Asset-Based Lending is a type of financing that businesses use to access capital quickly, without the need to provide collateral. This financial tool allows businesses to access funds quickly, giving them greater financial flexibility, and allowing them to take advantage of opportunities that may arise. Asset-Based Lending is a great option for businesses that need to access funds but may not have the necessary collateral to secure a traditional loan. This type of lending is a great way for businesses to grow and become financially successful.

Understanding Asset-Based Lending: What It Is and How It Works

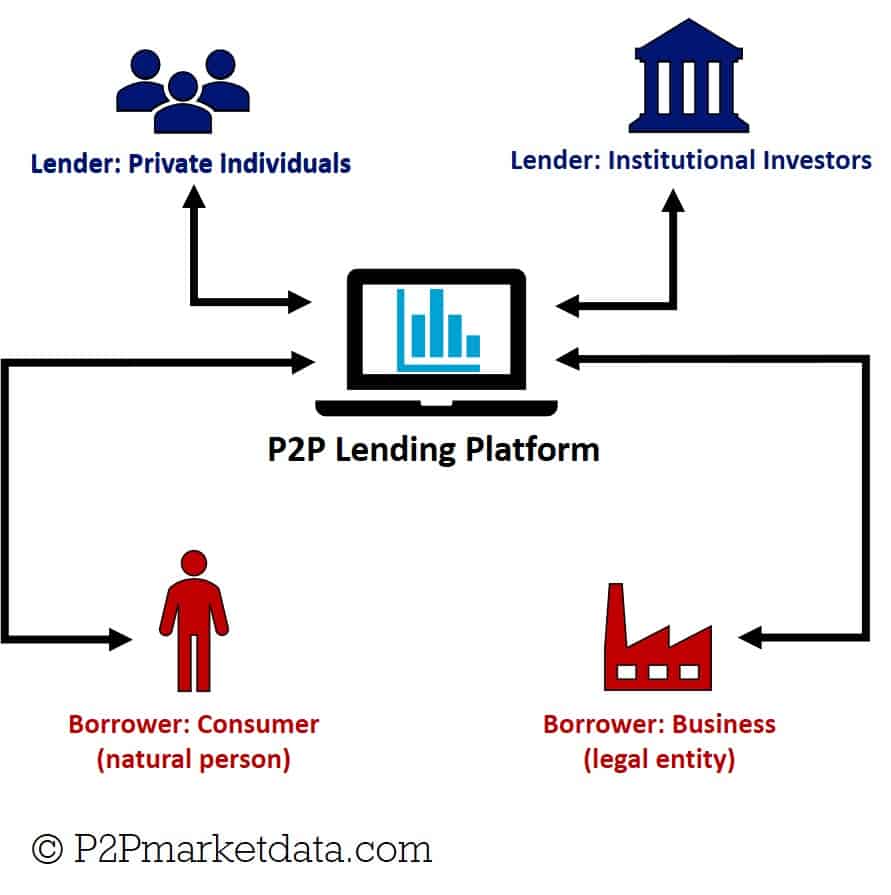

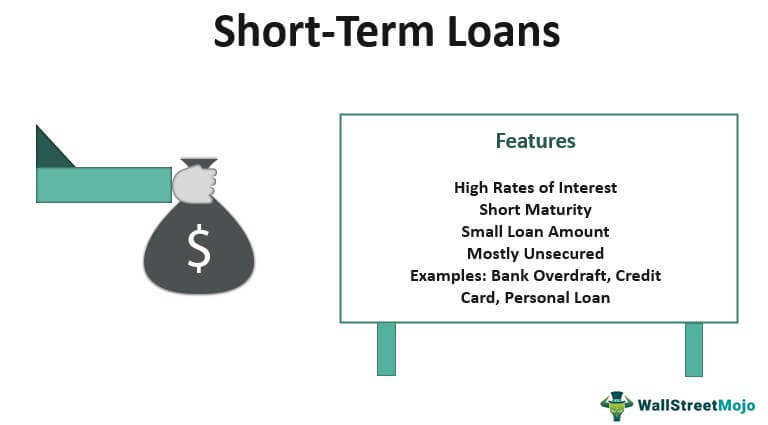

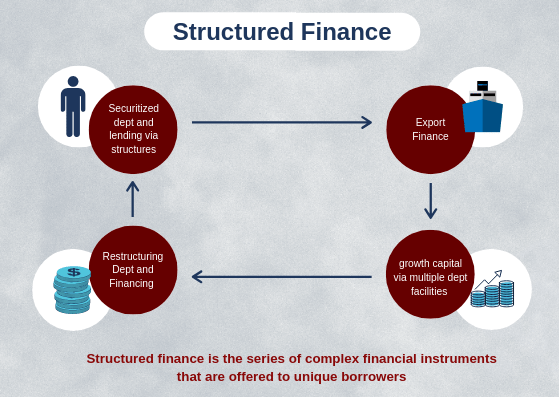

Asset-based lending is a type of financing that uses the value of your assets as collateral for a loan. It’s a great option for business owners who need short-term financing for their operations or investments, but don’t have the cash flow or credit history to qualify for traditional bank loans. Asset-based lending works by allowing you to pledge assets — like equipment, inventory, and real estate — as collateral for the loan. The lender then evaluates the value of the assets and determines how much they’re willing to lend. This type of financing is typically faster and easier to get than other forms of financing, since it doesn’t require a lengthy credit check. Plus, it can provide businesses with the capital they need to get started or grow without taking on additional debt. Asset-based lending is a great option for entrepreneurs and business owners who need cash fast, but don’t want to take on too much risk.

Benefits and Risks of Asset-Based Lending

Asset-based lending is an incredibly helpful tool for businesses looking to secure funding quickly, but there are risks involved that shouldn’t be overlooked. The primary benefit of asset-based lending is that it’s a great way to access capital quickly and without having to meet the stringent criteria that traditional lenders often impose. Additionally, it can give businesses the flexibility to draw down funds in a way that makes sense for their current situation, which can be particularly helpful for businesses that are in a growth or transition phase. On the other hand, it’s important to note that asset-based lending can be expensive and can come with higher interest rates and fees than would be the case with traditional financing. Furthermore, if the borrower fails to repay the loan, the lender is then able to take possession of the assets as collateral, which can lead to financial ruin. Ultimately, it’s essential that businesses weigh the benefits and risks of asset-based lending before taking out a loan.

