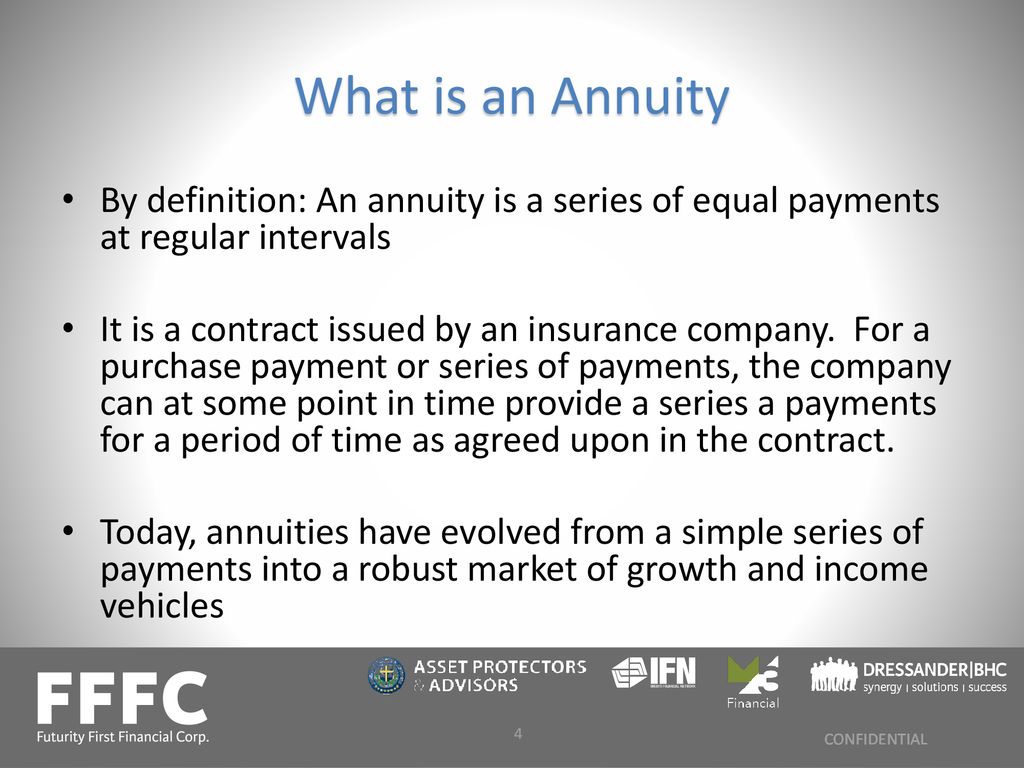

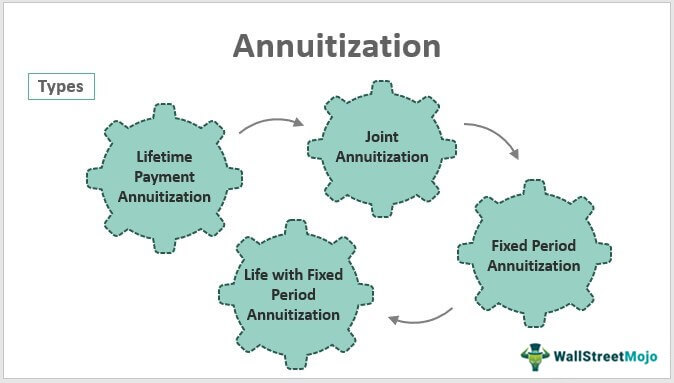

Annuitization is a powerful financial tool that can be used to help individuals secure a steady stream of income during retirement. It allows you to convert a lump sum of money into a series of payments made over a fixed period of time. Annuitization can give you the peace of mind that comes with knowing you have a reliable source of income during your golden years. If you’re considering annuitization as a retirement planning strategy, it’s important to understand how it works and the different types of annuities available. In this article, we’ll explain what annuitization is, how it works and the different types of annuities.

Understanding Annuitization: Definition and Benefits

Annuitization is a financial process that involves converting your lump sum of money into a series of regular payments over a certain period of time. It is a popular retirement planning tool that can help you turn your savings into a steady stream of income. With annuitization, you can create a secure retirement income, protect yourself against market fluctuations, and enjoy tax advantages. You can also choose to annuitize your savings to create a financial legacy for your loved ones. Annuitization can be a great way to make the most of your money in retirement and ensure a financially secure future.

