Asset turnover ratio is an important financial measure of a company’s ability to generate revenue from its assets. It is a key indicator of a company’s efficiency and profitability, and can be used to assess the overall performance of a business. The ratio helps to determine how well a company is using its resources and how much it is generating in sales from its investments. It is calculated by dividing a company’s total sales by its total assets. By understanding the asset turnover ratio, investors and other stakeholders can gain insight into the company’s performance.

What Does the Asset Turnover Ratio Measure?

The Asset Turnover Ratio is an important component of financial analysis. It tells you how efficiently a company is using its assets to generate sales. This ratio is calculated by dividing the net sales of a company by the total assets of that company. A higher number indicates that the company is more efficient in using its assets to generate sales. This can be a great indicator of a company’s overall performance. Knowing the Asset Turnover Ratio can help investors determine if a company is making the most of its resources, or if it’s time to look elsewhere. It’s important to remember that the higher the ratio, the better the company is doing. So if you’re looking for a company with great potential, the Asset Turnover Ratio is a great place to start.

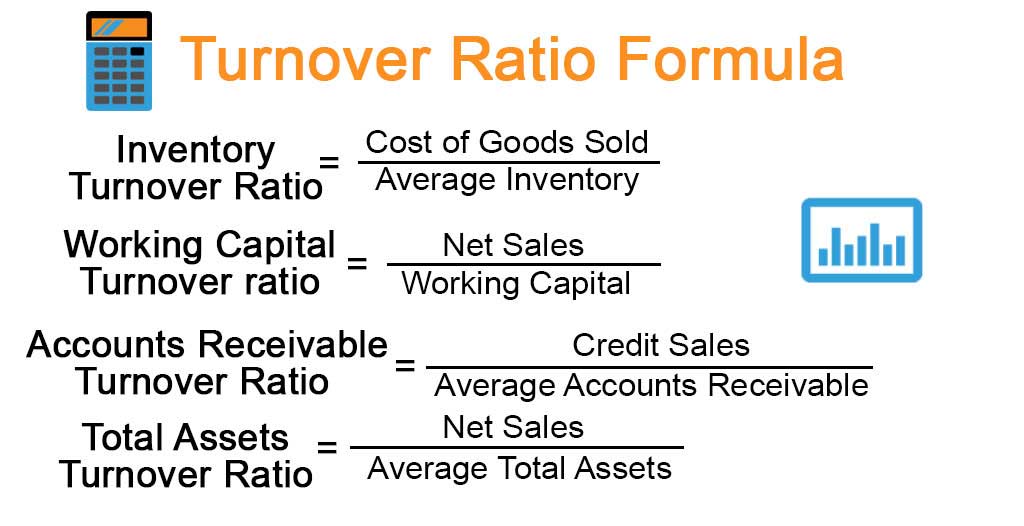

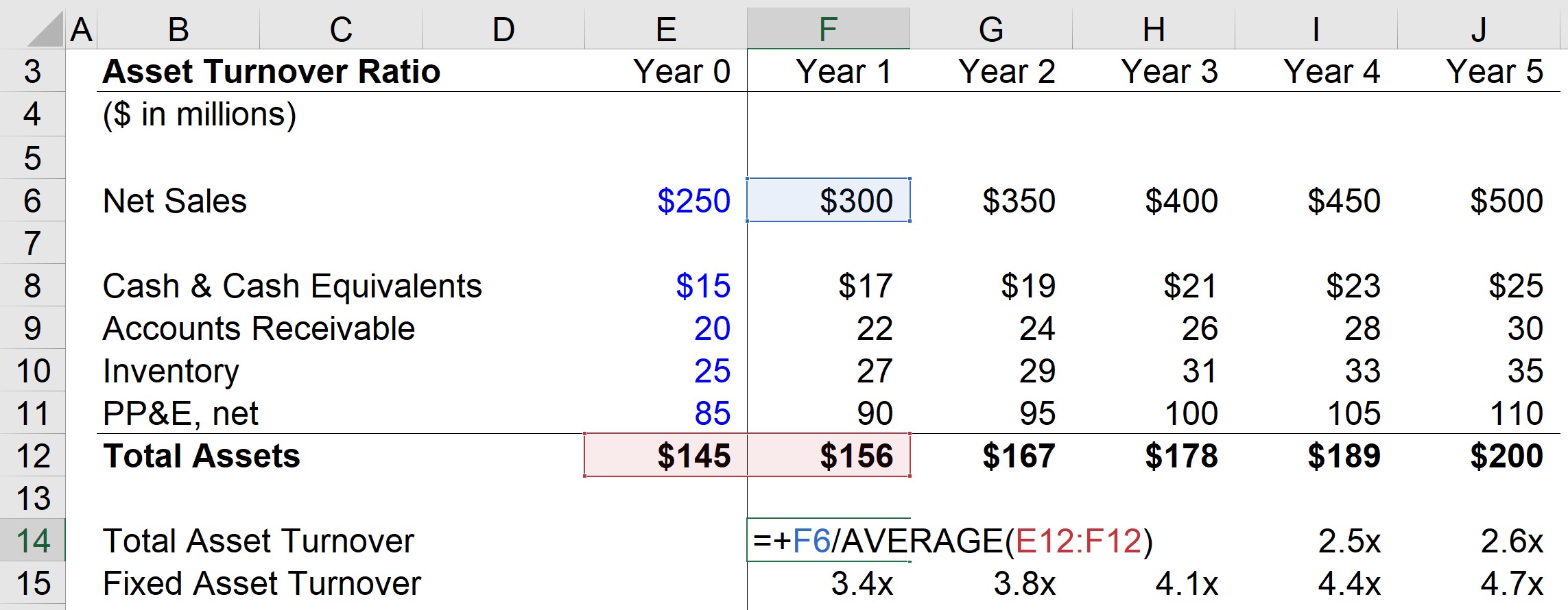

How Do You Calculate the Asset Turnover Ratio?

The asset turnover ratio is an important part of financial analysis and it can be used to measure the efficiency of a company. It measures the total sales generated by a company’s assets over a certain period of time. To calculate the asset turnover ratio, you first need to take the total sales over a period of time and divide it by the total amount of assets the company has. This will give you the asset turnover ratio. The higher the asset turnover ratio, the better it is for the company, as it means that more sales are being generated with the same amount of assets. It is important to note, however, that the asset turnover ratio does not tell the whole story and should be used in conjunction with other financial analysis metrics.

What Is a Good Asset Turnover Ratio?

