An annuity table is a chart used to calculate payments and interest rates for annuities. It offers an easy way to compare fixed-rate annuities, immediate annuities, and deferred annuities. With annuity tables, you can calculate the amount of money you would receive in regular payments, based on the amount you invest and the interest rate you are promised. This article will discuss how annuity tables work, the benefits they offer, and how to use them to your advantage.

What is an Annuity Table and How Does it Work?

An annuity table is a financial tool used to help people make decisions about their retirement investments. It shows the amount of money they can expect to receive over a given period of time, depending on how much they invest and when they start receiving payments. Knowing how much money they can expect to get out of their retirement investments can help people make an informed decision on when to start taking payments and how much to invest. An annuity table provides a visual representation of the future value of your investments, taking into account different variables such as the amount invested, the frequency of payments, and the rate of return. Understanding how an annuity table works is essential for any investor looking to make the most out of their retirement savings.

Benefits of Using an Annuity Table

Using an annuity table can be a great way to manage your finances and plan for the future. An annuity table is a chart that helps you calculate and compare payments from annuities of different types and at different times. It’s a great tool for anyone who wants to get a better understanding of the different types of annuities available and how they can help you reach your financial goals. With an annuity table, you can easily compare the rates of return, fees, and other important factors to help you make the best decision for your retirement. The table can also be used to estimate how much money you’ll receive from an annuity over a specific period of time and how much you’ll need to pay in taxes. Investing in an annuity is an important decision and having an annuity table to help you make the right choice can be invaluable.

Different Types of Annuity Tables

An annuity table is an important tool when it comes to understanding how annuities work. Annuities are a type of financial product that can provide a steady income stream during retirement. Annuity tables provide an easy way to calculate the amount of money you will receive at each age, based on the size of your annuity, the interest rate, and the length of your retirement. There are several different types of annuity tables, each with its own unique features and advantages. Fixed annuity tables allow you to calculate the amount of money you will receive each year based on the size of your annuity and the interest rate. Variable annuity tables allow you to vary the amount of money you receive each year depending on the performance of your investments. Immediate annuity tables are helpful for those who want to receive their payments as soon as possible. Finally, deferred annuity tables can help those who want to delay their payments for a certain period of time. Knowing which annuity table is right for you can help you make the best decisions for your retirement.

