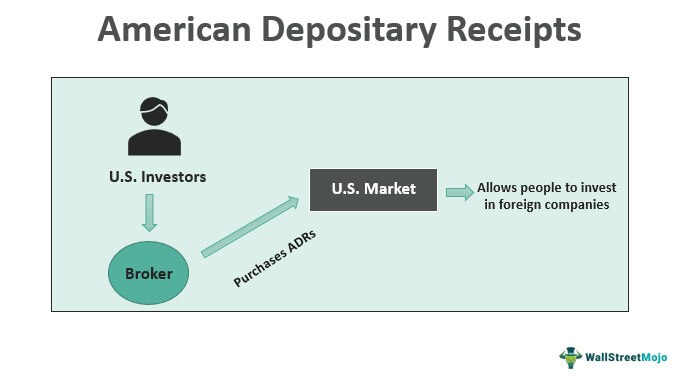

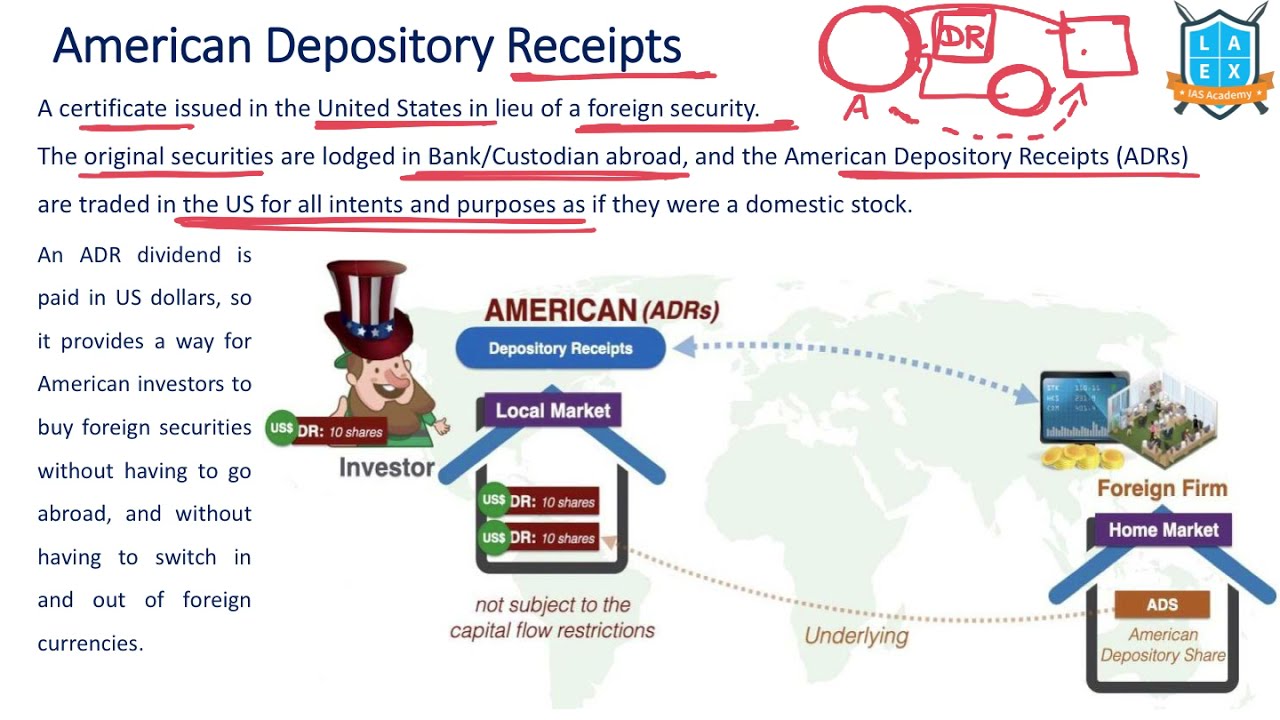

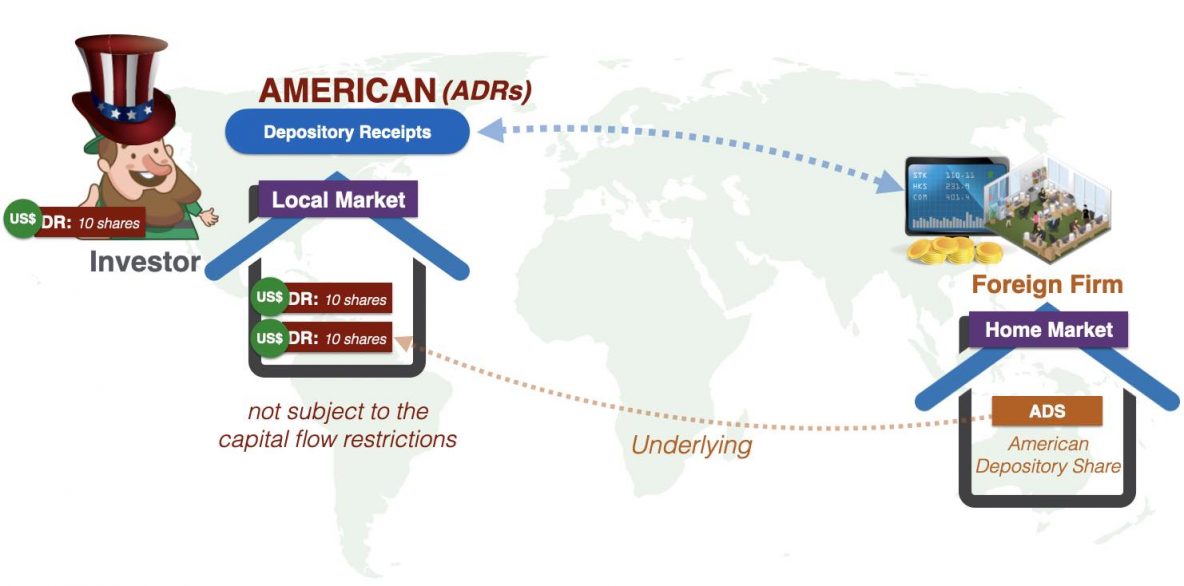

An American Depositary Receipt (ADR) is a form of financial instrument that allows U.S. investors to buy and sell shares of foreign companies, allowing them to invest in foreign markets without being exposed to the additional risk associated with investing overseas. ADRs are issued by a U.S. bank, which purchases the foreign stock and holds it in trust for the ADR holder. ADRs provide investors with the convenience and liquidity of a U.S. stock and provide foreign companies with an easy way to access the U.S. capital markets.

Introduction to American Depositary Receipts (ADRs)

ADRs are a great way to invest in foreign companies without all the hassle of dealing with foreign currency exchange and other financial intricacies. ADRs are American securities that represent ownership of foreign equity. They are traded on US exchanges, just like normal stocks. ADRs allow investors to buy a piece of foreign companies without worrying about the currency exchange rate. They also provide a convenient way for investors who don’t want to take the time to research international markets to get exposure to foreign stocks. ADRs can be a great way to diversify your portfolio and get exposure to different markets and economies. With so many advantages, it’s easy to see why ADRs are becoming increasingly popular with investors.

How ADRs are Used in the Financial Markets

ADRs are commonly used in the financial markets as a means of purchasing shares of foreign stocks without having to purchase and own the underlying stock. ADRs allow investors to purchase stocks from outside their country without having to convert their currency. ADRs are also used as a way to diversify investment portfolios by gaining access to international markets. ADRs have become a popular choice among investors because of their lower cost and ease of trading. By investing in an ADR, investors can benefit from the potential returns of an international stock without incurring the costs and risks associated with directly investing in a foreign company. ADRs can be traded in the same way as regular stocks, making them a viable option for investors looking to diversify their holdings.

Understanding the Benefits and Risks of ADRs

