An annual report is a detailed report of a company’s financial performance over the past year. It provides an in-depth and comprehensive look at a company’s financial status, including income statements, balance sheets, and cash flow statements. It also provides detailed information on a company’s operational performance, such as sales and expenses, as well as any changes in the company’s ownership. Understanding an annual report is essential for investors and stakeholders in order to get a better understanding of the company’s financial health and potential future growth.

What are the Benefits of Reading an Annual Report?

If you’re looking to stay on top of your finances, reading and understanding an annual report is a great way to start. An annual report is a comprehensive report on a company’s activities throughout the preceding year. It provides an in-depth look into a company’s financial performance, including income, expenses, assets, liabilities, and stockholder equity. Not only does reading an annual report give you a better understanding of a company’s financial health, but it also allows you to make more informed decisions when investing. Knowing the company’s financial performance over the past year can help you understand their potential for growth and profitability, giving you an edge when deciding whether to invest. Additionally, an annual report can provide insight into the company’s future plans and strategies, as well as their competitive edge. All in all, reading an annual report can be a great way to maximize your investments, so make sure to check them out if you’re looking to get ahead with your finances.

How to Read an Annual Report for Insights and Valuation

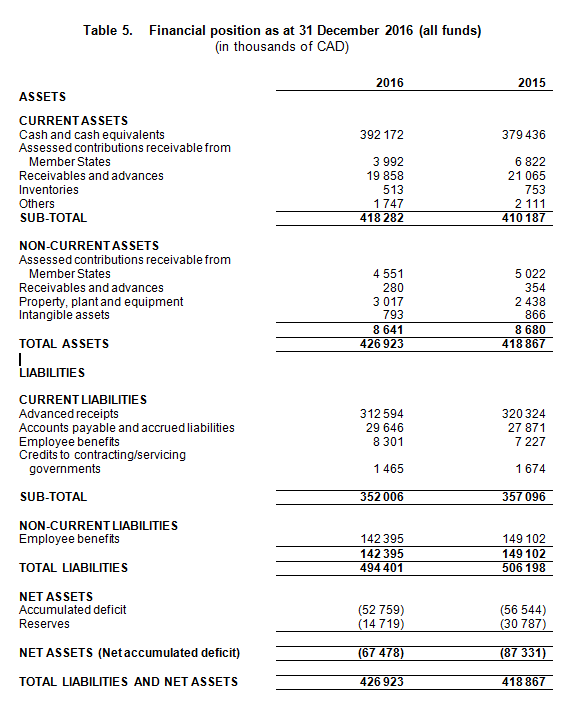

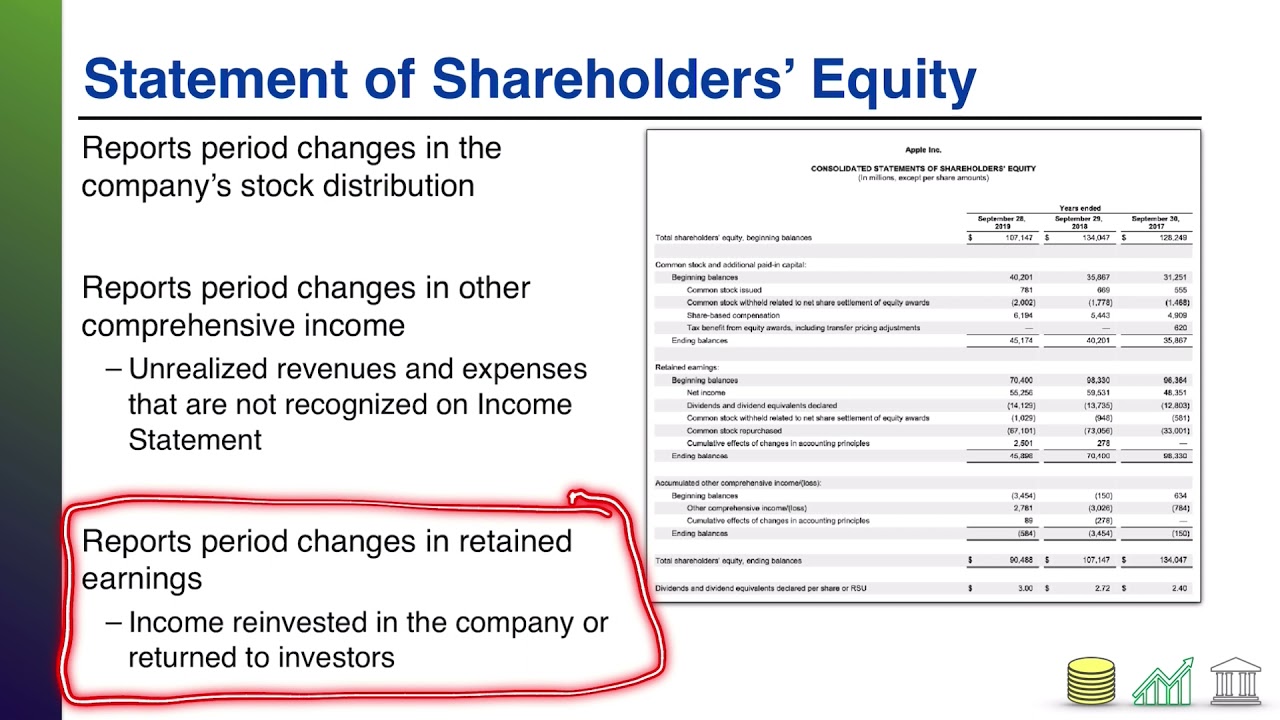

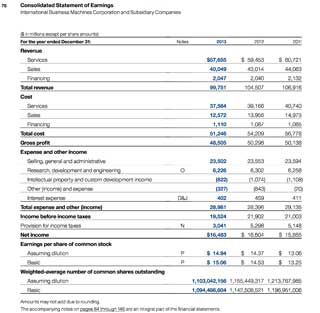

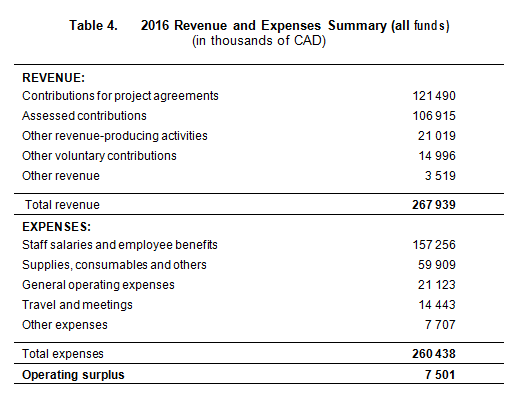

Reading an annual report is a great way to gain insight into a company’s financial health and make informed decisions about potential investments. It can also be a valuable tool for assessing the value of a company. To get the most out of an annual report, you need to understand what to look for and how to interpret the information. Start by analyzing the company’s financial statements, looking at the income statement, balance sheet, and statement of cash flows to get an idea of the company’s financial performance. Then, look at the management discussion and analysis section to get a better understanding of the company’s strategy, how it is performing, and how it plans to move forward. Finally, pay attention to the notes section for important disclosures about the company’s operations and finances. With this approach, you’ll be able to uncover valuable insights and make informed decisions about valuing a company.

Understanding the Different Sections of an Annual Report

