Asset Coverage Ratio is a key financial metric that measures the ability of a company to cover its debt obligations with its assets. It is an important indicator for investors to assess the financial health of a company and its risk of defaulting on its debt. It is also a critical factor for lenders to determine the creditworthiness of a borrower. This article will explain the concept of asset coverage ratio in detail, its importance and how to calculate it.

What Is the Asset Coverage Ratio and How Does It Affect Your Finances?

The asset coverage ratio is an important financial tool that can help you keep track of your financial health. It tells you how much of your assets are covered by your liabilities, giving you an indication of your financial security. This ratio measures the amount of debt you have compared to the amount of assets you have. A higher asset coverage ratio is generally considered to be a good thing, as it means that you have more assets to cover your debts in case of an emergency. On the other hand, a lower asset coverage ratio can be a warning sign that you may not be able to make payments on your debts if something unexpected happens. If you have a high asset coverage ratio, it can be a sign that you are in a good financial position and can continue to make payments on your debts. If you have a low asset coverage ratio, it could be a sign that you should take steps to improve your financial situation. Knowing your asset coverage ratio and how it affects your finances can help you make informed decisions and stay on top of your finances.

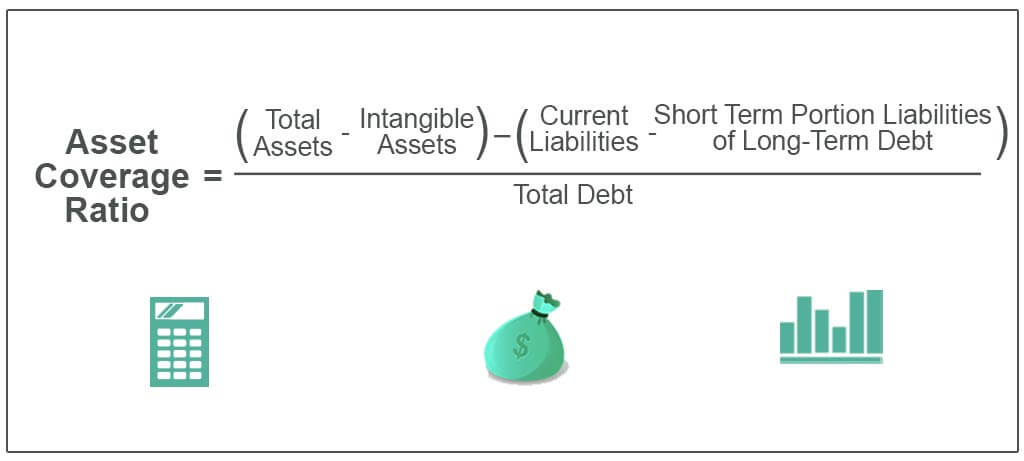

How to Calculate Your Asset Coverage Ratio

Calculating your asset coverage ratio is a great way to assess the health of your personal finances. It’s a simple calculation that can give you a good indication of how much debt you may be able to take on without becoming too leveraged. To calculate your asset coverage ratio, simply divide your total assets by your total liabilities. This will give you the ratio of the total value of your assets over the total value of your liabilities. This ratio can give you an idea of how much debt you can safely take on without becoming too leveraged. It’s important to keep in mind that this ratio is only an estimation and so it should not be taken as a guarantee. However, it can be a useful tool to help you make decisions about your personal finances.

Reasons Why Your Asset Coverage Ratio Matters

When it comes to understanding the importance of your asset coverage ratio, it’s important to know that it can be a major factor in determining your financial health. Your asset coverage ratio measures the amount of assets you have relative to your liabilities. In other words, it’s a way of measuring how much you have invested in assets to cover your debts. By understanding your asset coverage ratio, you can get an idea of whether you have enough assets to cover your liabilities if you ever needed to. Knowing your asset coverage ratio can help you determine if you have enough assets to cover your debts if the worst ever happened. It can also help you determine whether or not you need to make more investments in order to increase your asset coverage. A higher asset coverage ratio can help you secure better loan terms, as lenders will know that you have the resources to pay them back if necessary. It’s important to keep your asset coverage ratio in mind when making financial decisions, as it can have a significant impact on your overall financial health.

Strategies for Improving Your Asset Coverage Ratio

If you want to improve your asset coverage ratio, there are a few strategies you can implement. First, try to reduce your debt-to-asset ratio. This can be done by paying off debt or increasing your assets. Another option is to increase your earnings by investing in high-yield assets or taking on additional employment. Finally, you can increase your total assets by investing in new projects or expanding your business. By employing these strategies, you can make sure your asset coverage ratio is as strong as possible.

Common Mistakes to Avoid When Calculating Your Asset Coverage Ratio

When calculating your Asset Coverage Ratio, it’s really important to make sure you’re being accurate. Common mistakes to avoid include not properly accounting for debt or liabilities, not taking into account the value of assets, or just simply miscalculating the ratio. It’s also important to make sure you’re looking at the right type of assets for the ratio you’re trying to calculate. For instance, if you’re calculating a ratio for a real estate investment, you’ll need to consider the value of the land and buildings in your calculations. It’s also important to make sure you’re not double counting any assets or liabilities, as this could throw off your ratio. Lastly, be sure to factor in all potential investments, so you can get the most accurate picture of your asset coverage. Taking the time to get your asset coverage ratio right is a key step in making sure your investments are safe and secure.