An amended return is a document used to correct errors or omissions on a tax return that has already been filed. It is an important tool in the tax filing process, as it can help taxpayers avoid costly penalties and potential audits. Understanding amended returns and knowing when to use them can be invaluable to taxpayers looking to maximize their tax refunds or minimize tax liabilities. This article provides an overview of what an amended return is, why it is important, and how to go about filing one.

What is an Amended Tax Return and When Should I File One?

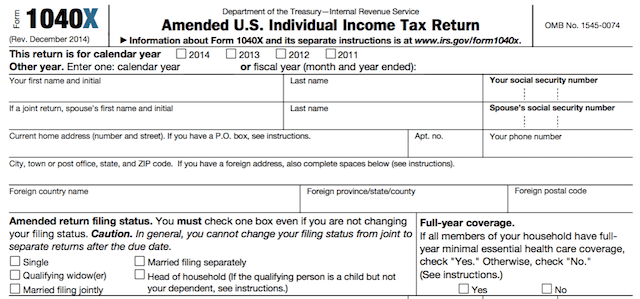

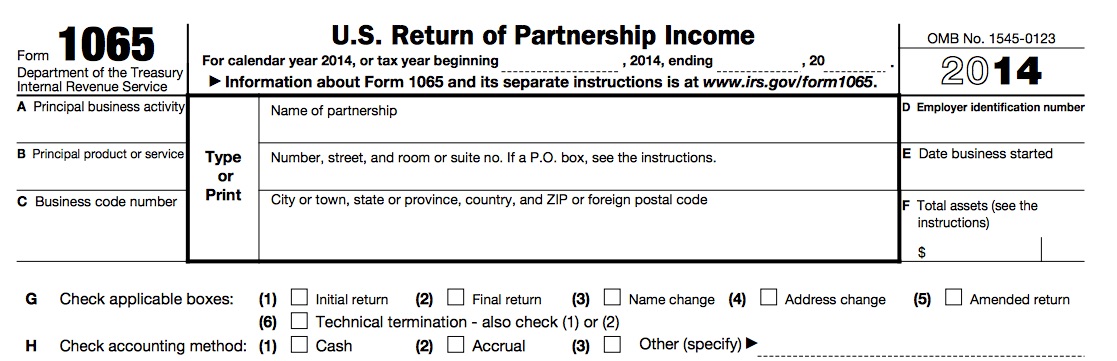

Filing an amended tax return can be a daunting task, but it’s important to understand why and when you should do it. An amended tax return is a document filed with the IRS that changes or corrects information from your original tax return. It’s important to file an amended return if you made a mistake on your original tax return, if you need to correct your filing status, or if you need to add or remove dependents. It’s important to note that amended returns can only be used to make corrections to previous tax returns, and not to claim additional deductions or credits. Filing an amended return can be a complicated process, so it’s best to consult with a tax professional to make sure you get it right. An amended return should be filed as soon as possible if you need to make changes to a previously filed return, as the IRS may charge penalties for late filing.

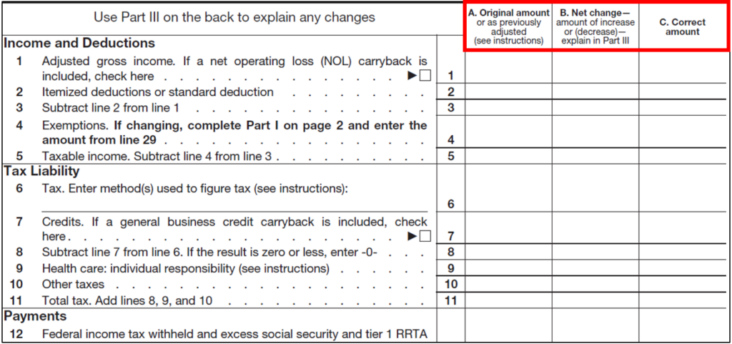

How to Prepare an Amended Return and Avoid Common Mistakes

If you need to make changes to your tax return, it’s important to make sure you know how to prepare an amended return that won’t get you into trouble. Here are some tips to keep in mind when filing an amended return: double check your math, make sure you include all the necessary information, and make sure to use the right forms. To avoid common mistakes, it’s important to make sure all the information you enter is accurate and up-to-date, and to double check everything before submitting your return. It’s also important to make sure you send your amended return to the right place, as sending it to the wrong address can delay the processing of your return. Finally, it’s wise to keep copies of all your filed documents for your records. If done correctly, filing an amended return can be a painless process that can help you get the most out of your tax return.

The Benefits of Amending Your Tax Return

Filing an amended return is a great way to ensure you get the most out of your taxes. Amending your tax return can help you get the best refund, correct any mistakes, and make sure you don’t pay more than you should. It’s also important to amend your return if you forget to include a deduction or credit. This can help you avoid any penalties or interest that would be accrued if the mistake was discovered later. Amending your return can also help you to take advantage of any new tax laws that have been put in place since you filed your original return. By amending your return, you can make sure you get the most out of your taxes and keep more of your hard-earned money.

Understanding Amended Return Penalties

Amended return penalties are serious, so it’s important to understand what they are if you need to file. An amended return is a new tax return filed with the IRS to correct errors or omissions in a previously filed return. If an amended return is not filed correctly or on time, the IRS may impose penalties. These penalties can include fines or even criminal penalties. A taxpayer may also be liable for back taxes, interest, and other fees associated with filing an amended return. It’s important to be aware of the penalties associated with filing an amended return so you can avoid them altogether. Knowing the potential consequences of filing an amended return can help you make an informed decision about how to proceed with your tax filing.

Tips for Avoiding Plagiarism when Preparing an Amended Return

When you’re preparing an amended return, it’s important to make sure you’re not plagiarizing any information. Plagiarism can be a serious offense, and it’s something you want to avoid in any situation. To help you stay on the right track, here are some tips for avoiding plagiarism when preparing an amended return. First, make sure you’re only using your own words to explain your amended return. Don’t copy someone else’s work, even if it’s the same information. Second, be sure to clearly cite any sources you use. This includes both text and data. Finally, always double-check your work for accuracy. Taking the time to double-check your amended return can help you make sure that you’re not plagiarizing any information. Following these tips will help you avoid any potential issues with plagiarism when you’re preparing an amended return.