The Aroon Oscillator is a technical analysis tool used to determine the strength of a trend in a given security. It was developed by Tushar Chande and is based on Aroon Indicator, which was designed to measure the strength of a trend and provide insight into the trend’s potential duration. The Aroon Oscillator can help traders identify trend reversal points, gauge the strength of a trend, and identify price tops and bottoms. This article will provide an overview of the Aroon Oscillator and its usage in financial markets.

Overview of the Aroon Oscillator and How It Works

The Aroon Oscillator is an important technical analysis tool used to gauge the strength of a trend. It’s a great way to identify potential breakouts or reversals in the market. The Aroon Oscillator was developed by Tushar Chande in 1995 and is based on Aroon Indicator. The indicator consists of two lines that measure the number of days since the highest and lowest prices were reached. By comparing the two lines, you can identify whether the asset is in an uptrend or downtrend. The Aroon Oscillator is an easy-to-use technical analysis tool that can help you make better trading decisions. It can help you identify potential breakouts or reversals in the market. If you’re looking for a way to make more informed decisions when trading, the Aroon Oscillator is a great tool to add to your arsenal.

Advantages and Disadvantages of Aroon Oscillator

The Aroon Oscillator is a technical indicator used by traders to measure the strength of a trend. The oscillator helps traders identify potential trend reversals and trend continuation. The advantage of the Aroon Oscillator is that it is relatively simple to use and understand, so even novice traders can easily pick up on its signals. The oscillator also provides an insight into market sentiment, which can help traders make better-informed decisions about when to enter and exit trades.On the other hand, the Aroon Oscillator is not without its disadvantages. First, it is only effective in markets that have a clearly defined trend, so it may not be suitable for traders who trade in markets with less predictable trends. Furthermore, the indicator can give false signals during periods of low volatility, so traders must be aware of this before relying solely on the Aroon Oscillator to make trading decisions.Overall, the Aroon Oscillator can be a useful tool for traders looking for an easy-to-use indicator for identifying potential trends and reversals in the markets. However, traders should be aware of the risks associated with the indicator, such as false signals during periods of low volatility, before making trading decisions based on

