Annuities are a powerful financial tool that can provide you with a steady stream of income throughout your lifetime. They are long-term investments that allow you to receive a guaranteed income for a specified period of time, making them an attractive option for retirees and other investors. Whether you’re looking to supplement your retirement income, protect your savings from market volatility, or just make your money work for you, you may want to consider the advantages of annuities. In this article, we’ll discuss what an annuity is, the different types of annuities, and how they can help you reach your financial goals.

An Overview of What an Annuity Is

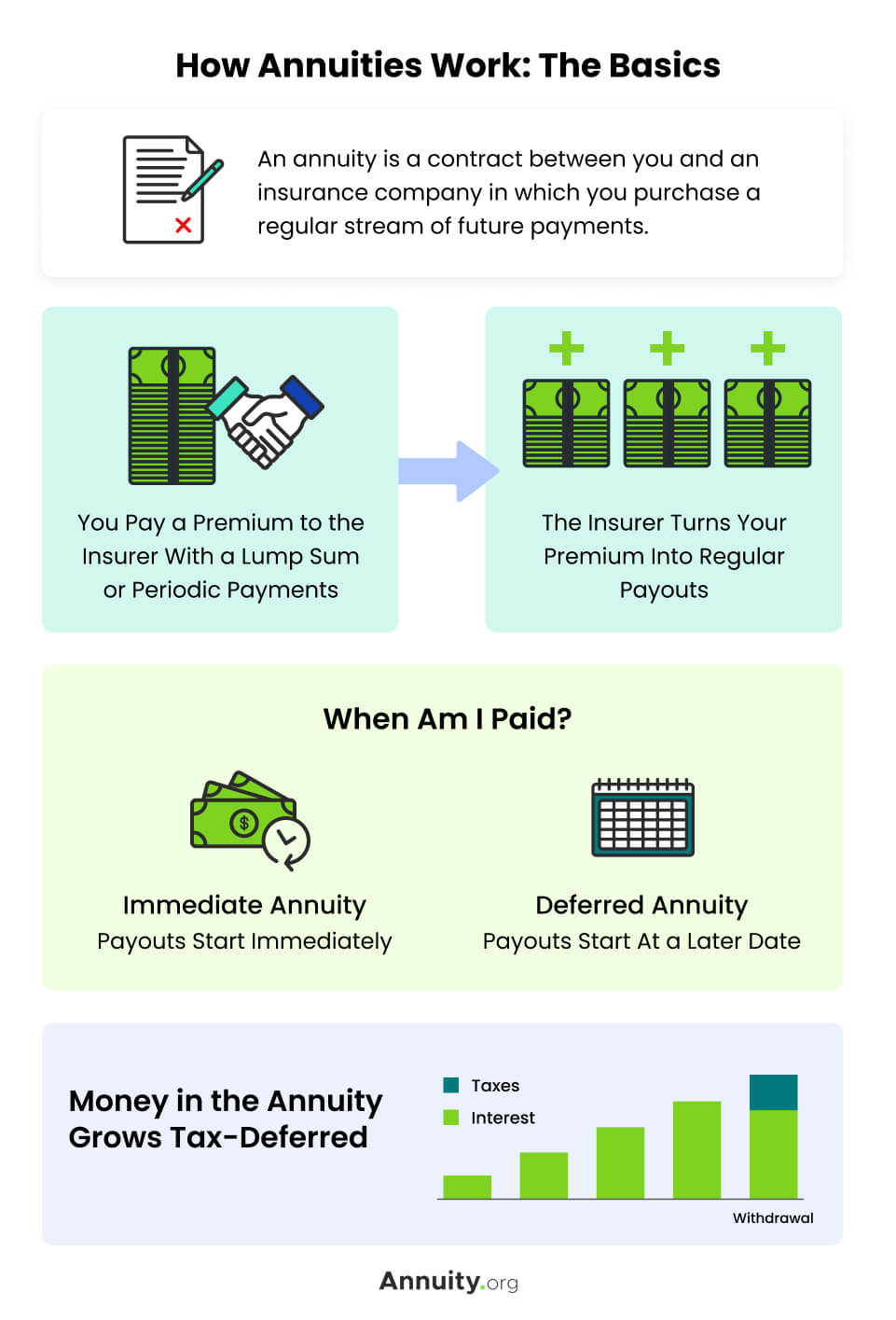

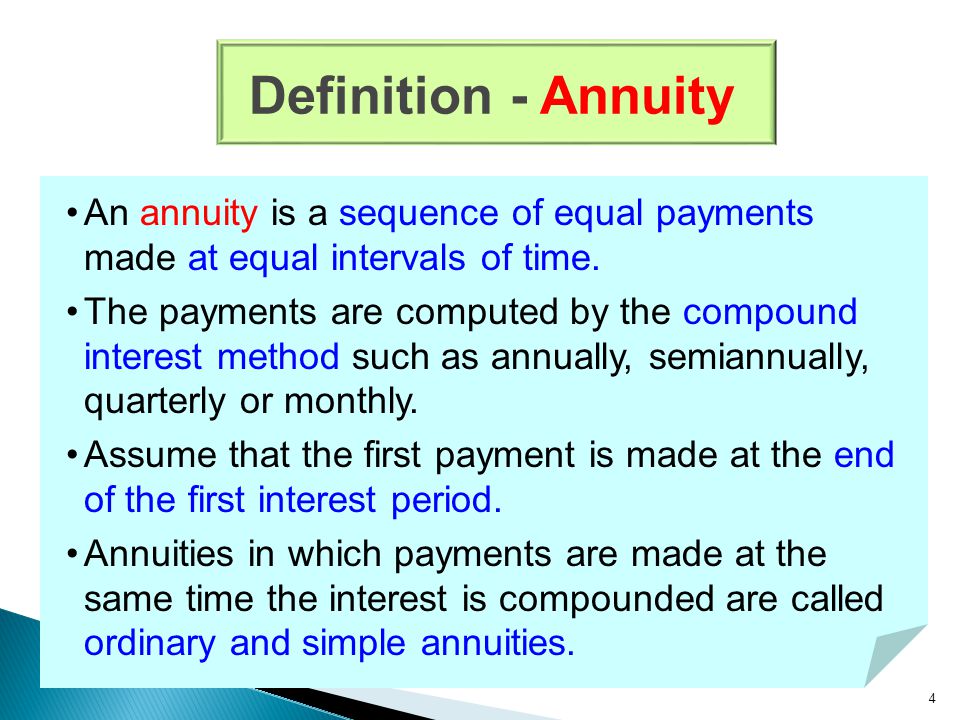

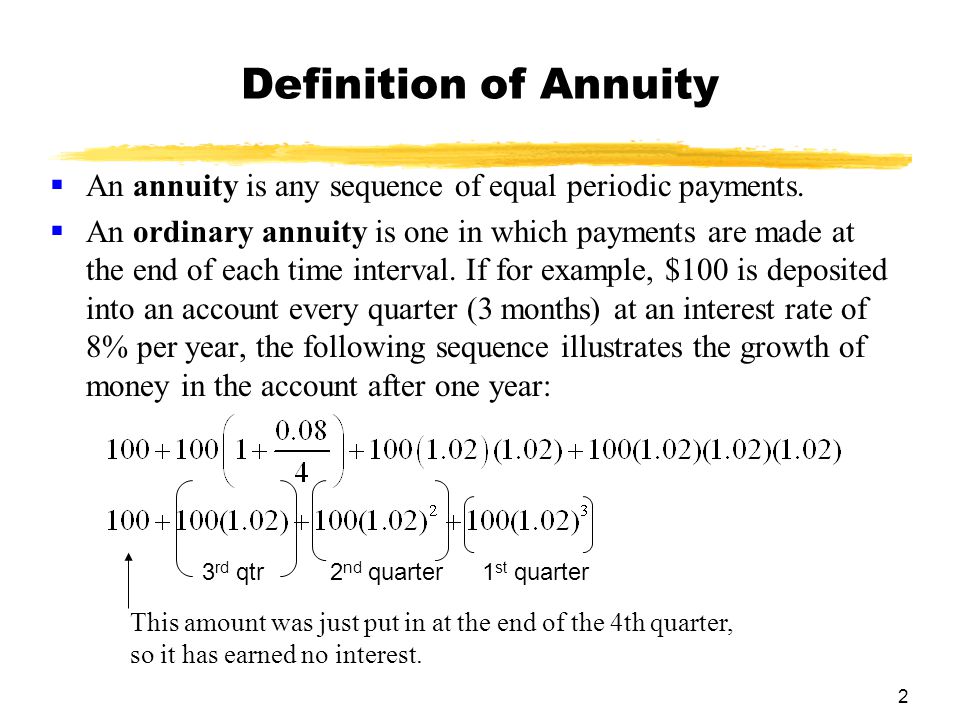

An annuity is an investment that allows you to make regular payments to an individual or company in exchange for a guaranteed income for a period of time. This could be a fixed or variable amount depending on the terms of the annuity. It’s a great way to ensure that you have a reliable income source when you retire. With annuities, you’re investing in your future and have the peace of mind that you’ll have a steady stream of income for the rest of your life. Plus, annuities can also provide you with tax advantages, so you can maximize your retirement savings. Whether you’re just starting to plan for your retirement or already have a plan in place, an annuity can help you achieve your financial goals.

Different Types of Annuities and How They Work

