Asset valuation is a process of determining the fair market value of an asset. It is a critical component of financial planning and investment decision-making for both individuals and businesses. It is essential for understanding the worth of a company’s assets and liabilities. Asset valuation is used to assess the value of tangible and intangible assets, such as real estate, equipment, intellectual property, and goodwill. By using market data, industry trends, and financial analysis, valuators can determine the value of an asset to help investors and business owners make informed decisions.

What Are the Different Methods of Asset Valuation?

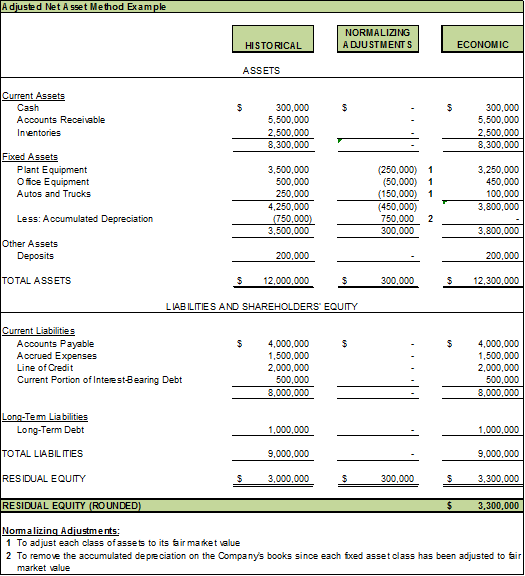

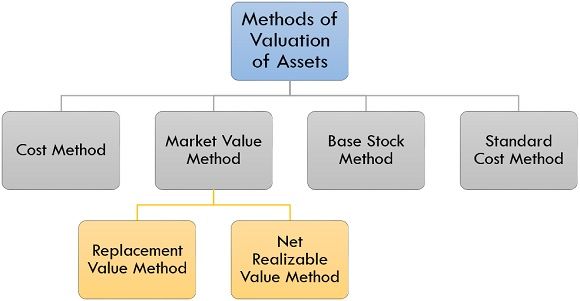

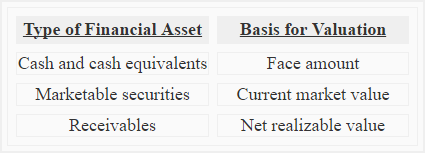

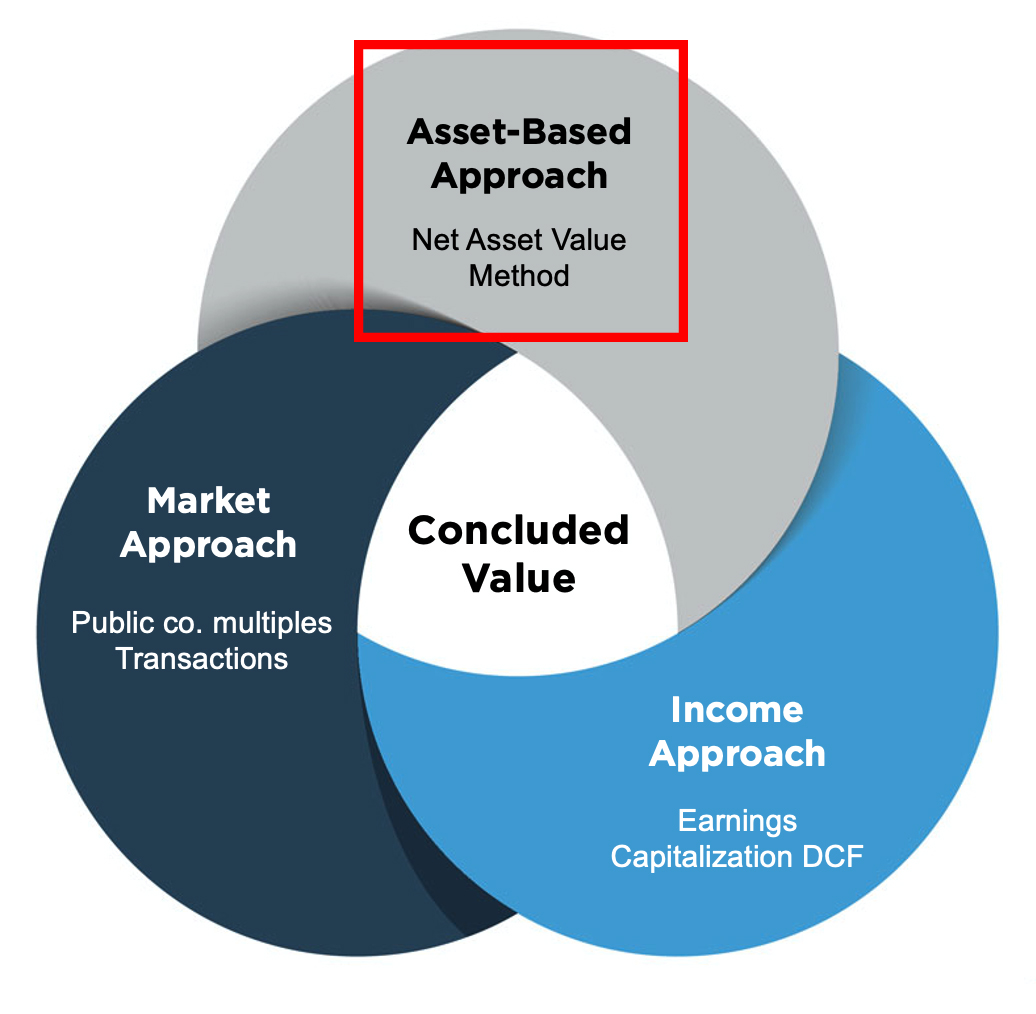

When it comes to asset valuation, there are a few different methods you can use to get an accurate estimate of an asset’s worth. The most common methods are the cost approach, the market approach, and the income approach. The cost approach is based on the current replacement cost of the asset, and it is usually used for tangible assets like land and buildings. The market approach is based on the comparison of similar assets that have already been sold, and is often used for things such as stocks and bonds. Finally, the income approach is based on the expected future cash flows generated by the asset, and is usually used for income-producing assets such as real estate investments. No matter which method you use, you should always double-check the valuations in order to ensure accuracy.

How to Accurately Calculate Asset Valuation?

Calculating asset valuation accurately can be a tricky task, but it’s important to get it right if you want to make a sound investment. To get started, you’ll need to consider the cost of the asset, the expected future return on the asset, and the current market value. You’ll also need to factor in any potential risks associated with the asset. Once you have all of this information, you can use various methods of asset valuation to determine the true value of the asset. These methods can range from simple comparisons to more complex calculations. Whichever method you choose, make sure to take all of the necessary steps to ensure the accuracy of your asset valuation. Doing so will help you make the best decision when it comes to investing in the asset.