When it comes to measuring the efficiency of a company’s asset utilization, the Asset Turnover Ratio is one of the best metrics out there. It helps to determine how well a company is using its assets to generate sales. A good Asset Turnover Ratio is one that is above the industry average or benchmark for the sector. Generally, a higher Asset Turnover Ratio indicates that a company is more efficient in its use of assets to generate sales. This can be especially helpful for investors looking to measure a company’s performance and potential for future growth. A great Asset Turnover Ratio can also indicate that a company is well managed, as it can be a sign of strong asset management and efficient operations.

Benefits of Knowing Your Asset Turnover Ratio

Knowing your asset turnover ratio has a ton of benefits, especially when it comes to assessing the success and performance of your business. With the asset turnover ratio, you can measure how efficiently your company is using its assets to generate revenue. This ratio tells you how much revenue you’re generating per dollar of assets and can help you decide if you need to invest more in your assets or if you should scale back. With that said, it’s important to understand your asset turnover ratio in order to make the best decisions for your business. Not only does it help you determine how well you’re generating revenue with the assets you have, but it also helps you understand how it compares to your competitors’ ratios. Knowing this information can help you make informed decisions on how to improve your asset turnover ratio and remain competitive in your industry.

Tips for Improving Your Asset Turnover Ratio

If you’re looking to improve your asset turnover ratio, there are a few easy tips you can follow. Firstly, try to lower your fixed asset base. This means reducing your inventory and equipment, and replacing them with more efficient, cost-effective alternatives. Secondly, streamline your processes – by automating or eliminating unnecessary steps, you can reduce costs and increase production. Finally, focus on increasing your sales – by engaging with customers and offering valuable products, you can increase your sales and generate more revenue. Following these tips can help you to improve your asset turnover ratio and make your business more efficient and profitable.