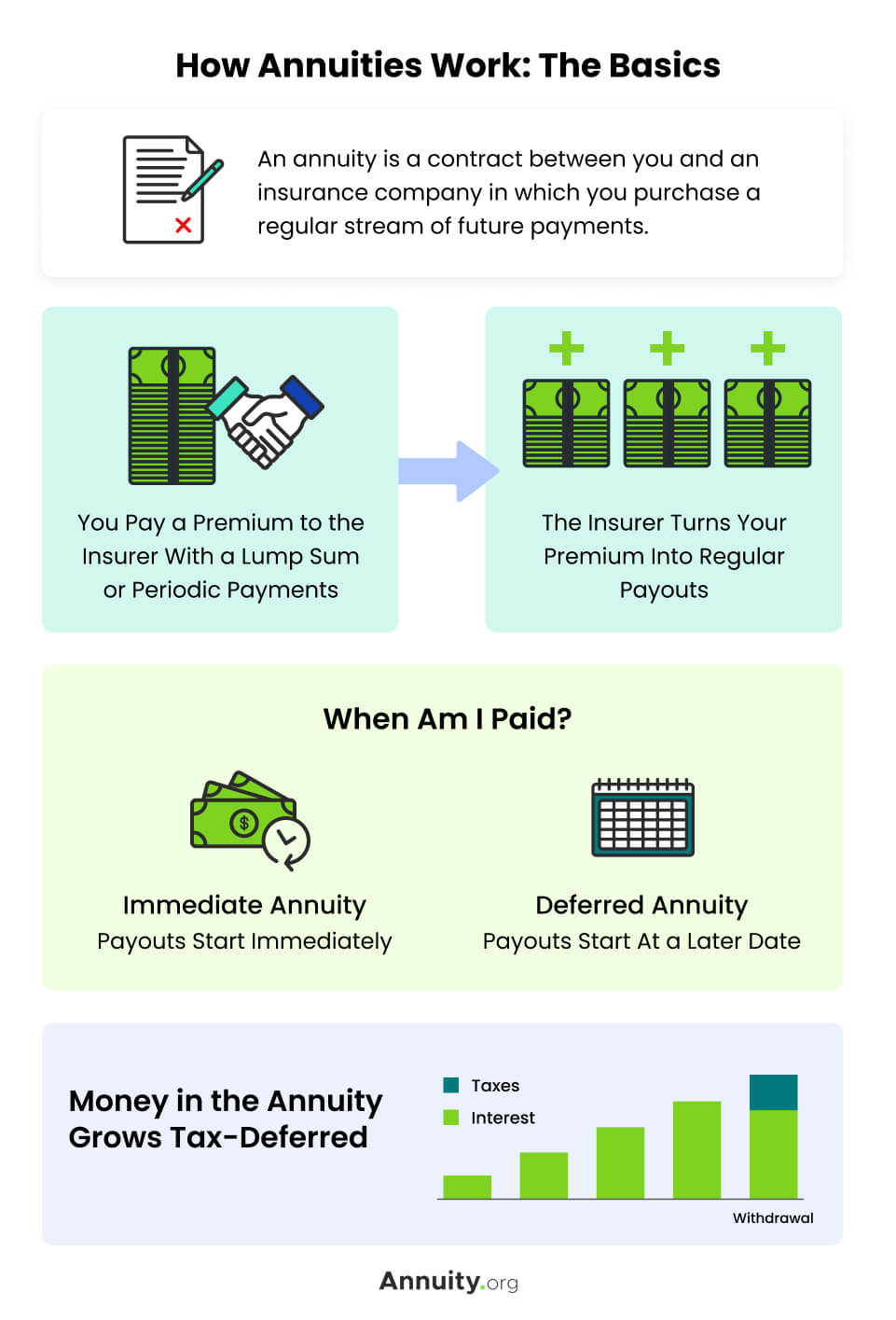

How Does Annuitization Work?