Annuities are a great way to save for retirement and can offer a variety of options for those looking for financial security. There are different types of annuities, each working differently and offering different benefits. Fixed annuities provide a guaranteed set payout rate, while variable annuities offer more flexibility in terms of investment options and returns. Index annuities offer a combination of both fixed and variable options, and are typically linked to a stock market index. Immediate annuities provide a lump sum payment in exchange for regular income, and deferred annuities allow for contributions to build up over time before taking out regular payments. Understanding each of these different types of annuities and how they work is important in order to make the right decision for your retirement.

Benefits of Investing in Annuities

Investing in annuities has several benefits that can make them a great addition to your portfolio. Annuities provide a guaranteed stream of income, even in retirement, so you never have to worry about running out of money in your golden years. They also offer tax advantages, since you can defer taxes on the earnings until you start to withdraw them. Additionally, annuities can offer protection against market volatility, since the returns on annuities are fixed and not tied to the stock market. With an annuity, you are guaranteed a minimum return, regardless of what happens in the market. Finally, annuities can provide peace of mind, since you don’t have to worry about making the wrong investment decisions and running out of money. Investing in annuities can give you the financial security you need and help you reach your long-term financial goals.

Risks of Investing in Annuities

.Investing in annuities can come with some risks. Annuities are complex financial instruments that can be difficult to understand. Choosing the wrong type of annuity or investing in an annuity with unfavorable terms can have a negative impact on your finances. Some of the risks associated with annuities include early surrender fees, expensive fees, and restrictions on access to money. Annuities may also have a limited rate of return, reducing the amount of money you’ll earn from your investment. Understanding the risks associated with investing in annuities is important in order to make an informed decision and protect your finances.

Questions to Ask Before Investing in an Annuity

When it comes to investing in an annuity, it’s important to know exactly what you’re getting yourself into. There are a lot of questions you should ask before investing in an annuity, such as what type of annuity is it, what rate of return can you expect, what are the fees and charges, and what’s the surrender period? Knowing the answers to these questions will help you make an informed decision about whether or not an annuity is the right investment for you. Additionally, it’s important to understand what the tax implications of investing in an annuity are, as well as the potential risks associated with the investment. It’s also a good idea to research the company that is providing the annuity, as well as the financial advisor who is helping you make the decision. Investing in an annuity can be a great way to secure your future financial security, but it’s important to understand the risks and rewards before taking the plunge.