Annual Percentage Yield (APY) is a term used to describe the effective rate of return on a savings account, certificate of deposit (CD), or other financial instrument that takes into account the effect of compounding interest. APY is an important concept to understand when comparing different financial investments as it is an effective way to calculate the total return on an investment and is a great tool to use when comparing various savings and investment products. This article will provide an overview of what APY is and how it can be beneficial when making financial decisions.

Overview of Annual Percentage Yield (APY)

Annual Percentage Yield (APY) is an important term to understand when you’re trying to make the most of your money. APY is the yearly interest rate that your savings account will earn on your deposited funds. It’s important to note that APY is different from your standard annual interest rate, as it takes into account the compounding effect of your interest rate. This means that your interest rate will increase over time as the interest earned will be added to your principal amount, thus increasing the amount of interest you’re earning. Knowing your APY is essential if you’re looking to maximize your savings and make the most of your hard-earned money.

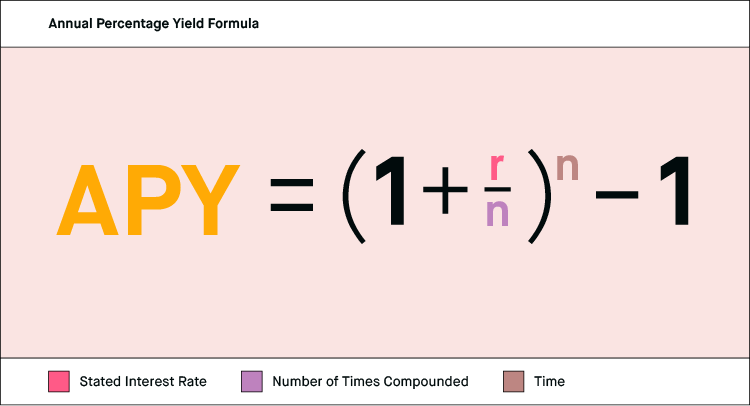

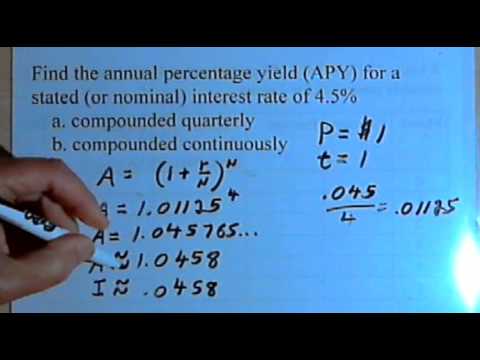

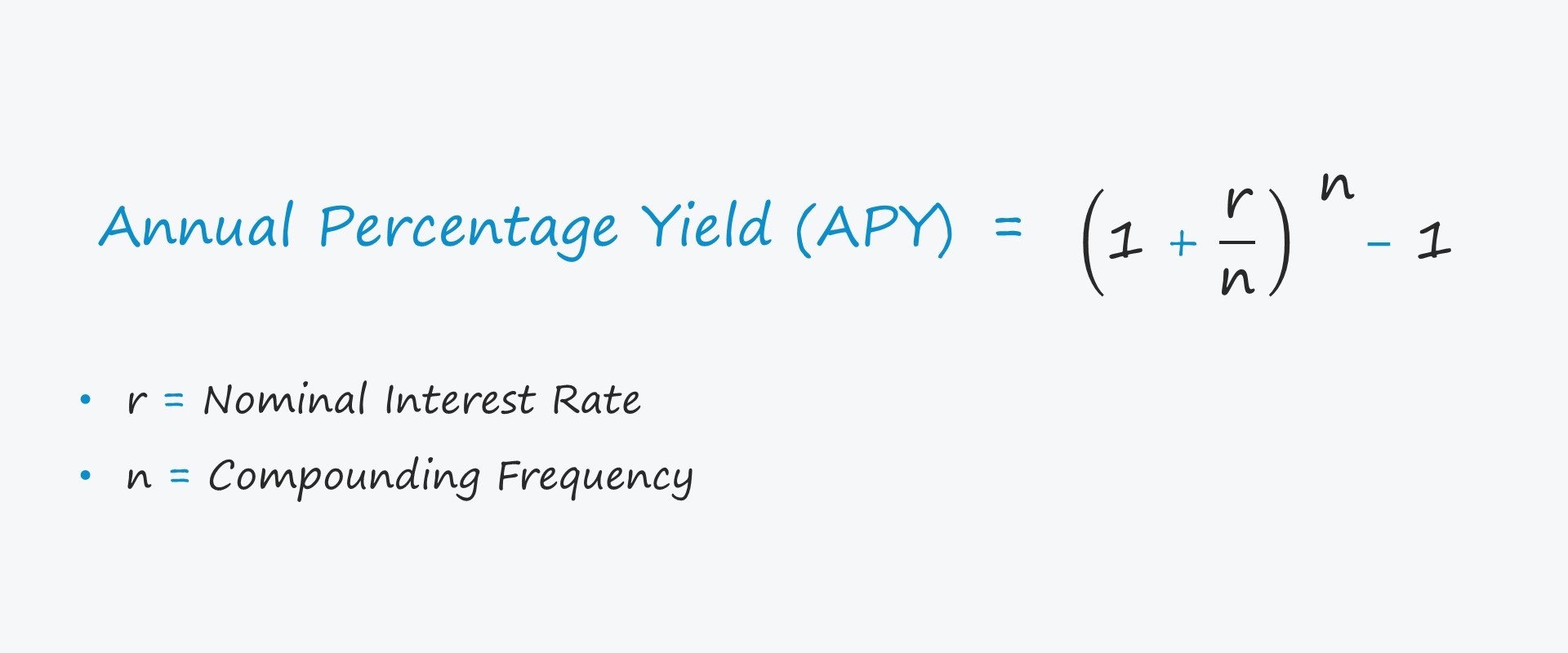

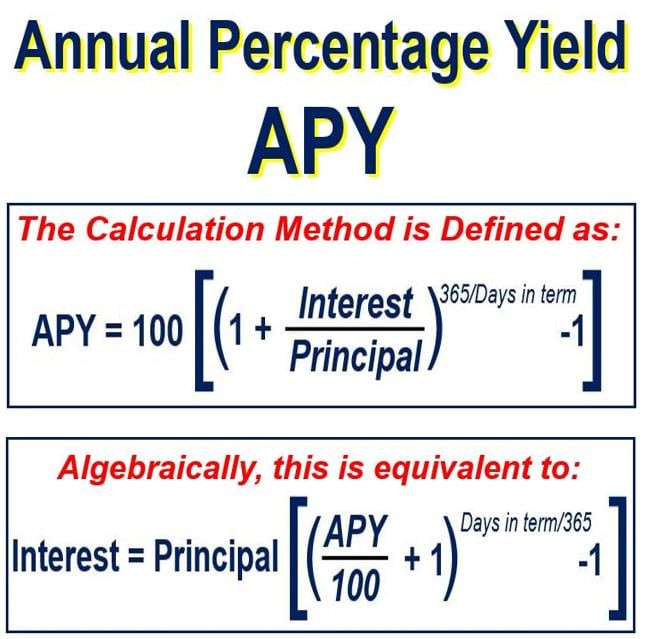

How to Calculate APY

Calculating Annual Percentage Yield (APY) can be a tricky process, but it doesn’t have to be. All you need to know is the interest rate and the frequency of compounding, and you’re good to go! To start, you will need to know the interest rate, which is the amount you will be earning on the investment. From there, you will need to calculate the effective annual rate (EAR). This is done by taking the interest rate and multiplying it by the number of times the interest is compounded. For example, if the interest rate is 5% and the interest is compounded monthly, the EAR is 5% x 12 (months) = 60%. Now, you can calculate the APY by taking the EAR and dividing it by the number of times the interest is compounded. In this case, the APY would be 60% / 12 (months) = 5%. As you can see, calculating APY is relatively simple, and understanding how to calculate it can help you make better investment decisions.

Advantages and Disadvantages of APY

