Asset financing is a type of financial solution that allows businesses to acquire physical assets such as equipment, machinery, and vehicles without having to use cash. It is a great tool for businesses to use in order to increase their purchasing power, improve their cash flow, and manage their capital. Asset financing is a great way for businesses to acquire the necessary assets while maintaining their liquidity and financial flexibility. With asset financing, businesses can quickly acquire the assets they need to grow and expand their operations, without having to make a significant upfront investment.

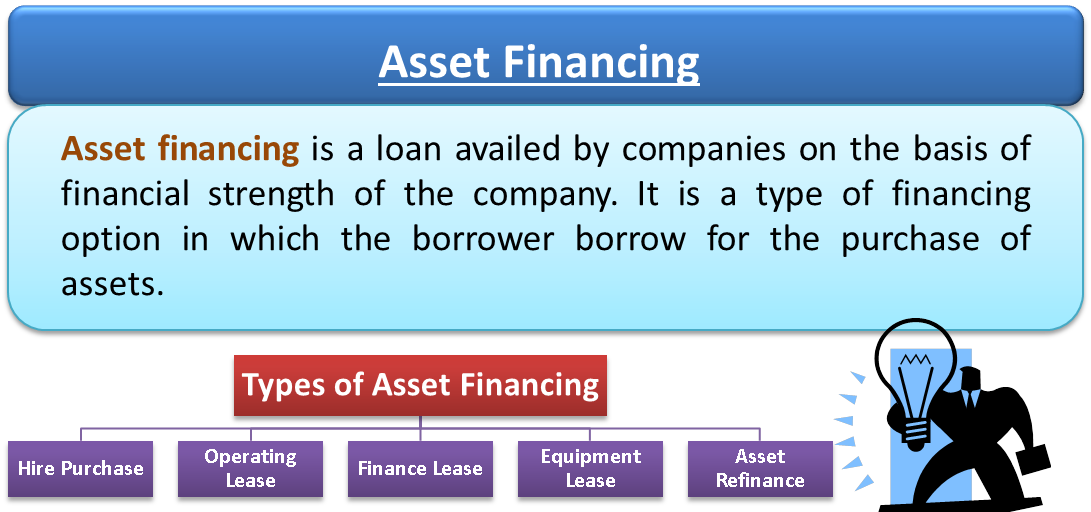

What is Asset Financing and How Does it Work?

Asset financing is an awesome way to get the stuff you need without having to break the bank. It’s a type of financing that allows you to acquire assets like equipment, vehicles, or real estate that you can use in your business, without having to pay for it upfront. It works by allowing you to use the asset as collateral to secure a loan from a lender. The lender then pays for the asset on your behalf and you repay the loan with interest over a set period of time. This way, you can get what you need now, without having to worry about coming up with a large sum of money all at once. Plus, you can typically get better terms and rates with asset financing than you would with other forms of financing. It’s the perfect way to make sure you have the resources needed to grow your business without putting too much strain on your finances.

Understanding the Benefits of Asset Financing

Asset financing is a great way to get the money you need to purchase a new asset without having to take out a loan. With asset financing, you can use the asset itself as collateral, allowing you to get the funds you need without having to put up any other collateral. This makes it a great option for those who don’t have access to traditional financing or have bad credit. Asset financing also provides a number of other benefits that can make it a great choice for businesses. For example, asset financing can help businesses save on taxes since the asset itself is used as collateral, meaning the business won’t have to pay interest on the loan. Additionally, asset financing can offer businesses the flexibility to purchase assets in installments or pay them off early without penalty, making it a great way to manage cash flow. It can also be used to purchase bigger, more expensive assets that may be too expensive for a business to purchase outright, giving them access to the resources they need to succeed. Ultimately, asset financing can be a great option for businesses that need to purchase new assets, but don’t have the access to traditional financing.

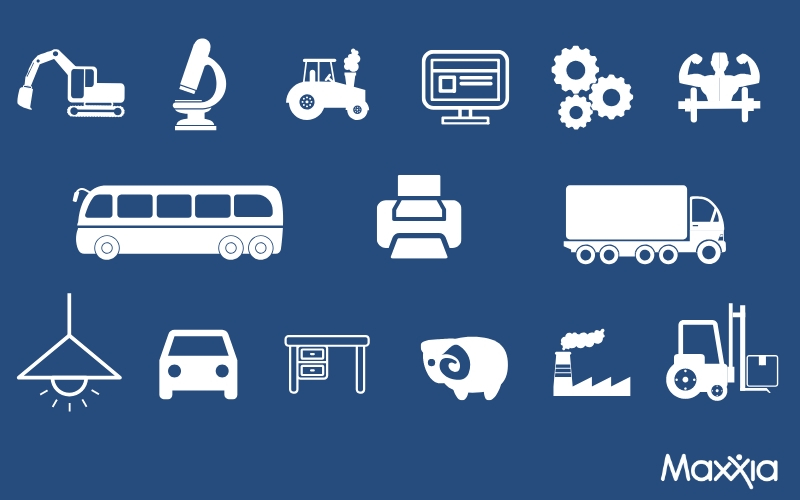

The Types of Assets That Can Be Financed

Asset financing is a great way to get the funds you need to expand your business or make a large purchase. There are many types of assets that can be financed, such as real estate, vehicles, inventory, and equipment. Real estate financing is common for purchasing or leasing land or commercial buildings. Vehicle financing is a great option for those who need to purchase a new or used car, truck, or van. Inventory financing is great for stocking up on merchandise or raw materials. Finally, equipment financing is great for purchasing heavy machinery or other large pieces of equipment. No matter what type of asset you’re looking to finance, there is a financial solution that can help make it happen.

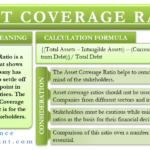

Factors to Consider Before Committing to Asset Financing

When it comes to asset financing, there are a few important factors to consider before committing. Firstly, it’s important to understand what asset financing is and how it works. Asset financing is a type of loan that allows you to acquire or lease assets without having to use your own capital. Secondly, you should consider the cost of acquiring or leasing the asset. This can include the cost of the asset itself, as well as any interest or fees associated with the financing. Additionally, you should consider the repayment terms and the length of the loan. Lastly, you should also consider how the asset will be used, as this can affect the financing process. By taking all of these factors into consideration, you can ensure that you make the best decision possible when it comes to asset financing.

Avoiding Common Pitfalls When Engaging in Asset Financing

Avoiding common pitfalls when engaging in asset financing is key to making sure that the process is smooth and successful. Many people get into asset financing without understanding the risks and rewards, which can lead to very costly mistakes. When entering into asset financing, make sure you have done your research and know what you’re getting yourself into. Knowledge is power and having a good understanding of the process can help you make the right decisions. Additionally, make sure you’re working with a trusted and experienced lender who will be able to provide you with the best possible deals and terms. Finally, be sure to consider the total cost of your asset financing, including any fees and interest rates, to make sure it’s a viable option for you.