Arbitrage is a powerful financial tool that can help investors maximize their returns by taking advantage of price discrepancies in different markets. It involves buying and selling a security or asset at the same time, typically in different markets, to take advantage of a price difference between the two. This strategy can be used to generate profits without taking on additional risk. It is important to note that arbitrage can be a complex and time-sensitive process since prices can change quickly. In this article, we will explore the concept of arbitrage in greater detail and explain the benefits of this investment strategy.

Overview of Arbitrage and What It Is

Arbitrage is a way of making money by taking advantage of differences in prices between different markets. In the most basic terms, it involves buying something at a lower price in one market and then selling it in another market at a higher price. It is a form of riskless trading that takes advantage of the differences in prices to make a profit. Arbitrage is an attractive option for investors who are looking for a way to make money without having to take on too much risk. It is also a great way to diversify a portfolio and take advantage of different markets. The key to arbitrage is to buy low and sell high, and to be able to act quickly on opportunities.

Different Types of Arbitrage

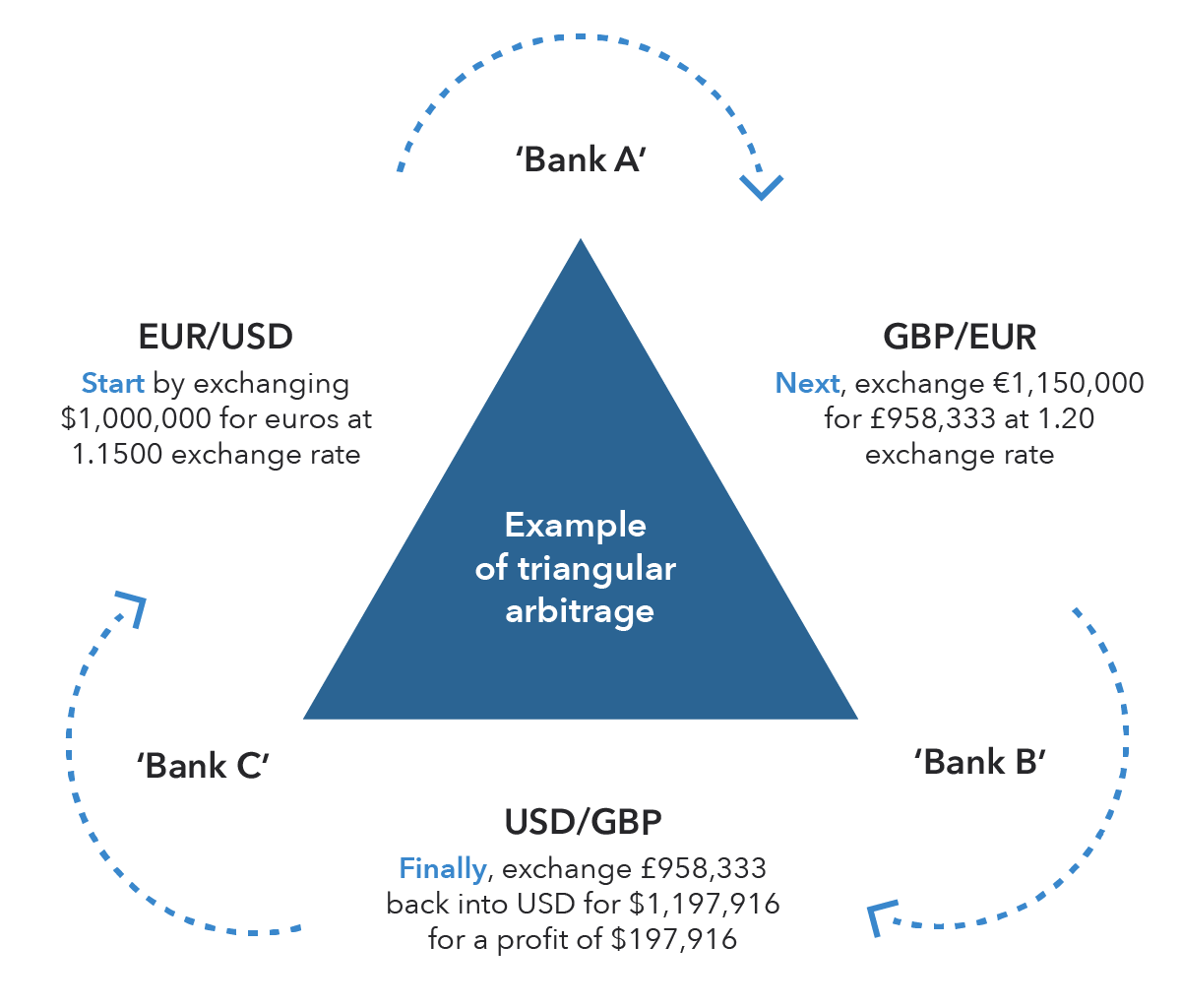

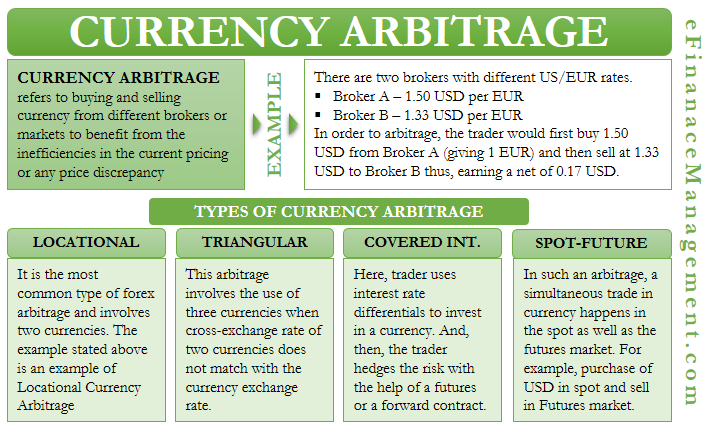

Arbitrage is a great way to make some money by taking advantage of price differences in different markets. There are many different types of arbitrage, each with their own advantages and risks. For example, one type of arbitrage known as risk arbitrage involves betting on the likelihood of a merger or acquisition happening. This can be a great way to make a profit, but it also carries the risk of a deal falling through, which could result in losses. Another type of arbitrage is called statistical arbitrage, which involves using algorithms to identify discrepancies in prices across different markets and then acting on them quickly. This type of arbitrage can be very profitable, but it also carries a higher risk since the algorithms must be carefully designed to identify reliable opportunities. Finally, there’s triangular arbitrage, which involves taking advantage of discrepancies in currency exchange rates. This type of arbitrage involves a lot of quick trades, making it a high-risk strategy. However, if done correctly, it can be a great way to make a profit.

