An annuity due is a type of annuity in which payments are made at the beginning of each period instead of at the end. This means that the annuitant, or the person receiving the annuity payments, receives the payments more quickly. An annuity due has some advantages and disadvantages over other types of annuities, and it can be a great option for those who need a steady stream of income with some security. In this article, we’ll explain what an annuity due is, how it works, and why it might be the right annuity option for you.

What is an Annuity Due and How Does it Work?

An annuity due is a type of annuity that can be used to provide a steady stream of income. Unlike a regular annuity, payments for an annuity due occur at the beginning of each period, rather than at the end. This makes the annuity due an attractive option for people who need a steady income but don’t want to wait until the end of each period to receive it. The basic idea behind an annuity due is that you make a one-time payment upfront and in return, the annuity company pays you a fixed amount of money at the beginning of each period. This money can be used for retirement, college tuition, or other long-term financial goals. With an annuity due, you’ll get access to your money faster, so you can start using it sooner. Plus, depending on the type of annuity you choose, you may also benefit from tax advantages. So if you’re looking for a reliable way to generate a steady income, an annuity due may be the perfect choice for you.

Benefits of an Annuity Due

An annuity due is a great financial tool that can help you reach your retirement goals. An annuity due is an annuity where payments are made at the beginning of each period, rather than at the end. This means that payments are made up front, providing you with a stream of income for the remainder of the period. The benefits of an annuity due are that you’re able to receive payments more quickly, and you’re able to invest the money that you’ve already made in order to increase your returns. Additionally, the payments are more reliable, as they’re not subject to market volatility that can occur with other investments. An annuity due is a great way to ensure that you have a steady stream of income throughout your retirement, while also allowing you to invest in other areas to maximize your returns.

Different Types of Annuities and Their Benefits

When it comes to investing, annuities are one of the best ways to secure your future and make sure your money is safe. There are a few different types of annuities, each of which have their own unique benefits. Fixed annuities are great for those who want to guarantee a certain return on their investment. Variable annuities are great for those who are looking to take a bit more of a risk and can potentially lead to higher returns. Immediate annuities are a great way to get guaranteed income for life and are perfect for those who want to ensure their money will last them throughout their retirement. Lastly, deferred annuities are great for those who are looking to save money for their retirement but want to receive payments at a later date. No matter which type you choose, annuities can be a great way to secure your future and make sure your money is safe.

Annuity Due Risk Considerations

When considering an annuity due, it is important to understand the risks associated with it. While annuities are a great way to save for retirement, they come with a variety of risks. For example, if you are investing in an annuity due, you are taking on the risk that the payments may not be made on time, or that the rate of return on your investment may not be as expected. Additionally, you may face the risk of rising inflation, which could affect the value of your annuity due. Additionally, the risk of an early death or disability may also be a factor when investing in an annuity due. It is important to understand the risks involved and to make sure you are properly diversifying your investments in order to minimize risk.

