The Arms Index, more commonly referred to as TRIN, is a technical analysis tool used to measure the trading volume and price movement of a stock or the entire stock market. TRIN helps traders understand the underlying supply and demand dynamics of the stock market and can be used to determine whether a stock is overbought or oversold. By understanding how TRIN works, traders can benefit from its insights to make more informed trading decisions.

Overview of Arms Index (TRIN)

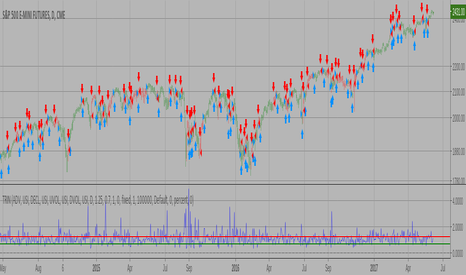

The Arms Index, also known as the TRIN, is a technical analysis tool used to measure the market’s breadth and momentum. It was created by Richard Arms in 1967 and is calculated by dividing the number of stocks advancing by the number of stocks declining, and then dividing that number by the total volume of stocks. The TRIN will usually range between 0.5 and 2.0. If the TRIN is above 1.0, it suggests that more stocks are declining than advancing and bearish sentiment is present in the market. Conversely, if the TRIN is below 1.0, it indicates that the market is showing bullish sentiment with more stocks advancing than declining. The Arms Index is an important tool for traders, as it can help them identify market trends and gauge market sentiment.

Uses of Arms Index (TRIN)

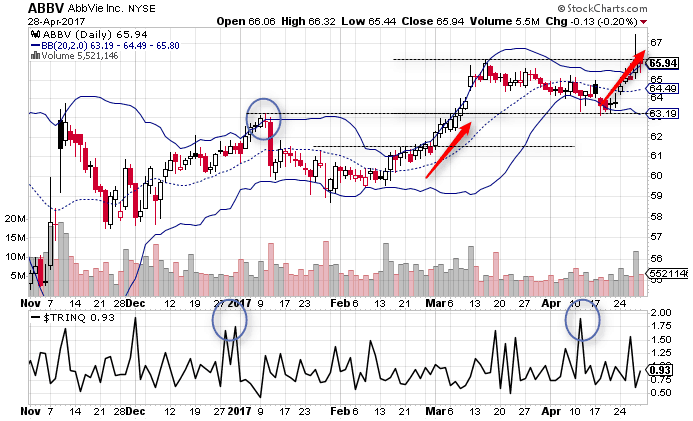

Arms Index (TRIN) is an incredibly useful tool for traders to keep track of the markets. It’s a technical indicator that is used to measure the relative strength of the stock market. It’s calculated from the ratio of advancing and declining stocks, and volume of advancing and declining stocks. This helps traders to identify when a stock or index is overbought or oversold. It can also be used to determine the overall sentiment of the market. By looking at the Arms Index (TRIN), traders can get an idea of whether the market is bullish or bearish, or if there is any potential for a reversal. This tool can also be used to identify buying or selling opportunities in the market. The Arms Index (TRIN) is a great indicator for traders to use to get a better understanding of the markets and to make informed trading decisions.

Calculating Arms Index (TRIN)

The Arms Index (TRIN) is a technical analysis tool that helps traders identify whether a market is in a state of overbought or oversold conditions. It is calculated by comparing the number of advancing stocks to the number of declining stocks, and then dividing the result by the total volume of the advancing stocks. This ratio helps investors track the market and make informed trading decisions. With the Arms Index (TRIN), traders can better understand the market’s sentiment and determine if a particular security is overbought or oversold. This can help them make profitable trades and protect against potential losses. The Arms Index (TRIN) is a great tool for investors who want to stay informed about the state of the markets.

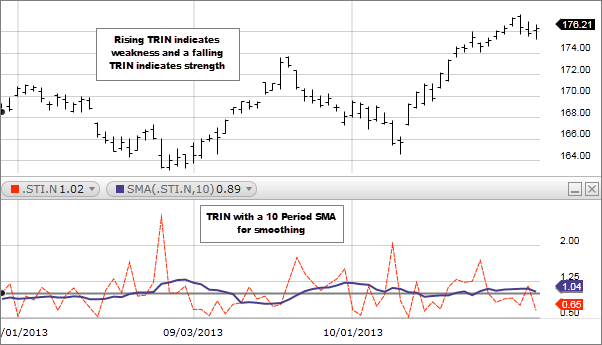

Interpreting Arms Index (TRIN)

Interpreting Arms Index (TRIN) is an important factor when it comes to understanding the stock market. TRIN, or Arms Index, is a market indicator used to measure the overall market breadth. It takes into account the volume of stocks that are advancing and declining, relative to the total volume traded. By looking at this information, traders can identify potential trends in the market. The higher the Arms Index, the more bearish the market is, while the lower the index, the more bullish the market is. Understanding the Arms Index is key to making smart investments, as it can give traders an idea of the overall market sentiment. A rising Arms Index indicates that the market is overbought, while a declining Arms Index indicates the market is oversold. With this knowledge, investors can make informed decisions about their investments and time their trades accordingly.

Benefits of Using Arms Index (TRIN)

Using the Arms Index (TRIN) can be a great way to get an informed perspective of the stock market. The TRIN is a technical indicator that helps traders identify overbought and oversold markets. It calculates the ratio of advancing issues to declining issues and the ratio of volume of advancing issues to declining issues. By analyzing the TRIN, traders can gain insight into the market sentiment, identify market trends, and time their trades accordingly. The TRIN is an incredibly useful tool for traders, as it can provide valuable insight into the overall sentiment of the stock market and help traders make informed decisions. It allows traders to assess the strength of a trend and can be used to identify potential entry and exit points. The Arms Index is a versatile tool that can be used by both novice and experienced traders, making it a great tool for any investor.