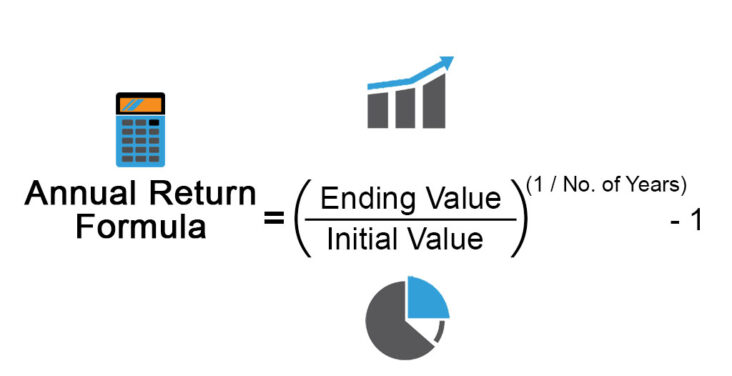

Are you a business owner or investor looking to understand the concept of annual return? Annual return is an important metric that can help you evaluate the performance of your investments over time. It is a measure of the total income generated from a particular investment in a single year, expressed as a percentage of the total investment. This article will explain the basics of annual return, its components, and how to calculate it. We will also provide some tips on how to use annual return to inform your investment decisions.

Overview of an Annual Return: What It Is and What It Tells You

An annual return is an important document that every business needs to file. It’s a detailed report of the company’s financial activities over the past year and can provide valuable insight into the company’s performance. The annual return contains a variety of information, including details about the company’s assets, liabilities, income, expenses, and more. It can also provide insight into the company’s share capital, directors and shareholders, and other key information. Knowing what’s included in an annual return can help you make more informed decisions about your business, as well as better understand the financial health of the company. Plus, having an up-to-date annual return is a requirement for any business that registers with Companies House. So, if you’re looking to better understand your business’s financials and make sure you’re compliant with the law, you should make sure you file your annual return each year.

What Does an Annual Return Include?

An annual return is a form you fill out each year that outlines the financial information of your business. It includes important details like the company’s directors, shareholders, and financial performance, as well as other key facts. When completing an annual return, it’s important to provide accurate and up-to-date information so that the government and other stakeholders can have an accurate picture of your business. The information included in an annual return can help investors understand your business better, and can be used by the government to ensure that businesses are compliant with relevant regulations. Knowing what to include in an annual return and understanding the importance of accuracy can help you ensure that your business’s financial information is up-to-date and correct.

Understanding the Tax Implications of an Annual Return

When it comes to filing your annual return, it’s important to understand the tax implications that come with it. By understanding the tax implications of your annual return, you can ensure that you are paying the right amount of taxes and not overpaying. Depending on your income, there could be different tax rates that you need to pay and if you don’t stay up-to-date on the latest tax laws, you may end up overpaying. It’s also important to keep track of any deductions or credits you may be eligible for, so you can get the most out of your return. Knowing the tax implications of your annual return will help you save money and stay on top of your taxes.

