Arbitrage Pricing Theory (APT) is a powerful and widely-used economic concept that has the potential to help investors make better informed decisions when it comes to investing. APT is a theory of asset pricing that suggests that the expected return of a security is determined by the relative pricing of unrelated assets. It also provides investors with a tool to evaluate the risk and return of an investment, allowing them to make informed decisions based on their own risk tolerance. By taking into account the relative pricing of assets, investors can use APT to maximize their profits and minimize their risk.

Overview of Arbitrage Pricing Theory (APT): What It Is and How It Works

Arbitrage Pricing Theory (APT) is an important economic concept that can help investors make smarter decisions with their money. APT is a theory that uses a variety of factors to analyze the value of an asset. It takes into account a variety of risk factors and market conditions to determine the expected return of an asset. By taking a more comprehensive approach to analyzing the value of an asset, investors can make better-informed decisions about when to buy or sell and how to allocate their resources. APT is a useful tool for predicting the expected return on an asset and can help investors make more informed decisions about their investments.

How APT Differs from Traditional Pricing Theory

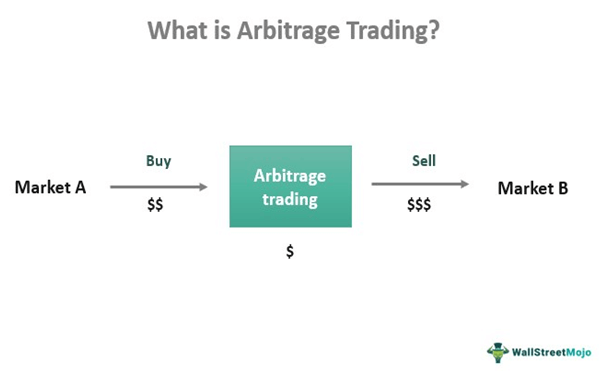

APT is a modern financial pricing theory that is different from traditional pricing models. It uses macroeconomic factors to determine the expected returns of a security. Unlike traditional models, APT takes into account the effects of changes in macroeconomic variables on the pricing of securities. It is based on the idea that the price of a security is determined by the supply and demand of that security in the marketplace. It also assumes that investors will take advantage of any mispricing in the security by buying it for less than its true value and selling it for more. This is known as the “arbitrage opportunity”. APT is an important tool for investors and analysts as it helps them to better understand the impact of macroeconomic variables on the pricing of different securities.