If you’re looking to gain a better understanding of an annual report, it’s important to know the different sections. The first section of an annual report typically includes an overview of the company, including information on its mission and vision, as well as its financial performance over the past year. This is followed by a discussion of the company’s key accomplishments and highlights, such as any new products or services launched, awards received, or milestones achieved. Next comes a review of the company’s financial statements, including balance sheets, income statements, and cash flow statements. This section can give you a better understanding of how the company is doing financially. The last section typically contains management’s discussion and analysis, which provides an in-depth look into how the company operates and what its plans are for the future. Knowing the different sections of an annual report can help provide you with a better understanding of how a company is performing and what its future prospects may be.

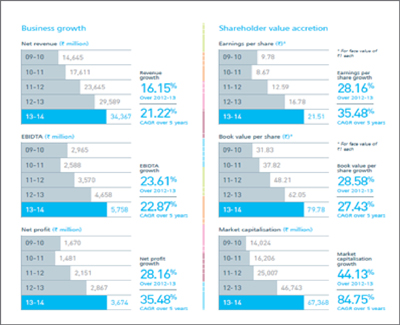

The Impact of an Annual Report on Shareholder Value

An annual report is one of the most important documents that shareholders can look to when determining the value of their investment. Not only does it provide insight into the company’s financial performance, but it also provides details on the company’s operational activities. It is a great way to gauge the overall success of the company and can have a significant impact on the value of the investment. It is important for shareholders to understand the information provided in the annual report so that they can make informed decisions about the future of their investments. By understanding the impact of an annual report on shareholder value, investors can make sound decisions that can lead to greater returns on their investments.

Tips for Avoiding Plagiarism When Writing an Annual Report

When it comes to writing an annual report, avoiding plagiarism is key. Plagiarism is a serious offense that can have legal ramifications, so it’s important to make sure every word you write is your own. Here are some tips to help you avoid plagiarism when writing an annual report. First, make sure you properly cite any sources you use. This means including the original source, the author’s name, the date of publication, and any other relevant details. Second, when you’re taking inspiration from other sources, be sure to put the ideas into your own words. Third, don’t copy entire passages from other sources without attributing the sources properly. Finally, use online tools like Copyscape to check your work for plagiarism and ensure that it’s original. Doing so can help you avoid any potential legal issues and make sure your annual report is truly your own work.