Are you confused about what an Assignment is? It’s a term that can be used in a variety of contexts and situations, and it’s important to understand the financial definition of it. In this article, we’ll take a closer look at Assignment, including what it is, why it’s used, and how it can impact you financially. We’ll also discuss the risks and benefits associated with Assignment, and how it can help you better manage your finances. By the end of this article, you should have a better understanding of Assignment and how it can affect your financial choices.

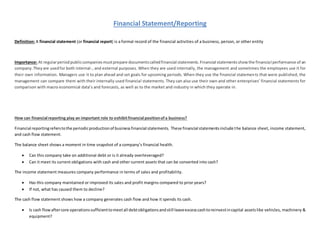

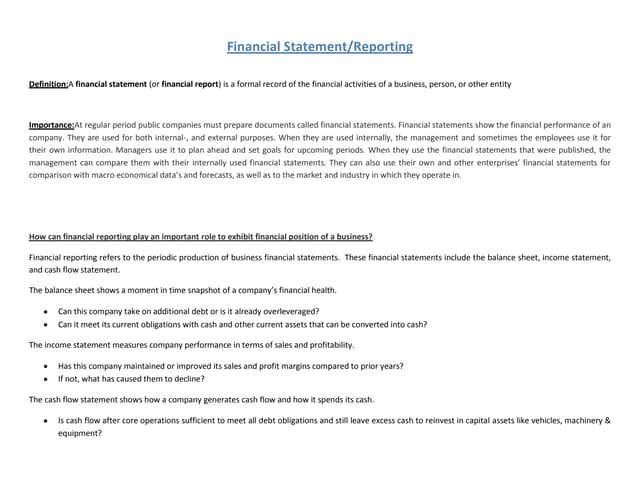

What is Assignment in Financial Terms?

When it comes to financial terms, an assignment is a transfer of rights from one party to another. It can be used in a variety of different financial contexts, such as stocks, bonds, and derivatives. When an assignment is made, it is a legally binding agreement and it is important that all parties involved understand the terms of the agreement. An assignment can involve the transfer of a security, a debt, or other types of financial instruments. The assignment must be made in writing and the terms should be clearly stated, including any payments to be made or received. It is important to remember that an assignment is not a sale and that the original party may still retain ownership of the asset or instrument after the assignment.

How to Avoid Plagiarism in Assignment Writing

When writing assignments, it is important to always give credit where credit is due. Plagiarism is a serious offense and is punishable in most academic settings. To avoid plagiarism in your assignment writing, there are a few things you can do. First and foremost, research your topic thoroughly, and make sure you understand the material before you start writing. Take notes as you go, and make sure to cite all sources of information you use in your paper. Additionally, use quotation marks when directly quoting someone else’s words and always cite the source, even if it’s paraphrased. Finally, be sure to write in your own words and style, and avoid taking shortcuts by copying and pasting information from online sources. With some diligence and a bit of creativity, you can avoid plagiarism in your assignment writing and save yourself from the consequences.

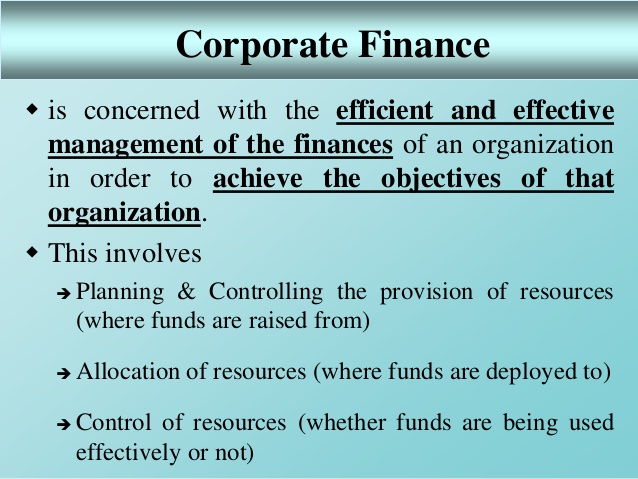

The Benefits of Understanding Assignment Financial Terms

Learning the financial terms associated with assignment can help you to understand your financial obligations and make better decisions regarding money. Knowing the terminology can help you to identify potential pitfalls or opportunities to maximize your earnings. Understanding these terms can also help you to better negotiate with lenders, as you will be better equipped to understand their requirements and evaluate the pros and cons of different financial products. With a better understanding of assignment financial terms, you can make decisions that are better suited to your financial goals and objectives.

Tips for Writing an Assignment Free from Plagiarism

Writing an assignment free from plagiarism can be tricky, but with a few helpful tips it’s totally doable. Firstly, make sure you understand what plagiarism is and what counts as plagiarism. It’s easy to accidentally use someone else’s words or ideas without knowing it, so always make sure you do your research and cite everything you use. Secondly, use your own words as much as possible when paraphrasing ideas or texts you find. Thirdly, if you’re unsure about something, always double check – make sure you understand the material thoroughly and can explain it in your own words. Finally, always make sure you cite any sources you use properly. Following these tips can help ensure that your assignment is entirely your own work, and will help you avoid the pitfalls of plagiarism.

Key Considerations for Understanding Assignment Financial Terms

If you’re unfamiliar with the term “assignment” when it comes to financial matters, it’s important to understand some key considerations before diving in. Assignment is a legal term that refers to the transfer of contractual rights from one party to another. Basically, it allows one party to transfer their rights and obligations from one contract to another. This is especially useful when it comes to loan transfers, where one party has the right to assign the loan agreement to another party. It’s also important to note that the new party is legally bound to the same terms and conditions as the original party. When it comes to assignments, the two main types are voluntary and involuntary. Knowing which one you’re dealing with is important, as involuntary assignments often have more legal implications. Understanding assignment financial terms can be complex, but knowing the basics can help ensure you make the right decisions when it comes to your finances.