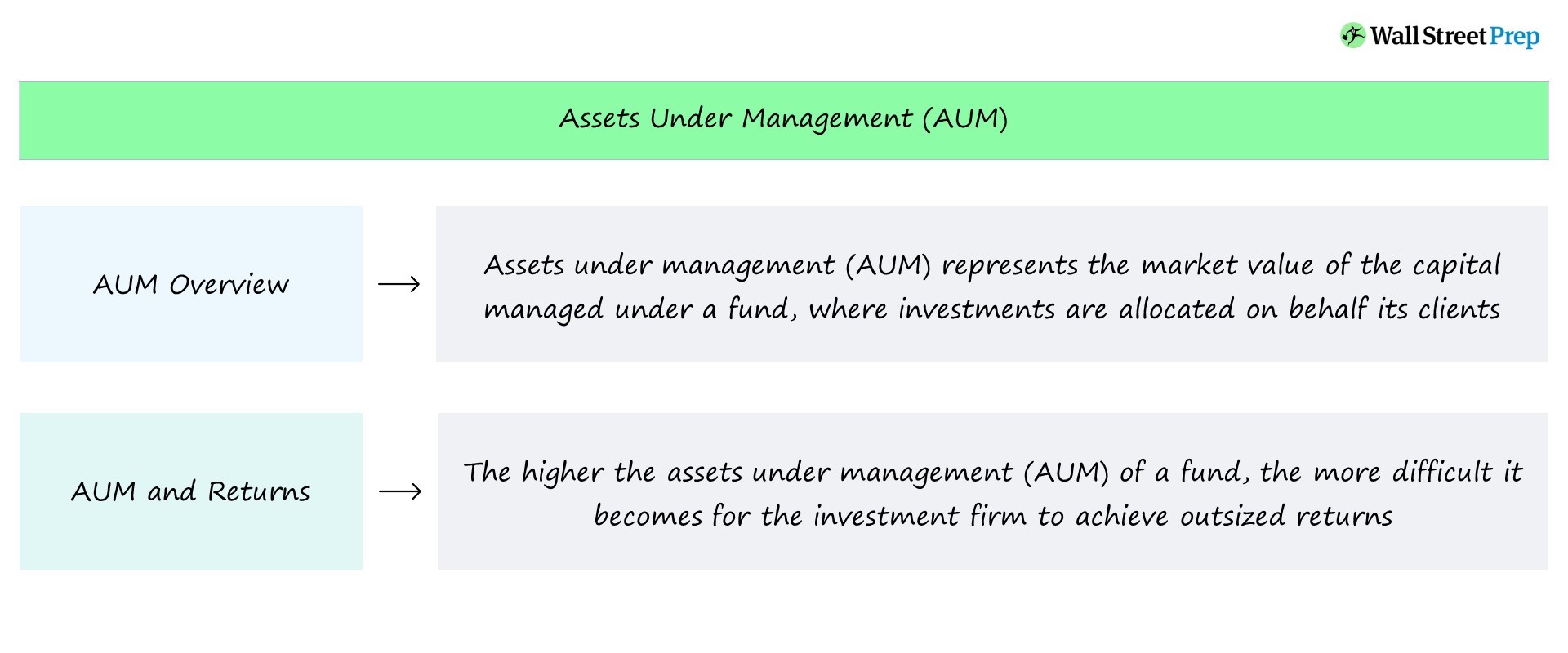

Assets Under Management (AUM) is a term used to describe the total market value of all the investments managed by a financial advisor, fund manager, or financial institution. It’s an important metric to consider when deciding whether to trust your money with a certain manager or institution. AUM measures the total market value of all the investments managed by a financial advisor, fund manager, or financial institution. It’s a simple way to measure the overall size and health of a portfolio. AUM works by taking the total value of all the investments managed by the financial advisor or fund manager and dividing it by the number of clients or investors. This gives an indication of how much money each client has invested with the manager and a general idea of the manager’s performance. AUM can be used as a benchmark for comparing different financial advisors and fund managers, and can help you make an informed decision when selecting a manager or institution to trust your money with.