APY can be a great way to save money and earn interest on your money. The advantages of APY are that it can give you a higher return on your money than a traditional savings account. This is because APY takes into account the compounding of interest, so your money will earn more over time. Additionally, APY accounts are usually FDIC insured, so you can be sure your money is safe. The disadvantages of APY include that it can be difficult to calculate the exact return you will get on your money. Additionally, most APY accounts have withdrawal limits, so you may not be able to access all of your money when you need it. However, for those willing to do the research and crunch the numbers, APY can be a great way to save and earn money.

Strategies for Maximizing APY

If you’re looking to maximize your return on investment, you should consider looking into Annual Percentage Yield (APY). APY is an important tool for investors to consider when weighing their options when it comes to investing. There are several strategies that can be employed to maximize your APY. One of the most important strategies is to shop around for the best rates. Different banks and financial institutions offer different APY rates, so it’s important to compare different options. You can also look for promotional rates, which can offer higher APY for a certain amount of time. Another strategy for maximizing APY is to invest in multiple accounts. This can help to diversify your portfolio and spread out your risk. Finally, you can consider investing in a longer-term account, such as a Certificate of Deposit. This type of account typically comes with a higher APY. By employing these strategies and researching your options, you can maximize your APY and get the most out of your investments.

Common Misconceptions About APY

APY is a term you’ll hear often when it comes to banking and finance, but it can be easy to get confused about what it really means. Common misconceptions about APY can lead to misunderstanding and mistakes. For starters, many people think APY is the same as interest rate. While the two are related, they are not the same. APY is the total amount of interest you earn on an account over a period of time, while interest rate is the percentage of interest you earn on the principal balance in a given period. Another misconception is that APY is always higher than interest rate. While it is true that APY takes into account compounding interest, making it higher than the interest rate, that is not always the case. Finally, some mistakenly think APY is a fixed rate, when in fact it can change depending on the type of account. It’s important to know the facts about APY in order to make the best financial decisions.