The Aroon Indicator is an invaluable tool for investors to use when analyzing stock trends and making investment decisions. The indicator was developed by Tushar Chande in 1995 and is used to measure the strength of a trend and the potential for its continuation. It works by measuring the direction and length of a trend and then creating a graph to visualize the data. By examining the graph, investors can determine whether a trend is likely to continue or is weakening and will soon reverse. With this information, investors can make more educated decisions about their portfolio.

Understanding the Aroon Indicator: What It Is and How It Works

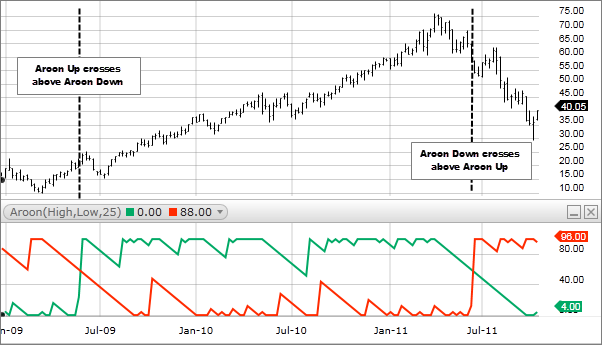

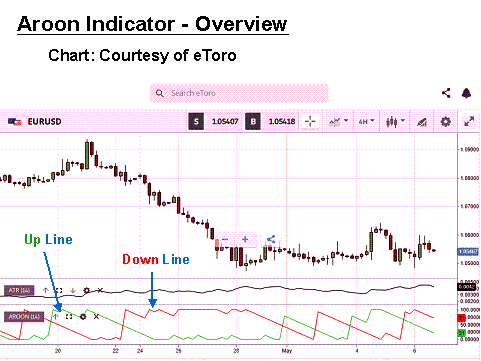

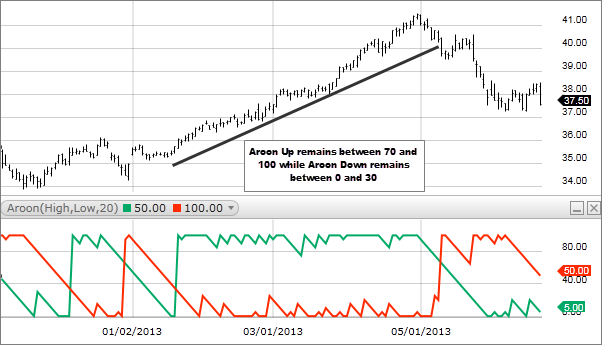

The Aroon Indicator is a widely used technical analysis tool that helps investors determine the trend and strength of a security’s price. It is a momentum-based oscillator that uses two lines to measure the time between highs and lows over a given period. The Aroon Up line measures the amount of time it takes for a security to hit its highest price since the beginning of the period, while the Aroon Down line measures the amount of time it takes for a security to hit its lowest price since the beginning of the period. Aroon Indicator helps investors identify the start of a new trend and the strength of a trend. A high Aroon Up line indicates a strong uptrend, while a low Aroon Down line indicates a strong downtrend. If both lines are at the same level, it may indicate a sideways trend. Knowing when a trend is starting or ending can help investors make informed decisions about when to buy and sell a security. Aroon Indicator also helps investors identify potential reversal points and can be used to confirm other technical analysis tools.

Applying the Aroon Indicator to Your Trading Strategies

Applying the Aroon Indicator to your trading strategies is a great way to get a better understanding of the current market trend. By analyzing the Aroon Up and Aroon Down periods, you can identify potential entry and exit points with greater accuracy. The Aroon Indicator can also be used to confirm the strength of a trend, and help you decide when to enter or exit a trade. By combining the Aroon Indicator with other technical indicators, you can further refine your trading strategies and increase the chances of success. With the right knowledge and practice, you can use the Aroon Indicator to your advantage and become a more successful trader.

Analyzing the Aroon Indicator: Different Methods and Interpretations

The Aroon Indicator is a great tool for traders looking to get a better handle on their market analysis. This indicator gives traders insight into the trend direction, momentum, and even time frames associated with the stock or other asset being traded. Aroon is a great tool for traders looking to stay ahead of the market and make more informed decisions. Different methods and interpretations can be used to analyze the Aroon indicator, such as Aroon Up/Down, Aroon Oscillator, and Aroon Convergence/Divergence. Each of these methods can provide traders with valuable insight into potential trends and entry/exit points. Understanding how to interpret and use the Aroon indicator can help traders make more informed decisions and better capitalize on market opportunities.

Benefits of the Aroon Indicator: Why Every Trader Should Use It

The Aroon Indicator is an incredibly useful tool for traders, as it helps identify trend reversals and direction. It’s a great tool for both novice and experienced traders, as it allows for easy assessment of any given security’s current trend. Additionally, the Aroon Indicator can be used to help identify the strength of a trend, as well as the potential for a continuation or reversal. Because the Aroon Indicator can detect trend reversals before they happen, it can help traders make informed decisions and avoid costly mistakes. It’s also incredibly easy to use and understand, which makes it a great choice for traders of all levels. Furthermore, the Aroon Indicator is incredibly affordable, making it an attractive option for traders who are on a budget. If you’re looking to improve the accuracy of your trading decisions, the Aroon Indicator is certainly worth considering.

Common Mistakes to Avoid When Using the Aroon Indicator

When it comes to using the Aroon Indicator, it’s important to avoid some common mistakes. One of the biggest mistakes traders make with this indicator is relying on it too heavily. It’s important to remember that the Aroon Indicator is just one tool in your trading arsenal and should not be used as the sole determinant of when to enter or exit a trade. Additionally, be sure to use the indicator in conjunction with other technical analysis tools like price charts and moving averages to get a more accurate picture of the market. Finally, make sure you’re aware of the Aroon Indicator’s limitations and don’t put too much faith in it. It’s a helpful tool, but it won’t guarantee you success. Pay attention to the other indicators out there, too!