Understanding Annual Percentage Rate (APR) is essential for managing your finances. APR is the cost of borrowing money expressed as a percentage, and is one of the most important concepts to understand when it comes to managing your money. APR is calculated by taking into account the interest rate, fees, and other charges associated with borrowing money, and will vary depending on the type of loan or credit product you use. This article will provide an overview of APR, and explain how it is used to inform your financial decisions.

What is an Annual Percentage Rate (APR)?

An Annual Percentage Rate (APR) is a metric used to calculate the annual cost of borrowing money. It is the interest rate charged to a borrower, expressed as a single percentage number that represents the total cost of borrowing. It’s important to understand APR, as it can help you make more informed financial decisions. APR can help you compare the costs of different loan products and understand the true cost of borrowing money. It’s important to remember that APR is NOT the same as the interest rate charged on your loan, as it also includes fees and other charges. Knowing your APR can help you make sure you get the best deal possible when looking for a loan or other type of credit.

Understanding the Difference between APR and Interest Rates

When it comes to loans and credit cards, it’s important to understand the difference between Annual Percentage Rate (APR) and Interest Rates. APR is the total cost of borrowing money and includes the interest rate plus any additional fees or charges. It reflects the total cost of a loan over the entire loan term including upfront fees. On the other hand, interest rate is the cost of borrowing money for a certain period of time and does not include any additional fees. Interest rate is the rate that you will be charged for borrowing money and is usually expressed as a percentage. The difference between APR and Interest Rate is important to understand because it can have a major impact on the overall cost of a loan. Knowing the difference between the two can help you make an informed decision when it comes to taking out a loan or using a credit card.