How to Use Arbitrage in Your Financial Strategies

Arbitrage is a great way to increase your portfolio’s performance by taking advantage of mispriced assets. By buying and selling assets simultaneously, you can capitalize on the difference in price and capitalize on the market inefficiencies. By using arbitrage in your financial strategies, you can reduce your risk while increasing your returns. Whether you’re a day trader or a long-term investor, arbitrage is a great way to add some extra potential to your portfolio. With a bit of research and understanding of the markets, you can take advantage of arbitrage opportunities and increase your profits.

The Benefits and Risks of Arbitrage

Arbitrage is a great way to make money on the stock market, but it does come with certain risks and benefits. The biggest benefit of arbitrage is that it can be extremely profitable. You can make a lot of money in a very short amount of time, especially if you’re able to predict the movements of the markets correctly. The downside is that there is always a risk of loss, and you may find yourself in a situation where you lose more than you gain. However, if you understand the markets and are able to predict them correctly, you can make a lot of money through arbitrage. Additionally, arbitrage is relatively low risk and is relatively easy to grasp, making it an attractive option for those looking to make money in the stock market.

How to Avoid Plagiarism When Researching Arbitrage

When researching arbitrage, it’s important to avoid plagiarism. To ensure you don’t copy someone else’s work, you should always cite any sources you use in your research. Additionally, try to look at the material in a new way and make sure your own thoughts and ideas are accurately represented in your work. You should also double check your sources to make sure you’re getting your facts right. Taking the time to do this will ensure that your research is both accurate and original.