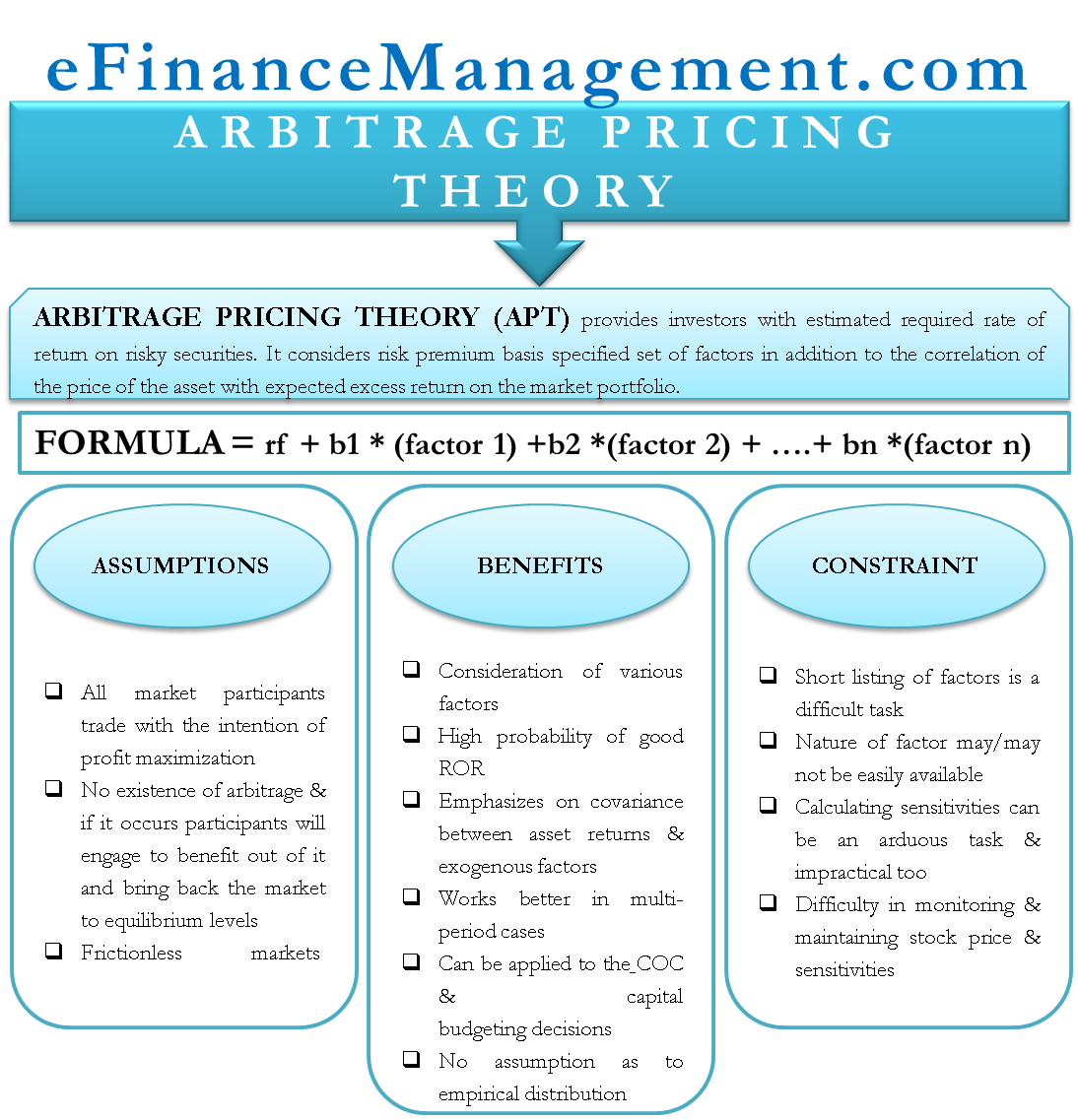

Benefits of APT: Advantages and Disadvantages

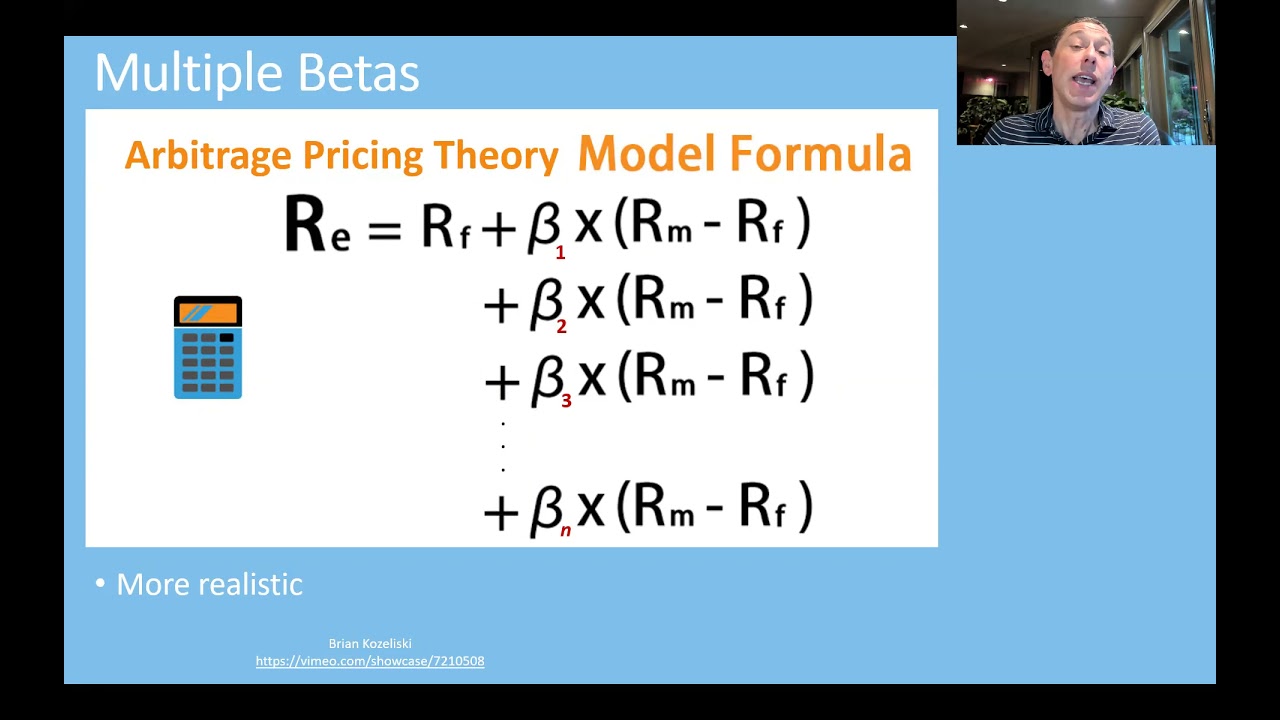

Arbitrage Pricing Theory (APT) is a tool used by investors and financial analysts to help them evaluate the risk and return associated with investments. The APT uses a combination of factors to determine the expected return on an investment, including market risk factors, industry risk factors, and company specific risk factors. The benefits of the APT include its ability to take into account multiple risk factors, which can help investors make more informed decisions about their investments. However, the APT does have some disadvantages, such as its complexity and the difficulty in finding reliable data for its components. Despite these drawbacks, the APT is still a useful tool for investors and financial analysts to evaluate the risk and return associated with investments.

Real-Life Examples of APT in Action

APT is one of the most popular theories when it comes to financial markets. It is used to help investors make decisions about where to invest their money. In a nutshell, APT predicts the future value of assets based on the current market conditions and the expected returns from the asset. Real-life examples of APT in action are seen in the stock market. When an investor believes that a certain stock is going to appreciate in value, they can use APT to identify the factors that will lead to the increase in share price. For instance, if the company is expected to have a strong earnings report, then the stock price will likely go up. The investor can use APT to determine how much of an impact the earnings report will have on the stock price and if it is worth investing in. Additionally, APT can help investors identify stocks that are undervalued and those that are overvalued. This allows them to make more informed decisions about which stocks to buy and sell.

Strategies for Implementing APT in Your Business

If you’re looking for a way to maximize your profits in the stock market, you should consider implementing Arbitrage Pricing Theory (APT) in your business. APT is an investment strategy that uses multiple factors to identify pricing discrepancies in the stock market and take advantage of them to make a profit. By utilizing APT, you can reduce your risk while maximizing your return on investment. Implementing APT in your business can be a bit tricky, however. Here are a few strategies you can use to ensure you’re using APT correctly and effectively:1. Utilize multiple sources of information. One of the most important things when using APT is to be informed. You should use multiple sources of information such as financial statements, news stories, and industry reports to identify potential pricing discrepancies.2. Keep an eye on the market. You should also be continually monitoring the stock market for any changes that may affect the pricing of a stock. This will help you make more informed decisions when utilizing APT.3. Develop a trading plan. Lastly, it’s important to have a plan when it comes to trading. You should develop a trading plan that outlines when you plan to buy and sell stocks to take advantage of any potential pricing