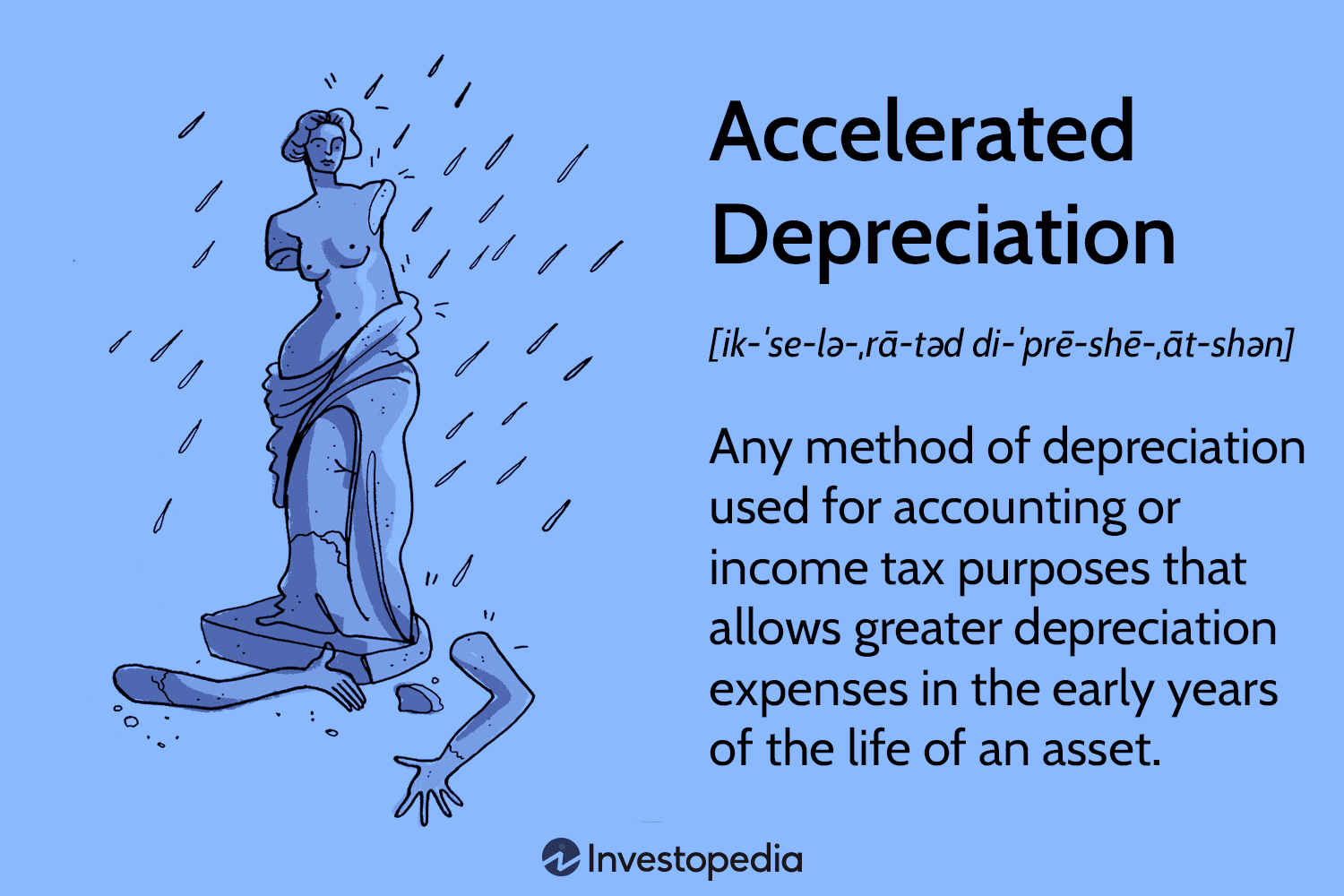

If you’re a business owner, it’s likely that you’ve heard of accelerated depreciation. But what exactly is it?

In simple terms, accelerated depreciation is a method of depreciating assets that allows businesses to write off the cost of an asset over a shorter period of time than under traditional methods.

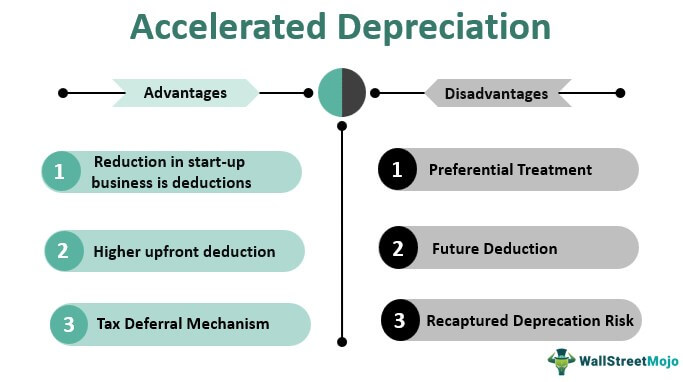

There are several reasons why a business might choose to use accelerated depreciation methods. In some cases, it may be for tax purposes – businesses can claim larger deductions in the early years of an asset’s life, when the asset is typically worth more.