Investing in American Depositary Receipts (ADRs) can offer a lot of advantages, but it also comes with some risks. ADRs are a great way to get exposure to foreign companies and the markets they operate in. They provide U.S. investors with the ability to trade foreign stocks on U.S. exchanges, with the same ease as trading domestic stocks. In addition, ADRs offer the potential for higher returns than domestic stocks due to the lack of liquidity of foreign stocks. However, there are some potential risks associated with investing in ADRs. Because they are traded on U.S. exchanges, they are subject to U.S. regulations, which can lead to increased costs and risk. The foreign company whose stock is being traded also risks facing currency fluctuations and political instability, which could affect the price of the ADR. Ultimately, investors should understand all of the risks and benefits associated with investing in ADRs before making any decisions.

The Tax Implications of Investing in ADRs

Investing in American Depositary Receipts (ADRs) is an attractive option for investors looking to diversify their portfolios. Not only can ADRs open up investment opportunities in international markets, but they can also be a great way to save on taxes. While ADRs are subject to U.S. taxes like any other investment, they can also offer certain tax benefits. For example, ADRs held for more than a year may be eligible for long-term capital gains tax rates, which are typically lower than short-term capital gains taxes. Additionally, some ADRs may be eligible for foreign tax credits, which can reduce the total amount of tax due on the investment. While taxes should always be considered when making any investment decision, the potential tax benefits of investing in ADRs could make it an attractive option for investors.

Strategies for Investing in ADRs

Investing in American Depositary Receipts (ADRs) is a great way to diversify your portfolio and gain exposure to international stocks. ADRs are securities that represent ownership in a foreign company and are issued and traded in the United States. They provide investors with many of the same benefits as investing directly in foreign stocks, but with the added convenience of trading on U.S. exchanges. When investing in ADRs, it’s important to understand the different strategies available. One strategy is to buy a basket of ADRs to gain exposure to a variety of foreign markets. Another strategy is to buy individual ADRs of companies that you believe will outperform the market. Finally, it’s important to do your research and understand the risks and rewards associated with investing in ADRs. With the right approach, investing in ADRs can be a great way to diversify your portfolio and benefit from international stock markets.