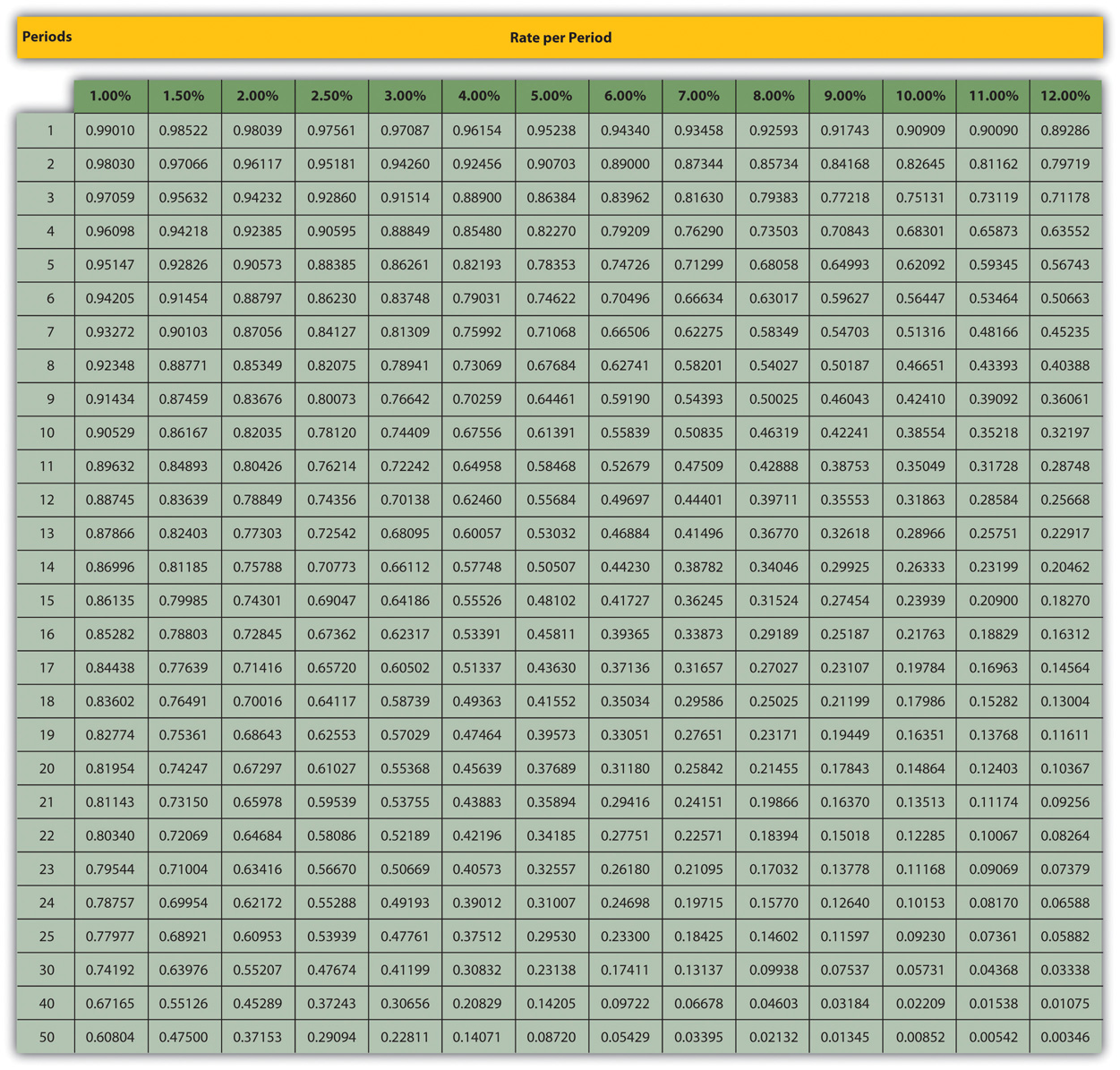

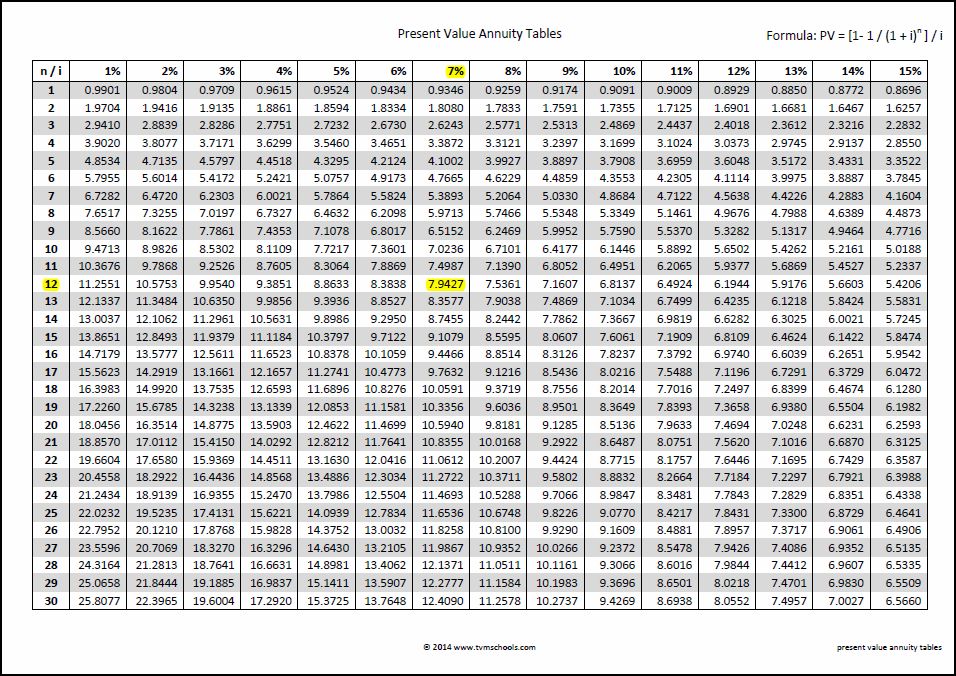

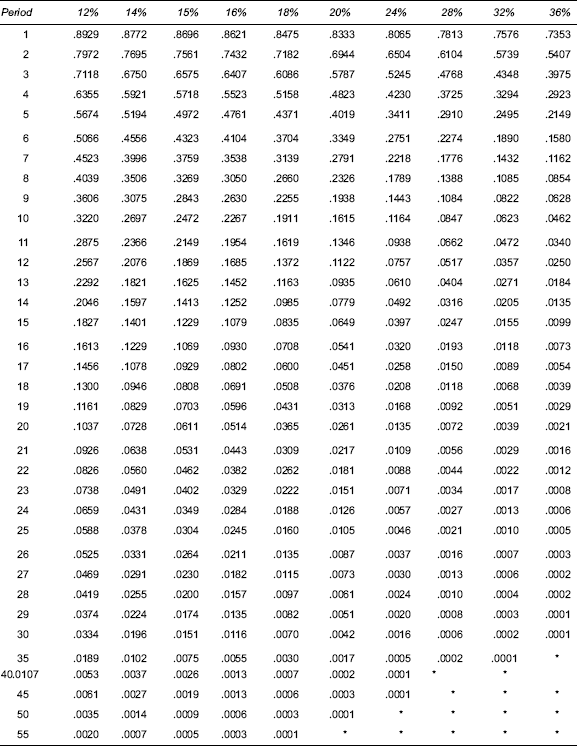

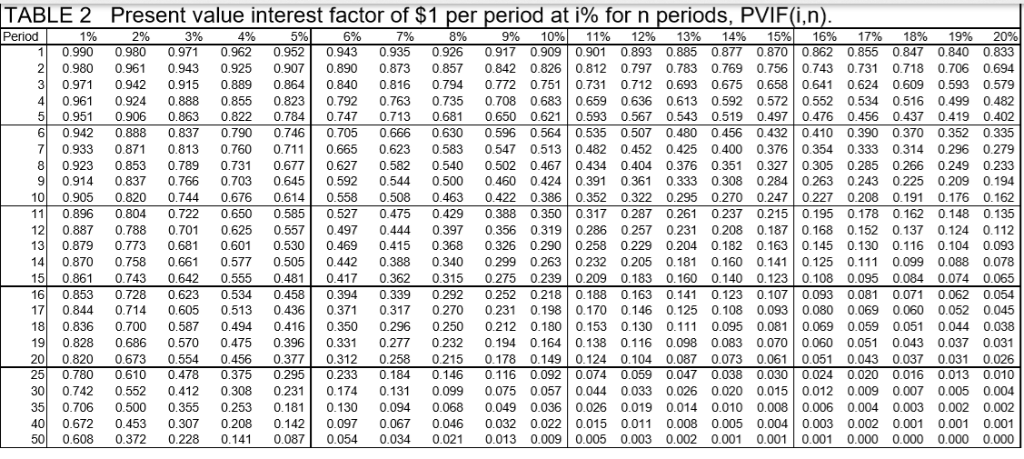

Calculating Present Value with an Annuity Table

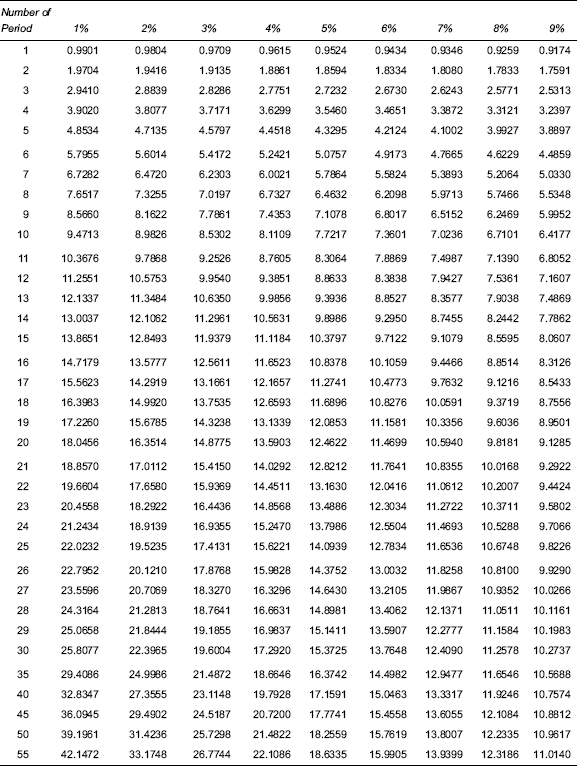

Using an annuity table can help you calculate the present value of a future payment stream. An annuity table is a table of interest rates used to calculate the present value of a series of future payments. The annuity table will show you the present value of a series of payments over a certain period of time, which is determined by the interest rate. To use an annuity table, you need to know the present value of the future payments, the time period for which the payments will be made, and the expected interest rate. With this information, you can look up the discounted present value of each payment in the annuity table. This will help you determine the total present value of the payment stream. An annuity table is a great tool to use when you need to quickly calculate the present value of a series of payments or investments. Knowing the present value of a payment stream can help you make better decisions about financial investments or retirement plans.

Strategies to Avoid Plagiarism in Financial Analysis with an Annuity Table

When it comes to financial analysis, using an annuity table can be a great way to ensure that you’re avoiding plagiarism. An annuity table is a chart that shows the future value of a series of payments. By using an annuity table, you can make sure that you’re coming up with your own conclusions and calculations. To make sure that you don’t get caught up in the plagiarism trap, you should always make sure that you’re doing your own calculations and not relying on someone else’s. Doing your own research and calculations is the best way to make sure you’re staying on the right side of the plagiarism line.