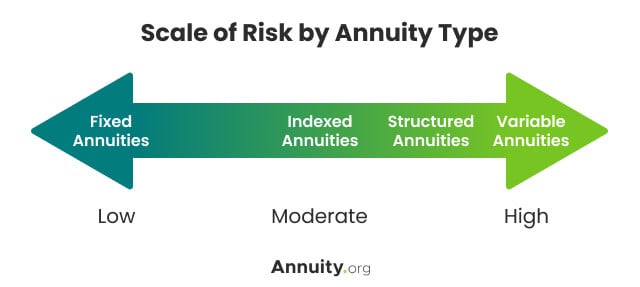

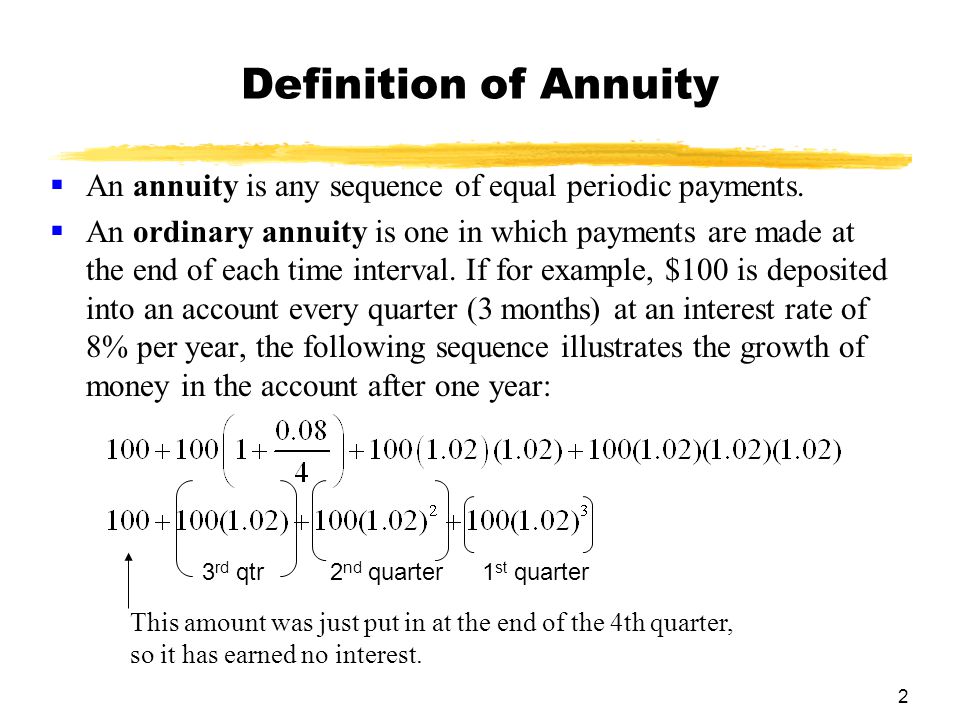

Annuitization is a financial process that can turn your lump sum of money into a steady income stream. It’s a great way to have a steady, reliable income for the rest of your life. It works by investing a lump sum of money in an annuity, which is a contract that pays you a set amount of money each month. When you annuitize, you are essentially transforming your lump sum of money into a guaranteed income stream for the rest of your life. You can choose a fixed annuity, in which you receive a guaranteed amount each month, or a variable annuity, in which your payouts depend on the performance of the investments in the annuity. Annuitization can be a great way to make sure you have a steady income for the rest of your life and can help protect you from outliving your money.

Annuitization as an Investment Strategy

When it comes to investing, annuitization is a great way to generate long-term income. By investing in an annuity, you’re able to create a steady stream of income that will last throughout your retirement years. Annuitization also gives you the option to choose when you want to receive payments, as well as the size of those payments. This makes it easier to plan for your future and make sure that you have enough money to cover all your expenses. With annuitization, you can also benefit from tax advantages, as well as the ability to pass on the annuity to your beneficiaries. Annuitization is a great way to secure your future and make sure that you have the financial security that you need.

Annuitization as a Retirement Tool

Annuitization is a great tool to use when it comes to retirement planning. It allows you to convert a large sum of money into a stream of payments that you can use to supplement your retirement income. Annuitization can provide an individual with a guaranteed stream of payments over a set period of time, and can even provide a guaranteed death benefit to ensure that your beneficiaries receive the remaining funds if you pass away. Additionally, annuitization can help you to avoid paying taxes on the entire lump sum at once, allowing you to spread out your tax burden over time. Annuitization is a great way to make sure you have a steady retirement income and to ensure your beneficiaries are taken care of after you’re gone.

Advantages and Disadvantages of Annuitization

Annuitization is a popular financial strategy for retirement that offers a number of advantages and disadvantages. Annuitization allows you to turn a lump sum of money into a guaranteed income stream for life, making it a great way to ensure that you’ll have a steady income during retirement. One of the major advantages of annuitization is that it provides a fixed income for life, no matter how long you live. This means that you’ll always have a consistent source of income, even if you outlive your retirement savings. It also provides a tax-deferred growth, allowing you to invest in higher-yielding investments without worrying about incurring taxes. Additionally, annuitization is a great way to ensure that you’ll have an income even if you’re unable to work due to an illness or injury. However, there are also some drawbacks to annuitization. One major disadvantage is that annuitization is a one-way street; once you annuitize your money, you can’t take it back. Additionally, annuitization is not suitable for everyone, as it works best for those who are close to retirement or who are in good health. Lastly, depending on the type of ann