Benefits of Assets Under Management (AUM)

Assets Under Management (AUM) is a great way to ensure that your investments are managed in the most efficient and cost-effective manner. With AUM, you have the benefit of having your investments managed by a professional, which can help you to maximize returns and minimize risks. AUM also gives you the ability to diversify your portfolio, reducing your risk and increasing the potential for higher returns. Additionally, AUM can provide you with access to a wide range of financial products, allowing you to choose the best products for your needs. AUM provides you with the security of knowing that your investments are in the hands of a professional, allowing you to rest assured that your investments are in the best hands possible.

Different Types of Assets Under Management (AUM)

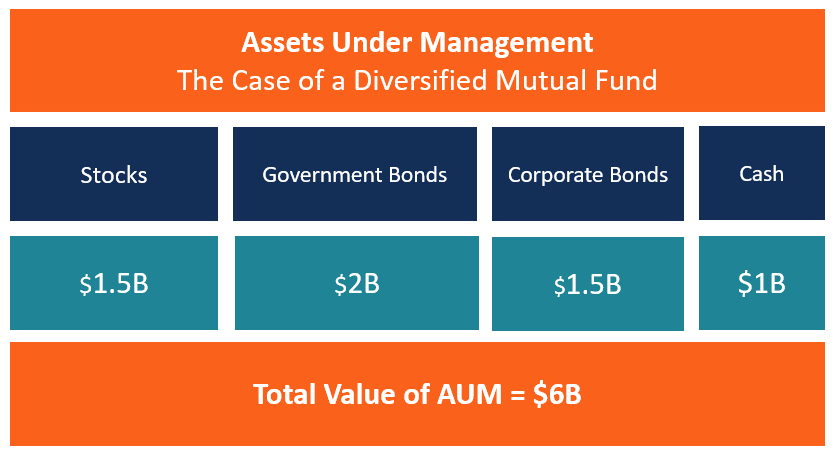

Assets Under Management (AUM) is the total market value of investments managed by a financial institution or individual. AUM is an important metric for investors and advisors, as it helps them determine the size and scope of the portfolio being managed. AUM is also an important factor when evaluating the performance of a financial advisor. Different types of assets under management include stocks, bonds, mutual funds, ETFs, commodities, and alternative investments such as real estate and private equity. For investors and advisors, understanding the types of AUM and how they fit into a portfolio is critical to making informed decisions and achieving long-term success. Investors should also consider the fees associated with managing AUM, as they can have a significant impact on the overall returns generated by an investment portfolio.

Calculating Assets Under Management (AUM)

If you’re looking to figure out your Assets Under Management (AUM), it’s important to understand the concept and how to calculate it. AUM is a measure of the total value of all assets that are managed by an institution or financial professional. This can include cash, securities, and other investments. To calculate AUM, you need to add up the total amount of money in all of the assets you manage. This should include any fees you receive for managing investments, as well as any other income that you generate from investments. AUM is a key metric when it comes to financial planning and management, as it helps you understand the size and scope of your business. It’s also a great way to measure the success of your investments and get a better idea of how your financial decisions are impacting your bottom line. Knowing your AUM is an important step to becoming a successful investor.

Risks and Challenges Associated with Assets Under Management (AUM)

Managing assets under management (AUM) can be a tricky process. It takes a lot of hard work to maintain and increase the value of AUM, and there are significant risks and challenges associated with it. For example, if the market takes a downturn, the value of AUM can plummet quickly, leaving investors with losses and diminished faith. Additionally, it can be difficult to accurately project returns on AUM, as the performance of individual investments and the market as a whole can be unpredictable. Finally, there are regulatory risks to consider when managing AUM, as failure to comply with laws and regulations can lead to hefty fines and other penalties. Despite these risks and challenges, many investors have found success with AUM and have seen significant returns. With a bit of knowledge and a lot of hard work, anyone can make AUM work for them.