How to Interpret Signals from the Aroon Oscillator

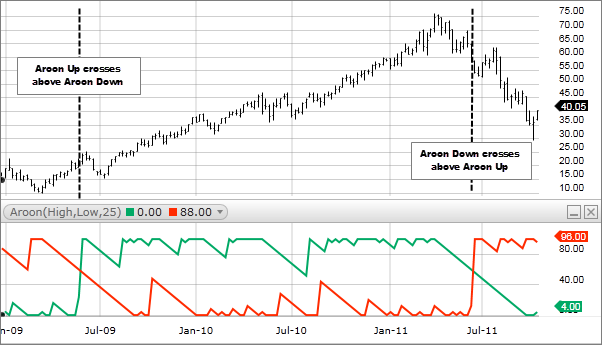

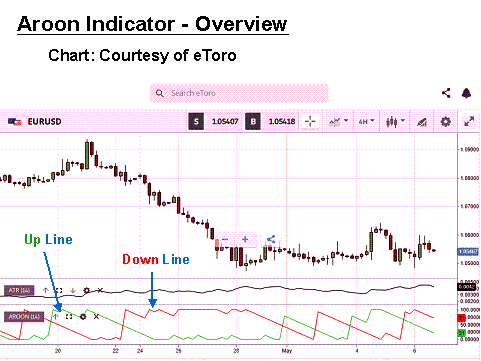

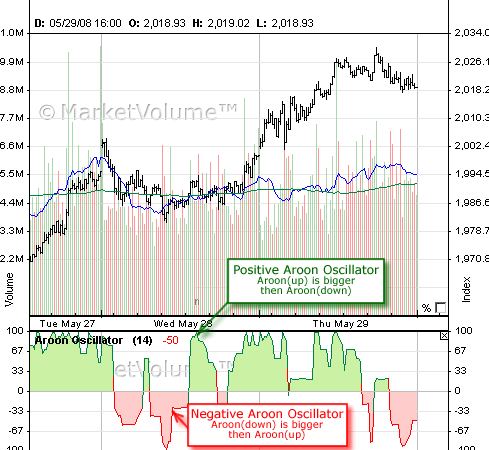

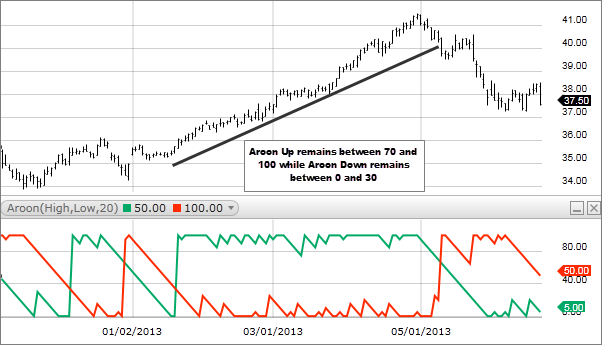

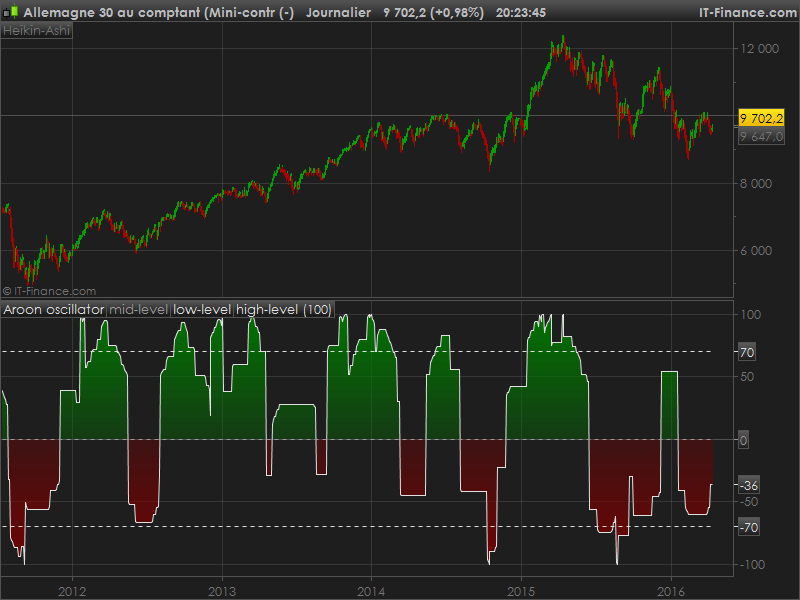

Interpreting signals from the Aroon Oscillator can be a powerful tool when used correctly. The Aroon Oscillator is composed of two lines – Aroon Up and Aroon Down. When the Aroon Up line is above the Aroon Down line, this usually indicates the presence of an uptrend, while if the Aroon Down line is above the Aroon Up line, this usually indicates the presence of a downtrend. The Aroon Oscillator can also be used to detect potential trend reversals. When the Aroon Up and Aroon Down lines cross, this can indicate a potential reversal of the current trend. Additionally, when the Aroon Up line falls below the Aroon Down line, this can indicate that a downtrend is beginning, while if the Aroon Down line falls below the Aroon Up line, this can indicate that an uptrend is beginning. By interpreting these signals correctly, traders can gain an edge in the market and increase their chances of success.

Practical Applications of Aroon Oscillator in Financial Trading

The Aroon Oscillator is an incredibly helpful tool for financial trading. It gives traders an easy way to identify potential trends in the markets. It can be used to identify when a trend is beginning, or when it is ending. The Aroon Oscillator works by measuring the amount of time it takes for the price of an asset to reach a new high or low. The indicator compares the highs and lows over a given period of time and creates an oscillating graph. When the graph is trending upwards, it indicates that an uptrend is in progress. Conversely, when the graph is trending downwards, it indicates that a downtrend is in progress. By analyzing the Aroon Oscillator, traders can make informed decisions about when to enter or exit a trade. This makes it a great tool for both short-term and long-term traders.

How to Use Aroon Oscillator as Part of a Comprehensive Trading Strategy

Using the Aroon Oscillator as part of a comprehensive trading strategy can be a great way to stay ahead in the markets. This technical indicator is a momentum indicator that helps traders identify the trend direction and strength of a given security. It can be used to gauge the strength of a given trend, as well as to detect potential trend reversals. By combining the Aroon Oscillator with other indicators and strategies, you can create a more comprehensive approach to trading and increase your odds of success. For example, by combining the Aroon Oscillator with trend-following indicators, such as moving averages, you can create a strategy that allows you to stay in the trend for longer and potentially increase your profits. Additionally, by using the oscillator to spot potential reversals, you can exit a position before it turns against you, reducing your risk exposure. All in all, the Aroon Oscillator can be a great tool for traders looking to increase their trading success.