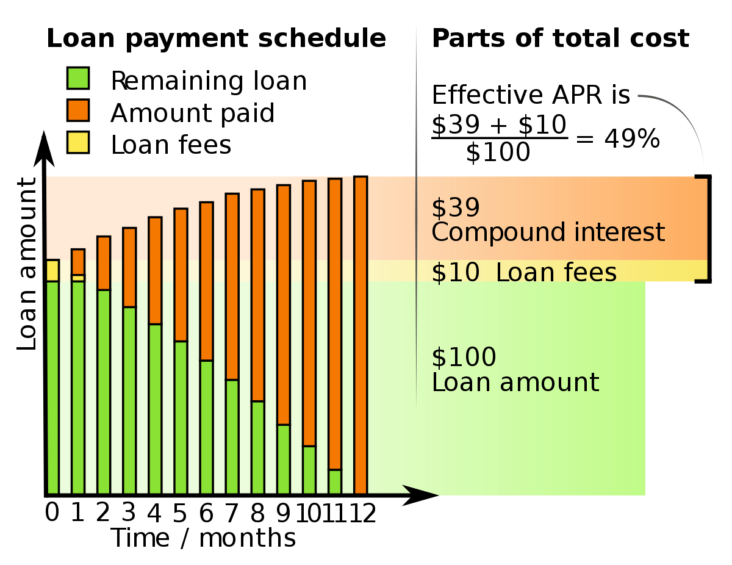

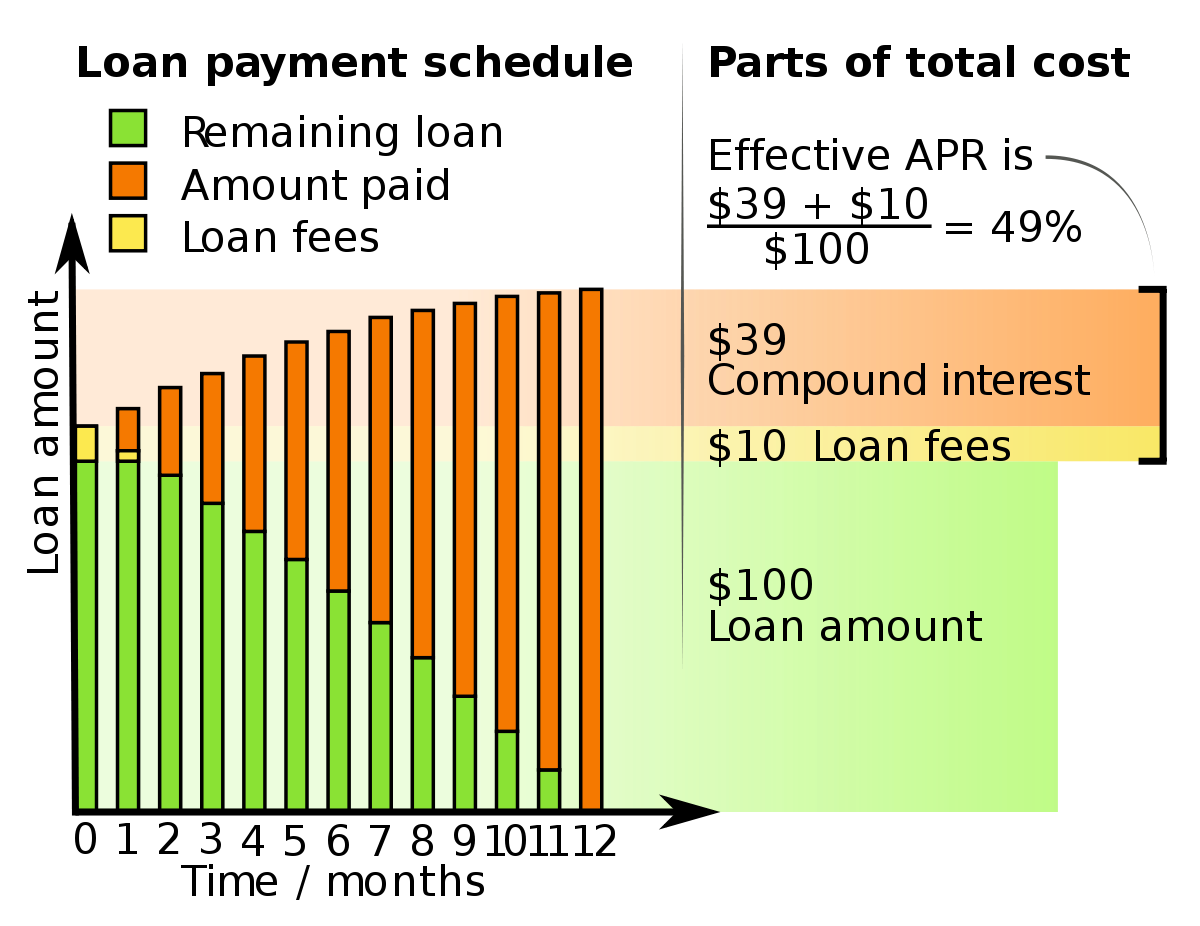

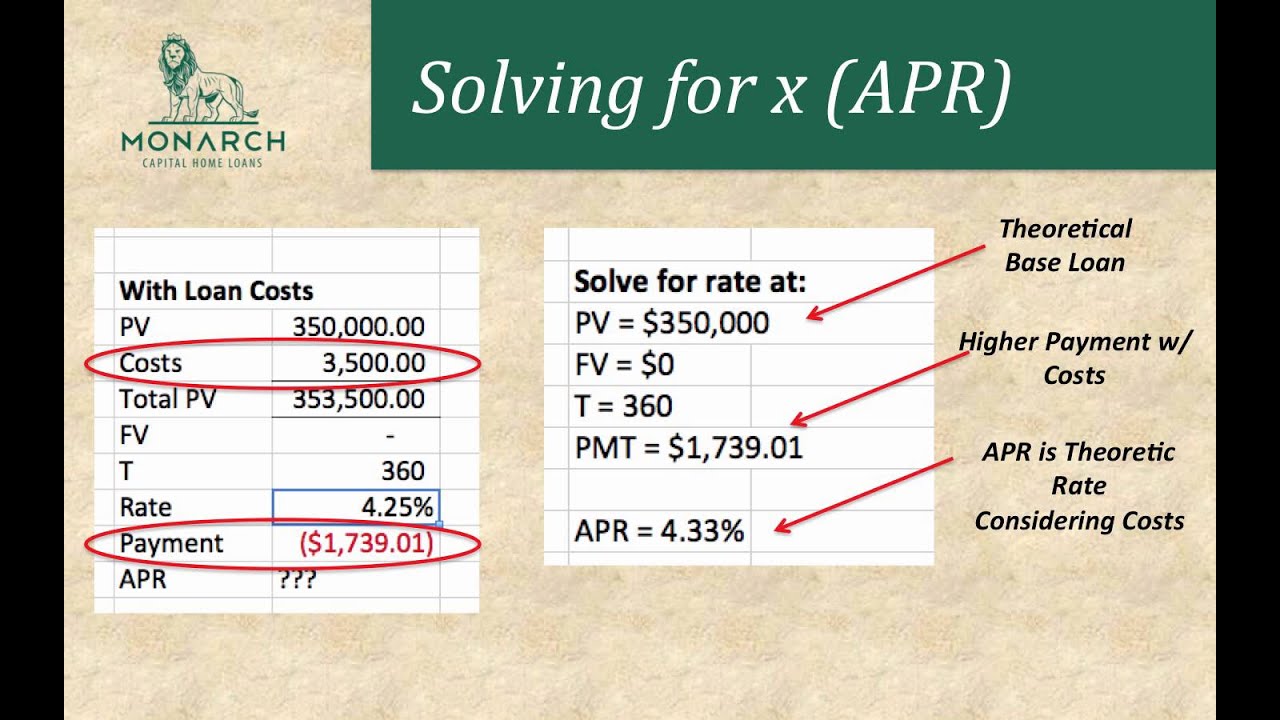

How to Calculate APR

Calculating APR can be tricky and intimidating, but it doesn’t have to be. By understanding the basic formula and being familiar with the different components of APR, anyone can easily calculate their APR. To begin, you’ll need to know the amount of the loan, the interest rate, and the number of payments. Once you have that information, you can calculate your APR using the following formula: APR = (Interest Rate/Number of Payments) x (1 + Interest Rate)^ Number of Payments. This formula takes into account the interest rate, the number of payments, and the amount of the loan to calculate your APR. Additionally, you can also use an online APR calculator to find the exact APR of your loan. Knowing your APR is important, as it gives you a better understanding of your overall cost of borrowing and can help you compare different loan options.

Benefits of Knowing Your APR

:Knowing your APR is super important when it comes to managing your finances. APR stands for Annual Percentage Rate and is the interest rate you pay on a loan. It’s important to know your APR so you can make sure you’re getting the best deal possible when it comes to loans or credit cards. It can also help you budget and plan for future payments. Knowing your APR also helps you make sure you’re not overpaying for a loan or credit card. By understanding your APR you can compare different offers and make sure you’re getting the best deal. Knowing your APR is a great way to manage your finances and make sure you’re not overpaying for your loans and credit cards.

Tips on How to Avoid High APR’s

When it comes to avoiding high APR’s, there are a few key tips you should keep in mind. First, always shop around for the best rates. Research different banks, credit unions, and lenders to find the best rates possible. Additionally, try to pay your balance in full every month. Paying off your balance reduces your overall cost and can help you avoid higher APR’s. Also, make sure to always read the fine print. Don’t sign up for any credit card or loan without knowing the terms, including the APR. Finally, be sure to make all your payments on time. Late payments can result in higher APR’s, so make sure to pay your bills on time to keep your rates low. By following these tips, you can reduce your overall APR and save yourself money in the long run.