Arbitrageurs are financial professionals who use their knowledge and expertise to take advantage of price discrepancies in markets. By buying and selling assets in different markets, arbitrageurs can make profits from the differences in prices. This type of trading can be quite lucrative, but it also carries a certain amount of risk. This article will explain what an arbitrageur is, how they make money, and discuss the risks associated with this type of trading. It will also provide an overview of the most common forms of arbitrage and the potential rewards and dangers of this process.

What is an Arbitrageur and How Does it Work?

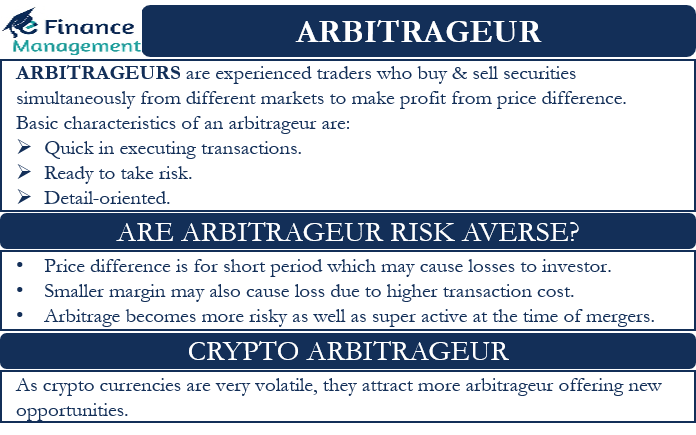

An arbitrageur is someone who takes advantage of price differences in different markets to make a profit. It’s a popular way of making money in the financial world because it involves buying an asset in one market at a lower price, and then selling it in another market for a higher price. It’s a risk-free way of making a profit, but it requires knowledge and experience to do it successfully. Arbitrageurs need to be familiar with how different markets work and have a good understanding of how to read financial statements. They also need to be able to identify trends and opportunities quickly, and act swiftly when they arise. By staying on top of the markets they are able to capitalize on any price discrepancies and make a healthy return on their investments.

Advantages and Disadvantages of Being an Arbitrageur

Being an arbitrageur is a great job for anyone looking to take advantage of financial market inefficiencies. It can be a lucrative career with many advantages, such as being able to make quick profits while having a low-risk profile. Arbitrageurs are able to exploit price differences between different markets, such as stocks, bonds, commodities, and currencies. They are also able to take advantage of any mispricing opportunities that may arise in the market. One of the biggest advantages of being an arbitrageur is the ability to make a profit regardless of market direction. This means that arbitrageurs can benefit from both rising and falling markets, allowing them to take advantage of any profit potential that may exist. Another advantage is that arbitrageurs can often make trades without taking on too much risk. This is due to the fact that arbitrageurs are looking to capitalize on small price differences that can be quickly closed out with minimal risk. However, there are also some disadvantages to being an arbitrageur. For example, the market is constantly changing, meaning that arbitrageurs must stay on top of their trades at all times in order to take advantage of quick-moving opportunities. This can be a difficult task, as it requires a great deal