Other times, businesses may use accelerated depreciation because it matches the pattern of usage or revenue generation for the asset. For example, if an asset is expected to generate revenue for only a few years before it needs to be replaced, businesses may choose to depreciate the asset more quickly so that the deductions match the revenue stream.

Introduction to Accelerated Depreciation

Accelerated depreciation is a method of depreciation in which larger amounts of depreciation are taken in the early years of an asset’s life, with the goal of matching the timing of the recognition of the asset’s costs with the revenue generated by its use.

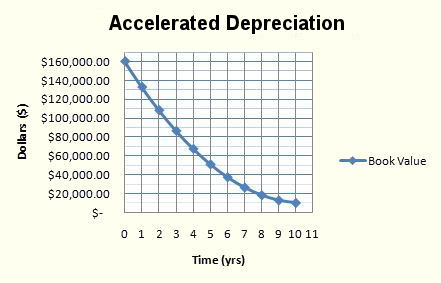

The most common form of accelerated depreciation is the double declining balance method, which doubles the straight-line rate of depreciation in each year. This results in a front-loaded schedule of depreciation, with a larger deduction in the early years and smaller deductions in later years.

There are several reasons why a business might choose to use accelerated depreciation. One reason is that it can provide a tax advantage, since accelerated depreciation results in a higher deduction in the early years when a business is likely to be in a higher tax bracket. Additionally, using accelerated depreciation can help to match the timing of income and expenses, which can be helpful for businesses that have uneven cash flow or that plan to sell the asset before it has reached the end of its useful life.

Another advantage of accelerated depreciation is that it can result in lower overall depreciation expense over the life of an asset. This is because accelerated methods generally result in shorter lives being used for depreciable assets. For example, if an asset is expected to last 10 years and is depreciated using straight-line methods, the total amount of depreciation expense would be 10% per year. However, if the same asset were depreciated using double declining balance methods, the total amount of

What Is the Cost of an Accelerated Depreciation Asset?

Assuming an accelerated depreciation asset is one that is eligible for the faster tax write-off, the cost of such an asset can vary. The basis for the cost of the asset is its purchase price, which is then reduced by any salvage value and any trade-in value of the old asset. The resulting net purchase price is multiplied by the Accelerated Depreciation Rate to get the first year’s depreciation expense. This income tax deduction reduces the taxable income of the business and, thereby, its taxes payable.

Types of Assets that Qualify for Accelerated Depreciation

There are several different types of assets that may qualify for accelerated depreciation. These include:

1. Business Equipment: This can include machinery, vehicles, computers, and other types of equipment used in a business setting.

2. Real Estate: Commercial and industrial buildings may be eligible for accelerated depreciation.

3. Intellectual Property: This can include copyrights, patents, and trademarks.

4. Natural Resources: Oil and gas wells, mines, and other natural resources may be eligible for accelerated depreciation.

When Should You Use Accelerated Depreciation?

You should use accelerated depreciation when you want to depreciate an asset faster than its normal rate. This could be for tax purposes or because you need the cash sooner. There are a few different methods of accelerated depreciation, so you’ll need to choose the one that best suits your needs.

What Is Accelerated Depreciation? – Accelerated Depreciation Financial Definition

Accelerated depreciation is a technique used to depreciate assets at a faster rate than under traditional depreciation methods. The accelerated depreciation financial definition generally refers to one of two types of accelerated depreciation: the double declining balance method or the 150% declining balance method.

The double declining balance method takes the original cost of the asset and multiplies it by a depreciation rate, which is typically twice the straight-line rate. For example, if an asset has a 10-year life and is being depreciated using the double declining balance method, its depreciation expense in Year 1 would be 20% (2 x 10%).

The 150% declining balance method is similar to the double declining balance method, but with a higher depreciation rate. The 150% declining balance method takes the original cost of the asset and multiplies it by 1.5. For example, if an asset has a 10-year life and is being depreciated using the 150% declining balance method, its depreciation expense in Year 1 would be 15% (1.5 x 10%).

While accelerated depreciation can result in higher tax deductions in the early years of an asset’s life, it also results in lower deductions in later years. As a result, accelerated depreciation is generally only used for tax purposes; it is not typically used for financial reporting purposes.