An asset class is a type of investment that shares similar characteristics and is subject to the same laws and regulations. Asset classes can have different levels of risk and return and can be used to diversify a portfolio. Understanding the different asset classes can help you make informed decisions when it comes to investing your money. In this article, we’ll discuss what an asset class is, the different types of asset classes, and how they can be used to help build and manage a portfolio.

What is Asset Class Investment?

If you’re looking to get into the world of investing, you’ve probably heard the term “asset class” thrown around. An asset class is a group of securities that have similar characteristics and behave similarly in the market. Investing in an asset class means investing in securities that share common characteristics, like stocks, bonds, and cash. Each asset class has different risk and return characteristics, so understanding the differences and how they work can help you decide which asset class is right for you. Investing in an asset class can help diversify your portfolio and reduce risk, as the performance of one asset class may offset the performance of another. Investing in multiple asset classes can also help improve the overall performance of your portfolio. With the right knowledge and strategy, investing in asset classes can be a great way to build wealth and reach your financial goals.

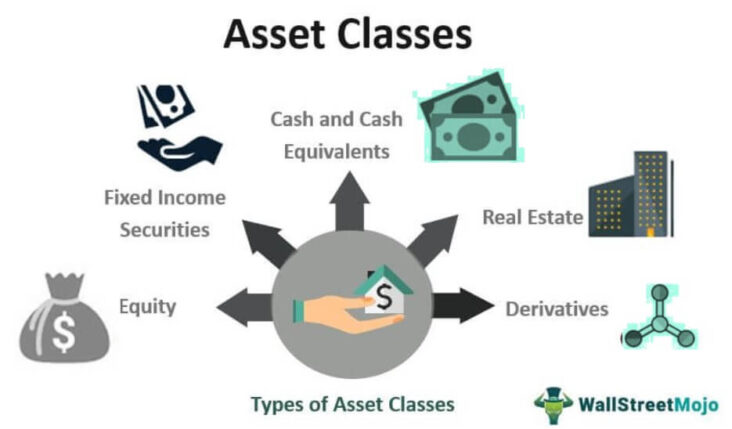

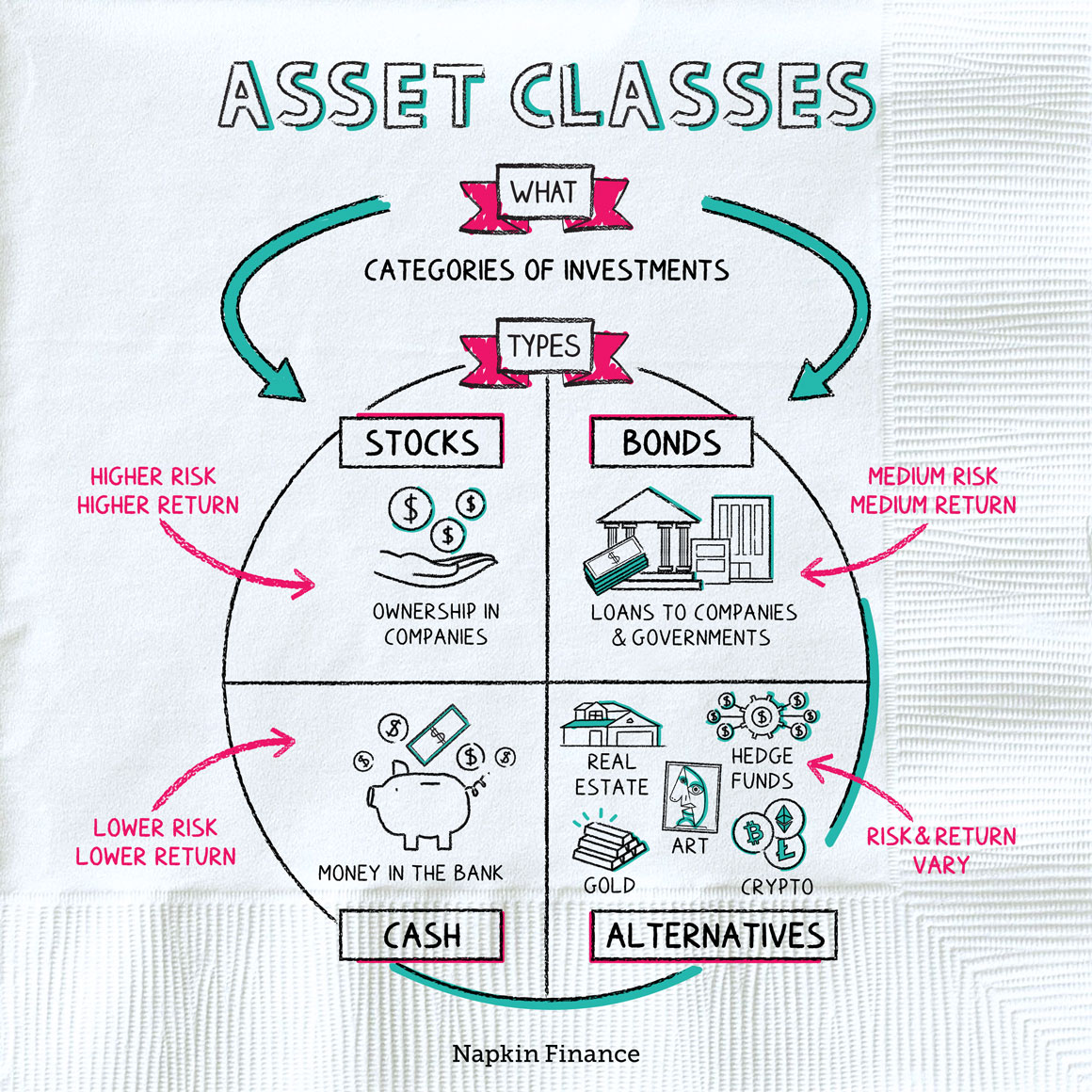

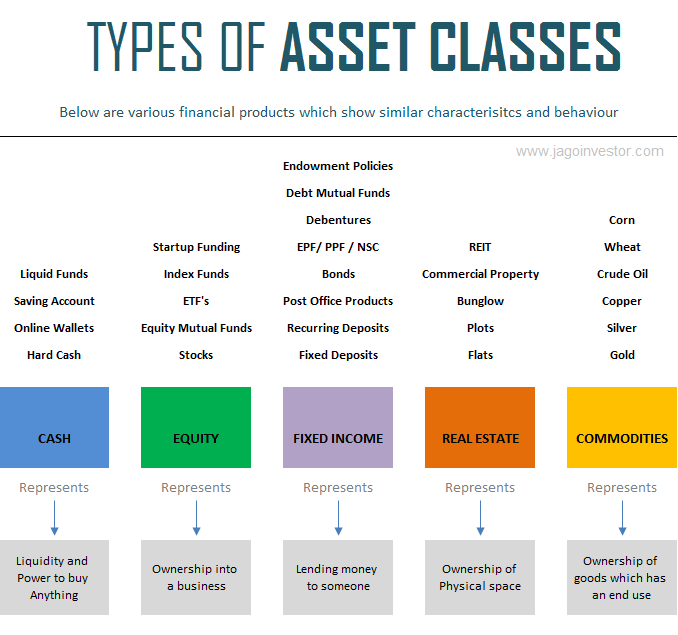

The Different Types of Asset Classes

When it comes to investing, understanding asset classes is essential. Asset classes are categories of investments that have similar characteristics such as risk, return, and liquidity. There are many different types of asset classes, each offering its own set of advantages and disadvantages. Some of the most common asset classes include stocks, bonds, commodities, real estate, and cash equivalents. Stocks are typically the most volatile asset class and offer the highest potential for return but also carry a higher risk of loss. Bonds are typically less risky than stocks, offering a more steady return over time. Commodities are also a more volatile asset class, often used as a hedge against inflation. Real estate is a great long-term investment with the potential of generating rental income, while cash equivalents offer the safety of a low-risk, low-return investment. Knowing the different asset classes available is key to making smart investment decisions.

Advantages of Investing in Asset Classes