Using Asset-Based Lending to Access Working Capital

Asset-based lending is a great way to access working capital for your business. This type of lending allows you to use the assets of your business, such as inventory, accounts receivable, and equipment, to secure the loan. It’s a great option for businesses that need quick capital, but don’t have the credit score or cash flow to secure a traditional loan. With asset-based lending, you can get the money you need quickly, without having to worry about your credit score or cash flow. This type of lending makes it easy to access the capital you need to grow your business and increase profits.

Who Is Eligible for Asset-Based Lending?

Asset-based lending is a type of financing that allows businesses to borrow money based on the value of their assets. Businesses who are eligible for asset-based lending include those who have assets such as inventory, accounts receivables, and other collateral that can be used as security. Asset-based lending can provide businesses with access to capital when traditional loans may not be available. This type of financing can help businesses bridge cash flow gaps, fund expansion, acquire new assets, and more. Asset-based lending can be a great way for businesses to get the capital they need to grow and succeed.

Common Misconceptions about Asset-Based Lending

Asset-based lending is often misunderstood, leading to some common misconceptions about the practice. Some people think that asset-based lending is only for start-ups or high-risk businesses, but this isn’t true. Asset-based lending can be a great option for any business that needs access to extra liquidity to grow or take advantage of new opportunities. It’s also not just for businesses with bad credit; even businesses with good credit histories can benefit from asset-based lending. Additionally, many people think that asset-based lending is only for short-term needs, but it can also be used for long-term needs such as funding a capital expansion project. Asset-based lending is a great financial tool that can help businesses of all sizes and credit ratings access the capital they need to reach their goals.