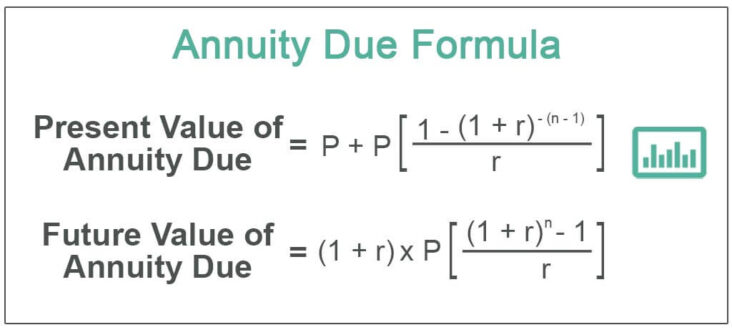

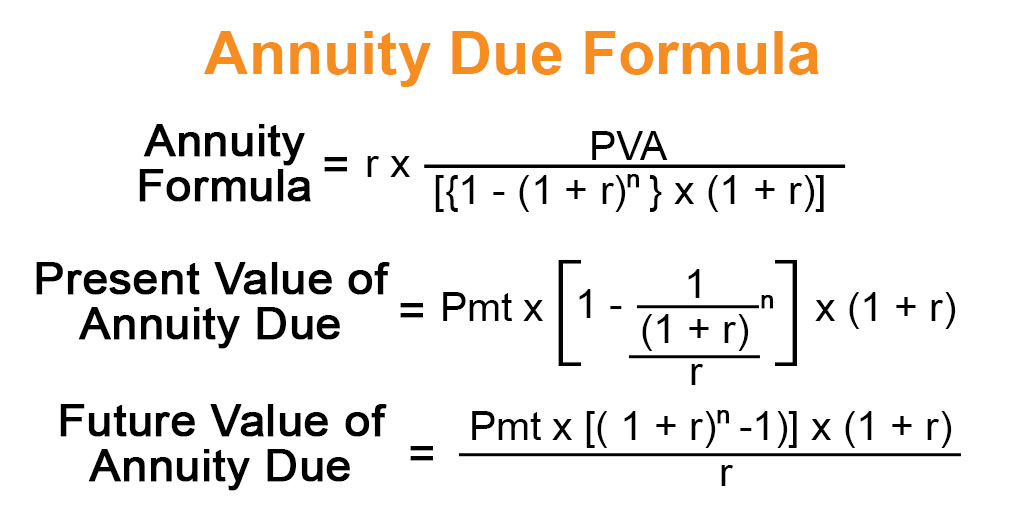

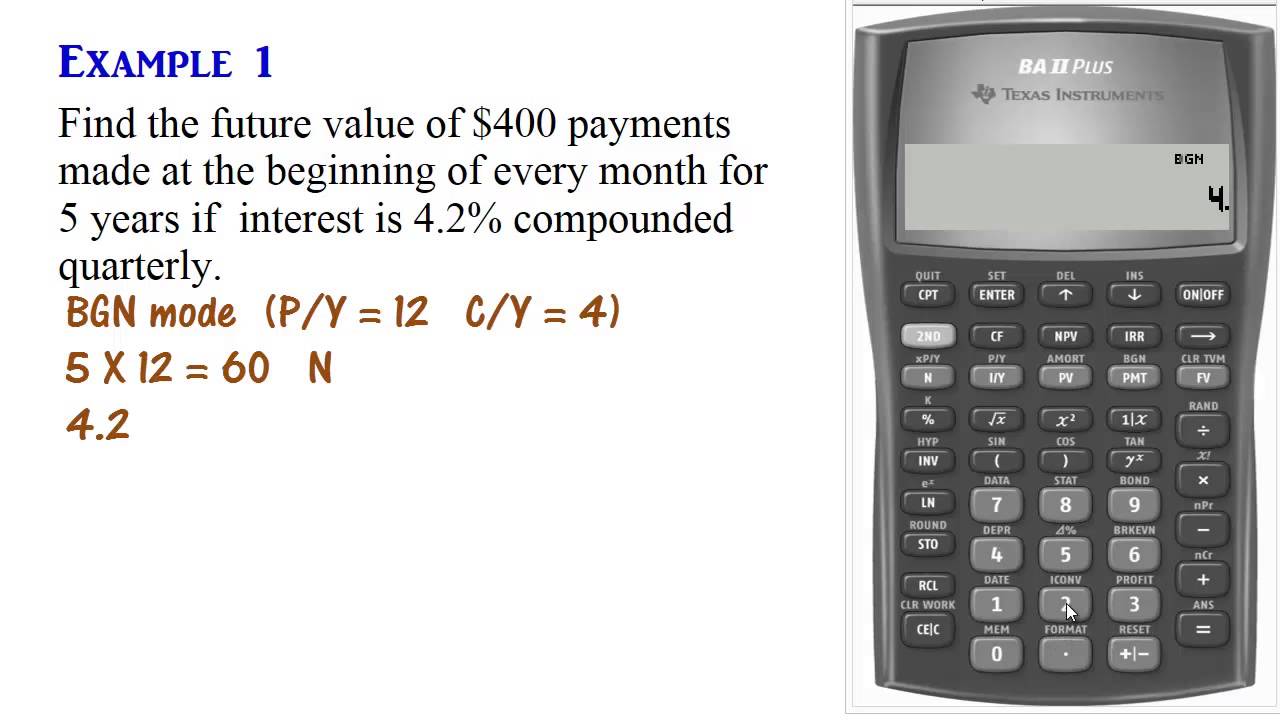

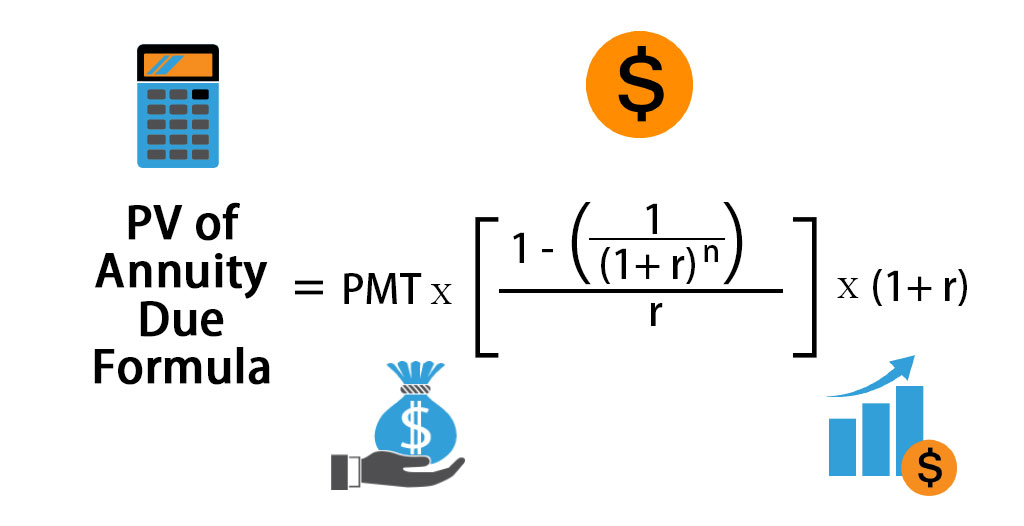

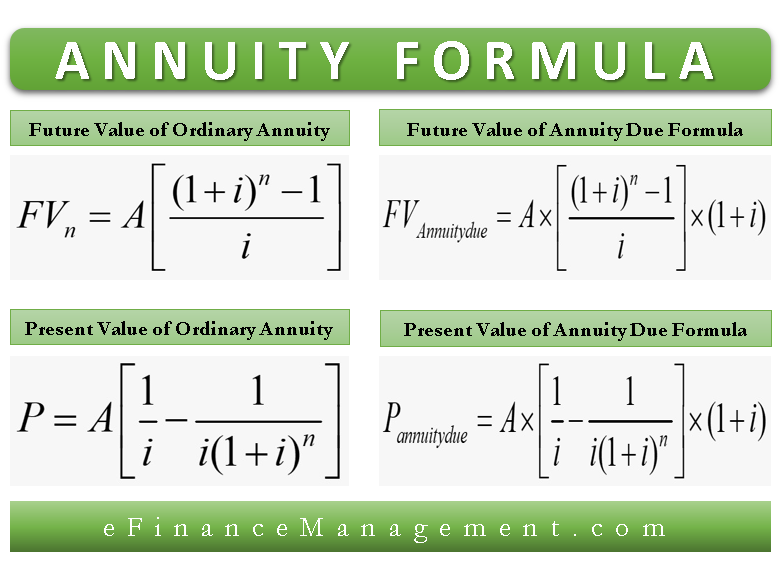

How to Calculate an Annuity Due Payment

Calculating an annuity due payment can be a tricky task, but luckily there’s a simple formula to help you out. An annuity due is a type of annuity where the payments are made at the beginning of each period, rather than at the end. This means that the payment must be made in advance, rather than in arrears. To calculate an annuity due payment, you’ll need to know the amount of the annuity, the number of payments, and the interest rate. Then, you’ll need to use the annuity due formula, which is A = P * [((1+i)^n – 1) / i] * (1+i). That formula might look complicated, but it’s really quite straightforward – just plug in the numbers for the amount of the annuity (P), the number of payments (n), and the interest rate (i) and you’ll get your answer. With the annuity due formula, you can easily calculate your annuity due payment – no more guess work or guess-timation!