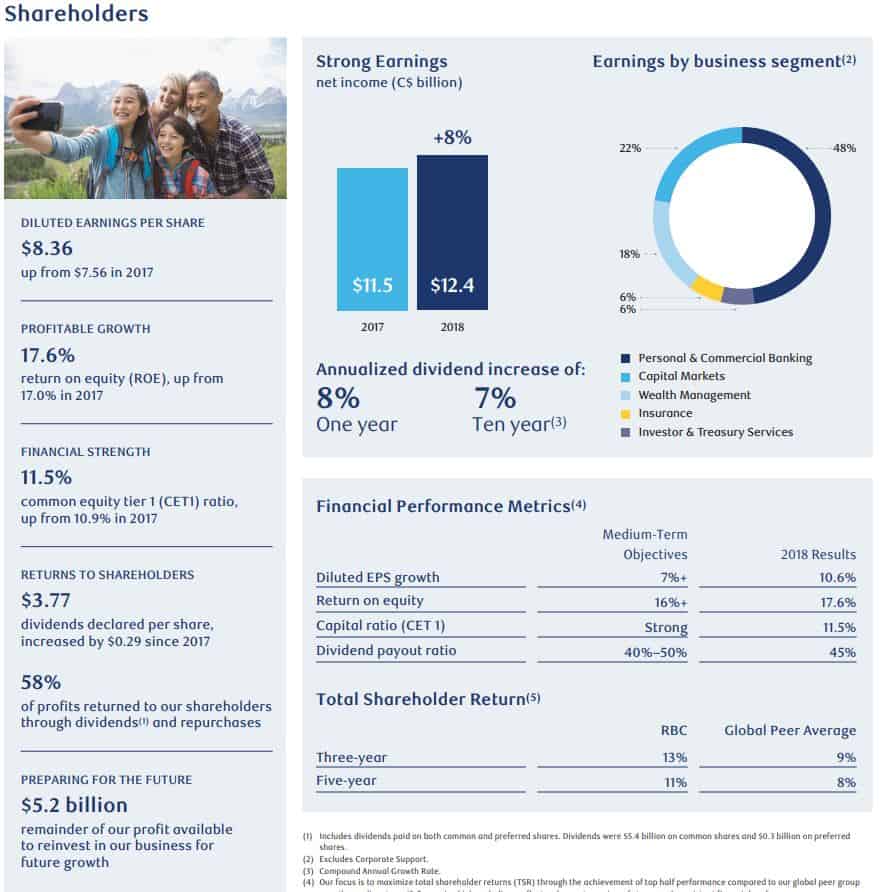

Leveraging an Annual Return to Make Financial Decisions

Leveraging an Annual Return to Make Financial Decisions can be an invaluable tool for young adults looking to make smart financial choices. With an Annual Return, you can get a better understanding of your overall financial portfolio, allowing you to make decisions that will pay off in the long run. For example, you can use an Annual Return to compare investments and assess the potential risks involved. This can help you figure out which investment opportunities are most likely to yield a return and which ones are more risky. You can also use an Annual Return to compare the performance of different investments over time, so you can get a clearer picture of which investments are performing best. By using an Annual Return to make informed decisions, you can ensure that you’re making the right financial choices for your future.

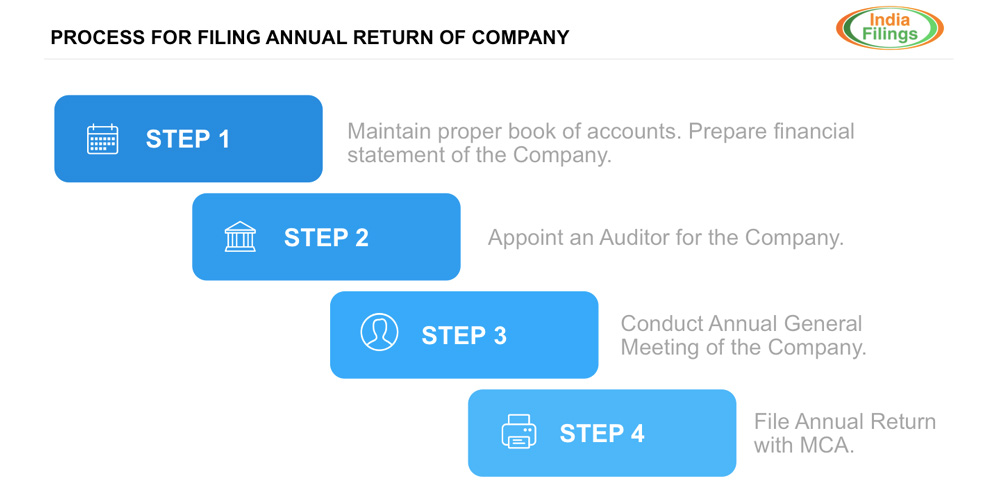

Tips for Filing an Accurate Annual Return

Filing an accurate annual return is important for any business, and it’s important to make sure you get it done right! Here are some tips to make sure you don’t make any mistakes and file your annual return accurately. First, make sure you double check all the details and information you enter. It’s easy to make a mistake when entering information, so double check your work and make sure everything is correct. Second, keep your documentation organized and up to date. Make sure you have all the necessary paperwork and documentation for your annual return, and make sure it’s all in order. Finally, make sure you file your annual return on time. It’s important to submit your annual return before the due date to avoid any problems or penalties. Follow these tips and you’ll be able to file your annual return accurately and on time!