Investing in asset classes can be a great way to help diversify your portfolio and take advantage of different types of investments. Asset classes are groups of investments that share similar characteristics and behave similarly in the market. The main asset classes include stocks, bonds, cash, commodities, and real estate. Each asset class has its own unique risks and rewards, so it’s important to consider how each one fits into your overall investment strategy. Investing in multiple asset classes can help reduce your overall risk by spreading it out across different types of investments. Additionally, the different asset classes can provide different returns, helping you to maximize your return on investment. Investing in asset classes can be a great way to build a well-rounded portfolio that takes advantage of different types of investments and diversifies your risk.

Understanding Risk and Return with Asset Classes

When it comes to investing, it’s important to understand the different types of asset classes and the risk and return associated with each. Asset classes are categorized by the type of asset, such as stocks, bonds, cash, commodities, and real estate. Each asset class carries a different level of risk and potential return. Stocks have the potential for higher returns, but also carry higher risk. Bonds have a lower level of risk, but also have lower potential returns. Cash investments are usually the safest, but also have the lowest returns. Commodities and real estate have higher potential returns, but also carry a higher level of risk. Knowing the different asset classes and their associated risks and returns can help you make the best decisions when building your investment portfolio.

Strategies to Maximize Returns with Asset Classes

If you’re looking for ways to maximize your returns with asset classes, there are a few strategies that you can use. One of the most effective is diversification – spreading your investments across different asset classes. This helps to reduce your risk, as different asset classes tend to perform differently in different market conditions. Additionally, it’s important to keep track of how your investments are performing and make sure that you’re taking advantage of any potential opportunities. If you’re able to find investments that offer a higher return than the average for the asset class, then you could potentially make a lot more money. Finally, it’s important to stay informed about the different asset classes and the markets in which they operate, as this can help you make more informed investment decisions. With the right strategies, you can maximize the returns you get from asset classes and reach your financial goals.