Understanding the Risks of Arbitrage

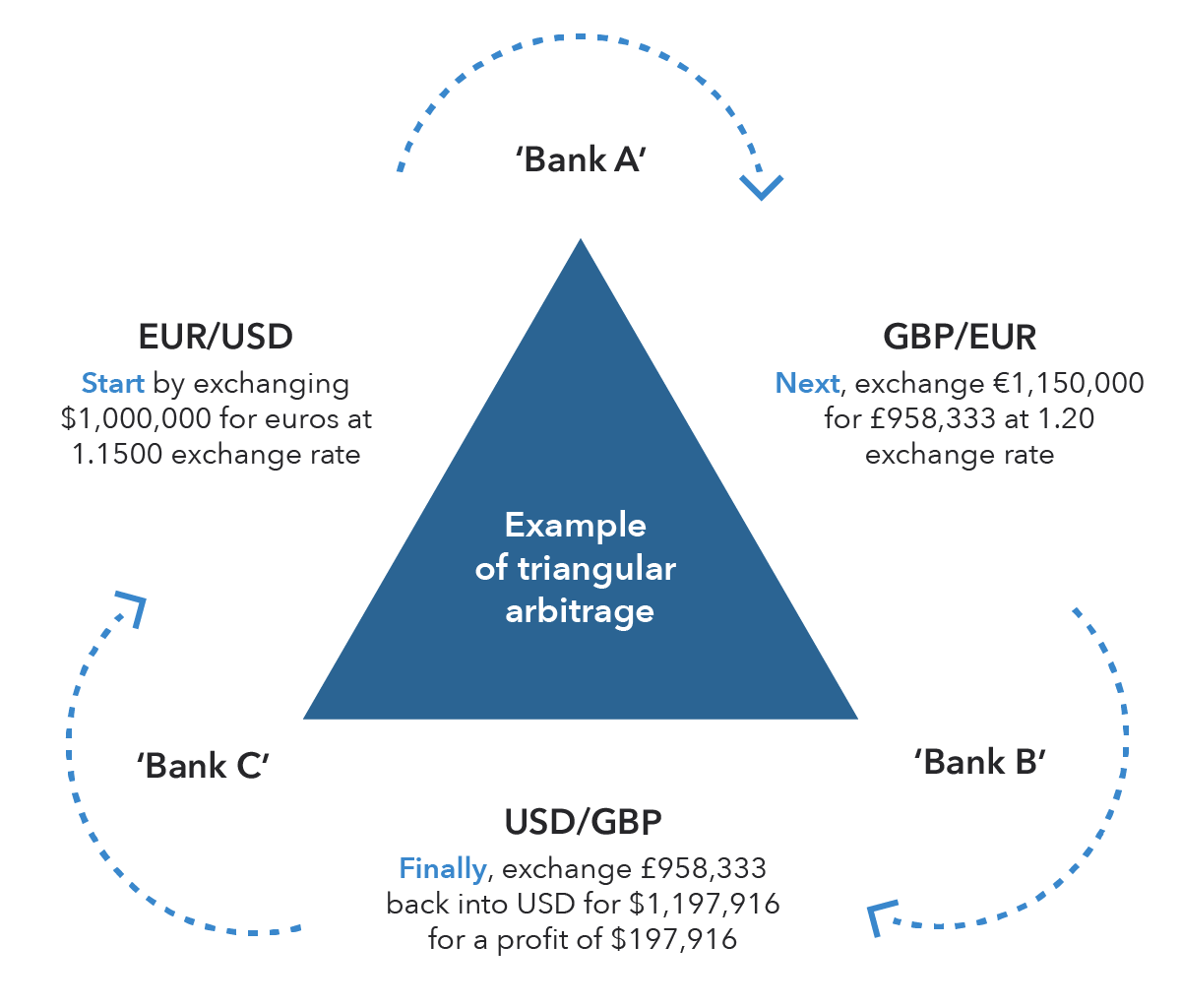

If you’re thinking about getting into arbitrage, you need to understand the risks that come along with it. Arbitrage is a complex financial process that involves buying and selling assets simultaneously in different markets to take advantage of price discrepancies. While this has the potential to be extremely profitable, it comes with several risks, such as market volatility, liquidity risk, and execution risk. Market volatility can cause the prices of assets to fluctuate quickly, meaning that you could end up losing money if you don’t act quickly. Liquidity risk refers to the difficulty of getting in and out of a position, meaning that you could be stuck with a loss if you’re unable to cash out. Lastly, execution risk is the risk that the trades you make won’t be executed properly, either due to technical issues or other factors. All of these risks need to be taken into account when considering arbitrage as an investment strategy.

Strategies for Successful Arbitrage

Strategies for successful arbitrage can seem daunting and difficult to understand, but with the right approach and knowledge, anyone can become a successful arbitrageur. The key is to start small and gain experience, so look for arbitrage opportunities with low risk and low volume, as these will help you build up your confidence and increase your knowledge. Research is also a key factor in successful arbitrage – research the markets you are trading in, understand how they work, and stay up to date with news and trends. Finally, it is important to remember to take calculated risks as an arbitrageur – never invest more than you can afford to lose, and always have an exit strategy in mind. By following these strategies, you can maximize your profits while minimizing your risk.

Tips to Avoid Plagiarism when Discussing Arbitrageur Financial Definition

As an arbitrageur, you know that information is key. It’s important to stay in the know when it comes to financial markets, and it’s essential to be able to discuss financial topics with confidence. However, it can be easy to fall into the trap of plagiarism when discussing the financial definition of an arbitrageur. To ensure you are not plagiarizing, there are a few steps you can take. First, always use your own words when discussing financial terms. Secondly, when referencing any outside sources, always make sure to cite them properly. Lastly, check your work for any similarities to other texts, as this could be an indication of plagiarism. By following these simple steps, you can make sure you are writing about the financial definition of an arbitrageur in an ethical and professional manner.