The Benefits of Professional Asset Valuation

If you’re thinking about investing in assets, it’s important to get an accurate value of what they’re worth. Professional asset valuation services can help you do just that. Having an expert in asset valuation assess the value of your investments can be incredibly beneficial. Not only can they give you an accurate price, but they can also provide you with advice on how to make the most out of your investments. Professional asset valuation services can help you make smarter decisions about investments and make sure that you’re getting the most out of your assets. Additionally, having a professional evaluate your assets can help you protect your investments and make sure you don’t overpay for them. Having a professional asset valuation service on your side can help you make smarter investments and get the most out of your assets.

The Impact of Asset Valuation on Financial Decisions

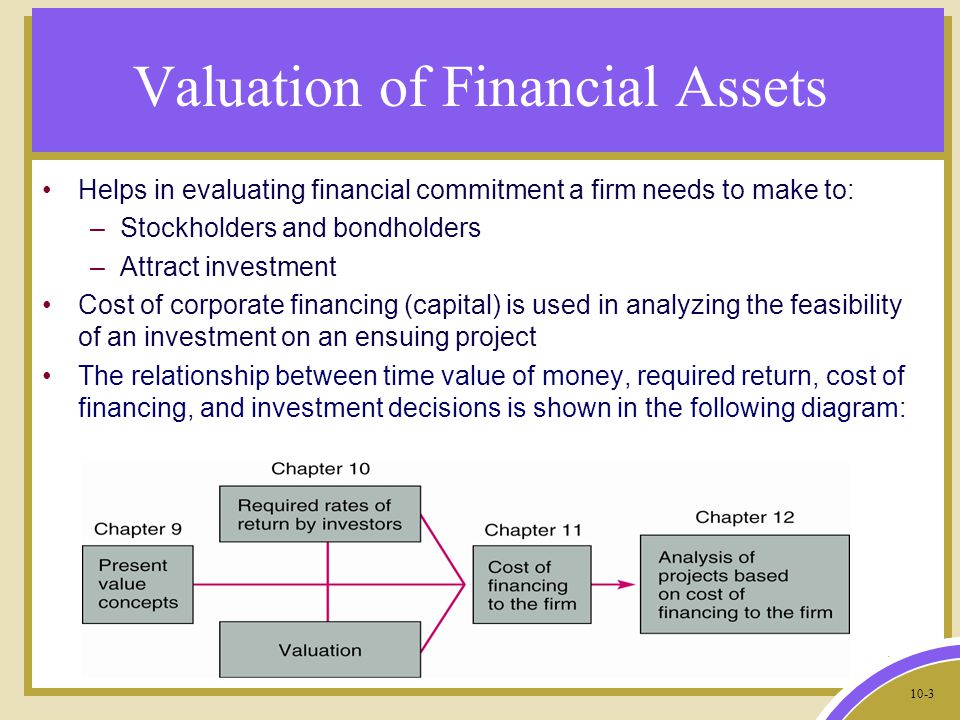

Asset valuation has a huge impact on financial decisions. It can be the difference between making a wise investment or a bad one. Asset valuation is the process of estimating the worth of an asset, usually for the purpose of determining the value of an investment. It involves analyzing a variety of factors, including market conditions, supply and demand, and the asset’s potential future value. Asset valuation helps investors determine whether to buy, sell, or hold an asset, and is also used by companies to get a better understanding of their financial position. A thorough understanding of asset valuation is essential for making sound financial decisions and achieving long-term success.

Common Pitfalls to Avoid When Valuing Assets

When it comes to asset valuation, there are a few common mistakes that people make that can have a big impact on the value of your assets. Firstly, it’s important to make sure that you are using an accurate and up-to-date method of valuation for each asset. This means that you should be utilizing up-to-date market data to make your calculations. Secondly, make sure you are taking into account all the associated costs that come with the asset, such as maintenance and storage. Finally, don’t forget to factor in any potential depreciation of the asset over time. By avoiding these common pitfalls when valuing your assets, you can ensure that you receive a fair and accurate valuation.